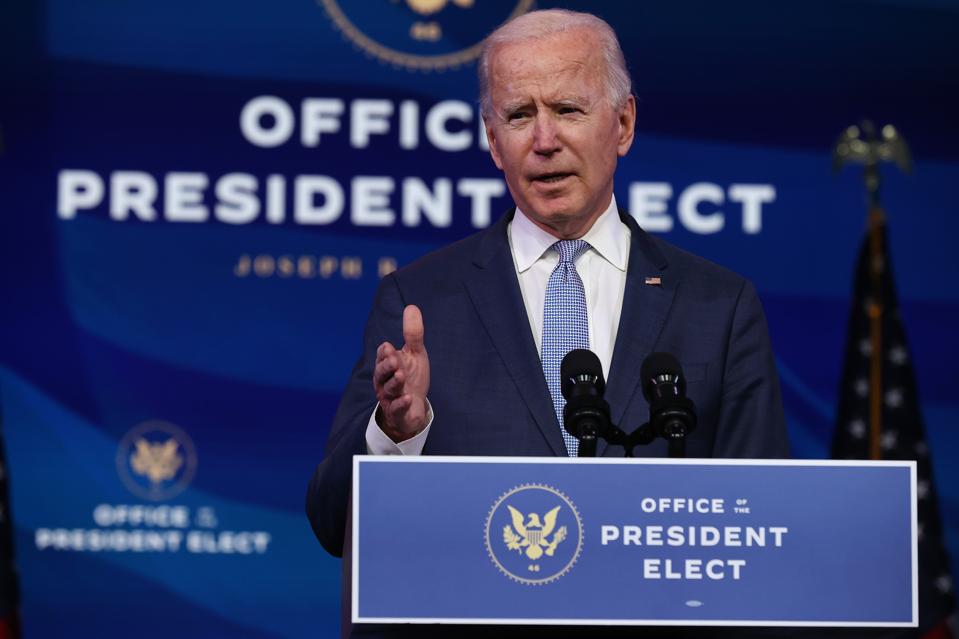

WILMINGTON, DELAWARE – JANUARY 06: U.S. President-elect Joe Biden delivers remarks about the … [+]

Getty Images

With improbable Democratic wins in both Georgia Senate runoff elections, President-elect Joe Biden has an opportunity to govern with a congressional majority—though one that will be excruciatingly narrow. The party’s ability to eke out 51 Senate votes, thanks to tiebreaking vote of Vice-president Kamala Harris, gives Biden the opportunity to pass some of his domestic policy ideas, including some tax initiatives. But don’t expect anything like the ambitious agenda he laid out in his campaign.

Razor-thin majorities in the Senate and House and limited, if any, GOP support mean Biden will have to satisfy a small group of Democratic moderates to pass bills. And that suggests some of his most ambitious ideas likely will fall by the wayside. Here are six clues to what Biden may be able to accomplish in 2021.

What will Biden and the Democrats cram into budget reconciliation bills? Unless Democrats repeal the Senate filibuster, which is highly unlikely, they’ll generally need 60 votes to get legislation passed in the upper chamber. That means they’ll turn to a big exception to the 60-vote requirement, the special process used to pass a budget framework known as reconciliation. For it, 50 votes+1 will do.

The biggest question Biden must answer in 2021: What will he stuff into those reconciliation bills? The possibilities seem endless: immigration, infrastructure, tax increases, tax cuts, free college education, health care, climate change, and on and on. My guess is infrastructure investment and funding along with some reforms to the Affordable Care Act will float to the top of the list. So may some modest tax cuts.

Biden also may try to use a new pandemic relief or stimulus bill as a vehicle for some permanent legislation early in the year. But that may be a bigger lift.

Watch the moderates. The most important legislators in 2021 may be a small band of moderate Democrats. To get to even 50 Senate votes, Biden will need to satisfy senators such as Joe Manchin of West Virginia, Jon Tester of Montana, and Angus King of Maine (an independent who caucuses with the Democrats). In the House, he’ll need buy-in from moderates such as Abigail Spanberger of Virginia and Conor Lamb of Pennsylvania.

MORE FOR YOU

They may not be well known, but they will be far more consequential than the Democratic far left, despite the progressives’ ability to attract attention. If legislation is not acceptable to lawmakers like Manchin and Spanberger, it will go nowhere. Case in point: The Green New Deal.

Leadership of the tax committees. Those panels have lost much of their influence in recent years as bill-writing has largely been taken over by party leaders. But the House Ways & Means and Senate Finance committees—and their chairs— still have clout. In 2021, those chairs will be Rep. Richard Neal (D-MA) and Sen. Ron Wyden (D-OR). Both are center-left lawmakers whose instincts are to seek bipartisan agreement, especially on tax bills.

Time is of the essence. Realistically, Biden has just a year to score legislative wins and, let’s face it, much of his first year will be all about the controlling the pandemic. By 2022, it will be even tougher to pass legislation in a Congress where lawmakers are obsessed with their own re-elections. That narrow legislative window will require Biden to limit his priorities and pick winnable fights. It also means that initiatives that don’t make to the top of Biden’s priority list in 2021 may never get the president’s full attention.

Raising taxes in the pandemic economy seems improbable. Even with a Democratic majority, it is hard to imagine this Congress raising taxes on corporations and high-income households by $3 trillion over 10 years as Biden proposed in his campaign, though some corporate tax hikes could be in the offing. By contrast, some of Biden’s proposed $1 trillion in tax cuts for low- and middle-income households could win passage. Possibilities include expansion of some refundable tax credits such as the Earned Income Tax Credit and the Child Tax Credit, and some new retirement savings incentives for low-income workers.

Don’t look for massive change. If you’ve read this far, you probably sense a pattern. Biden can get some important wins in 2021, but only by scaling back his ambitions.

In some ways, those two Senate victories in Georgia change everything for Biden. They mean Democrats will control the legislative agenda, they end potential confirmation roadblocks to Biden’s appointments, they avoid time-consuming congressional investigations, and they given Biden a chance to build consensus around some legislation.

But Biden has no free hand. He’ll be constrained by a divided Democratic caucus, resistant Republicans, and by his necessary focus on effectively distributing a vaccine. Those Georgia wins give his agenda a chance but only a limited one.