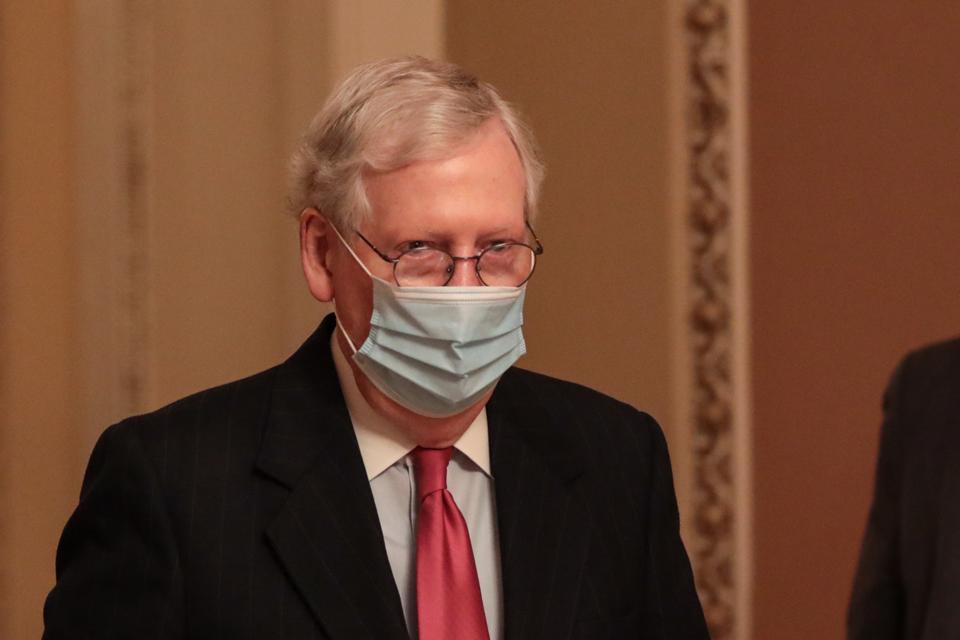

WASHINGTON, DC – DECEMBER 21: Senate Majority Leader Mitch McConnell (R-KY) walks to his office … [+]

Getty Images

The nearly 5600-page omnibus government funding and covid relief bill passed by Congress yesterday was an undeniable win for the American people, providing much-needed relief for those most affected by the pandemic. In addition to preventing a government shutdown, the bill extended and expanded unemployment insurance; provided aid to restaurants, airlines, and other businesses heavily impacted by the pandemic; and provided robust funding for vaccine distribution to help end the pandemic sooner and get people back to work. It also included other important policy developments, such as a long-stalled proposal to limit surprise medical billing and investments to combat climate change. But an arbitrary demand from Republicans that the bill not exceed $1 trillion, combined with their monomaniacal focus on business tax cuts, resulted in some bizarre and unfortunate tradeoffs.

One of the final holdups in cementing an agreement was a demand by populists on the left and right to add $600 stimulus checks to the package. Many in the Congressional Progressive Caucus framed them as “survival checks,” even though most of the people receiving the payments are not actually struggling to survive. Almost every American adult earning under $75,000 this year, as well as their children, is eligible for the full payment (but adult dependents, such as college students frozen out of the economy by the virus, got no such support).

To make space for this proposal, lawmakers cut back the extension of emergency unemployment benefits from 16 weeks to 11. As Sens. Mark Warner (D-VA) and Joe Manchin (D-WV) rightly argued prior to the bill’s passage, there is nothing progressive about taking money from unemployed people directly affected by the covid pandemic to finance a poorly targeted stimulus check. Unfortunately, the federal government will now spend nearly 40 percent more on the stimulus checks than it will on unemployment benefits. Even worse, millions of unemployed Americans now face the prospect of losing their only source of income before enough people have access to the vaccine for jobs to return.

The bill also included a massive tax cut for businesses that received subsidies from the Paycheck Protection Program. Normally a business is able to deduct its expenses from its income for tax purposes, as the corporate income tax is only supposed to tax profits. Accordingly, the IRS previously ruled that businesses could not deduct expenses paid for with PPP funds because those businesses were not actually using taxable income to cover such expenses. Congress overturned that decision, essentially creating a windfall for businesses: they both got free money from Congress to pay their bills, then got to claim an extra tax cut on top of it. This giveaway is especially disappointing because PPP gave aid to many businesses that weren’t likely to lay off workers, making it one of the least-effective stimulus programs in the CARES Act. Some experts estimate this pricey provision would cost more than $200 billion that could have been better spent on better-targeted relief measures.

Perhaps most egregiously, the bill included several special-interest tax cuts that are unlikely to do anything much to help the covid economy. For example, Republicans demanded the inclusion of an expanded tax deduction for business meals that they claim will “lead to increased spending in restaurants and more income for staff.” But lawmakers could have provided such support directly to affected businesses and workers rather than subsidizing the ones that are already financially prosperous enough to afford employee meals. Sen. Ron Wyden (D-OR) rightly noted that “Republicans are nickel-and-diming benefits for jobless workers, while at the same time pushing for tax breaks for three-martini power lunches.” Worst of all, a similar incentive adopted by the United Kingdom earlier in the pandemic actually led to an increase in covid infections from indoor dining, making the policy not only ineffective stimulus but also counterproductive for public health and economic recovery.

MORE FOR YOU

To their credit, Democrats only agreed to this provision in exchange for a much more admirable one that would allow claimants of the Earned Income and Child Tax Credits to calculate their eligibility based on their 2019 incomes. Because the value of these credits rises as people earn more income up to a certain threshold, the policy prevents a reduction in support for low-income workers who saw their incomes fall further in 2020. But the legislation also made permanent a number of so-called “tax extenders” that should have been allowed to expire years ago, which is a trade-off that is much harder to justify.

Despite the inclusion of these disappointing provisions, lawmakers – especially the bipartisan negotiators who injected new life into the relief effort three weeks ago – should be applauded for preventing millions of Americans from losing lifesaving benefits after Christmas. Yet there remains more work to be done: after the new year, lawmakers must begin work on one final package to ensure businesses, families, and state and local governments truly have enough support to survive until the covid pandemic had been fully defeated. Hopefully that bill will be better-targeted than the one that passed yesterday.