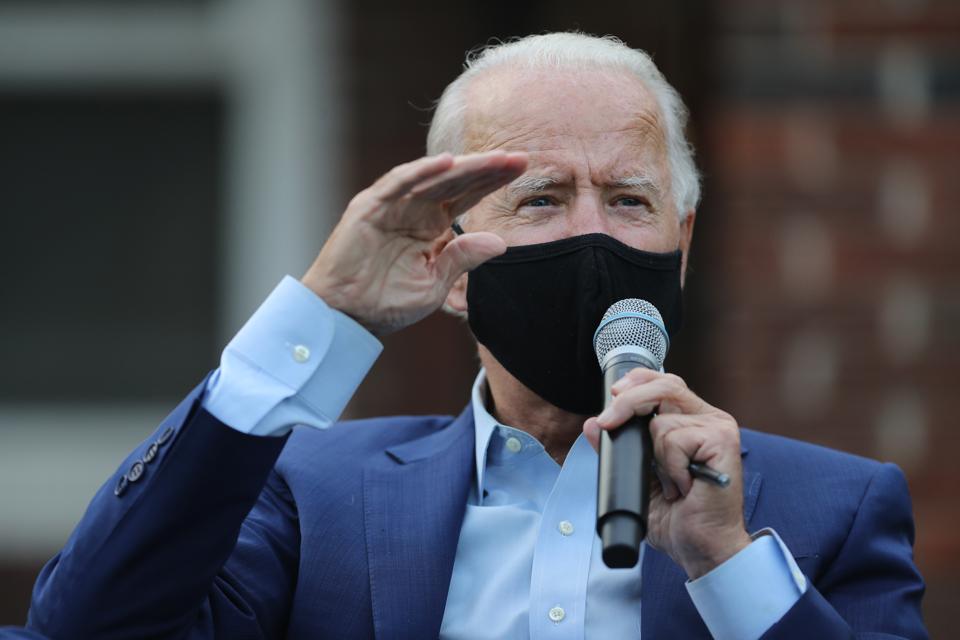

Joe Biden campaigning in Warren, Michigan on September 9th. (Photo by Chip Somodevilla/Getty Images)

Getty Images

It’s safe to say that the 2020 Presidential election between the incumbent Donald Trump and his challenger, former Vice President Joe Biden, will be the most vicious this country has ever witnessed. The first debate remains weeks away, and yet the rhetoric emerging from both sides has already devolved from poignant policy critiques to accusations of corruption, treason, and even dementia. At this point, we’re probably days away from one candidate alleging that the other routinely lures children to his gingerbread house. It would all be laughable if it weren’t so damn depressing.

While I’m content to ignore a majority of the mudslinging, there is one thing I can’t let slide. This:

Now, far be it from me to question the tax policy chops of “Floridian Loud Mouth,” but…This. Is. A. Lie.

I may not be suited to speak to either candidate’s capacity for corruption or cognitive capabilities, but I can tell you about their tax plans. And while Joe Biden has promised to raise taxes, he is proposing targeted tax increases aimed squarely and solely at those earning more than $400,000. For the 97% of Americans who earn less than $400,000 annually, Biden will preserve the status quo, while proposing new or improved credits that for some, will actually lower, rather than increase, tax liability.

So while I’m generally content to let the voting public consume its election information from poorly worded memes and misinformed tweets, in this case, let’s clear up any confusion by taking a detailed look at what Biden’s plan actually proposes. We’ll break it down, piece by piece.

Top Rate On Ordinary Income

Current Law: As part of President Trump’s signature legislation — the Tax Cuts and Jobs Act (TCJA), passed in 2017— the top rate on ordinary income — things like wages, business income, and interest income — was reduced from a high of 39.6% to 37%. Of course, the U.S. tax system is a progressive system, meaning we pay higher rates as our income increases. Under the current structure, those rates begin at 10%, and then climb to 37% via the following steps: 12%, 22%, 24%, 32%, and 35%. It’s also important to note that there is an additional 3.8% surcharge that applies to the “net investment income”of certain high-income individuals — things like interest income or income from a business in which you don’t actively participate — meaning the top rate on these forms of income can reach a high of 40.8%.

Biden’s Plan: In the short term, Biden has proposed raising one – and only one – of the seven tax rates: the top rate of 37%. This 37% rate, which currently kicks in for single taxpayers with income in excess of $520,000 and married taxpayers with income in excess $620,000, would jump to 39.6%.

That means that despite what your uncle’s Facebook post alleged, if you currently earn $75,000, your tax rate of 12% will remain 12%. No doubling. No increase at all. In fact, if you earn $300,000, your rate of 35% will remain 35%.

For a married taxpayer filing jointly, the comparison can be illustrated as follows:

table

Nitti

It is not clear if Biden will impose the 39.6% rate on all income earned in excess of $400,000, but if he did, the brackets for a family would look like so:

table

Nitti

Now, I say Biden won’t increase the rates of anyone earning less than $400,000 “in the short term” because one of the design flaws of President Trump’s TCJA is that ALL of the individual cuts expire on December 31, 2025. Thus, if Biden were to win in November, and then again in November 2024, he could choose to let all of the TCJA provisions expire at the end of 2025. But even then, someone earning $75,000 would see their rate increase from 12% to 15%.

Top Rate on Long-Term Capital Gains and Qualified Dividends

Current Law: Long-term capital gains (think: the sale of stock held more than one year) and qualified dividends are currently taxed at a high of 20%, though most American’s pay 15%, with those in the 10% and 12% brackets paying 0%. Of course, you have to tack on the aforementioned net investment income tax of 3.8%, so the rate reaches a high of 23.8%.

Biden’s Plan: Biden would increase the top rate on long-term capital gains and qualified dividends from 20% to 39.6% for taxpayers earning more than $1 million. What this means, however, is that if your income is less than $1 million (it is), you need not worry about this increase.

Payroll Taxes

Current Law: If you earn money through wages or are self-employed, you pay payroll taxes. In the employer-employee context, the employer and employee split a 12.4% tax on earnings up to the Social Security wage base, which in 2020 is $137,700 For ALL wages, the employer and employee split a 2.9% Medicare tax. If you’re self-employed, you’re on the hook for the full 15.3% (though you do get to deduct half of the taxes on your return). Finally, as part of Obamacare, those who earn more than $250,000 (if married, $200,000 if single), are subject to an additional 0.9% payroll tax.

Biden’s Plan: Biden has promised to secure the solvency of the Social Security fund by lifting the cap on the Social Security payroll tax, but once again, ONLY ON WAGES IN EXCESS OF $400,000. This would create a donut hole: an employee paid a $500,000 salary would pay the 6.2% Social Security tax on the first $137,700, no Social Security tax on wages from $137,700 to $400,000, and then another 6.2% tax on the wages between $400,000 and $500,000. He or she would also pay the 1.45% Medicare tax on all wages and the 0.9% Obamacare tax on wages over $250,000 (if married).

So not to go all broken record on you, but if you earn $75,000, or even $399,999, your payroll taxes, like your income taxed and capital gain taxes, won’t increase a single penny.

Itemized Deductions

Current Law: Taxpayer are entitled to deduct the greater of 1) the standard deduction, or 2) the sum of the itemized deductions (things like mortgage interest, medical expenses, state and local income and property taxes, and charitable contributions). The TCJA nearly doubled the standard deduction (from $6,350 to $12,400 for single taxpayers, $12,700 to $24,800 for married couples), while limiting or eliminating certain itemized deductions, a confluence of changes that decreased the number of filers who will itemize from 30% in 2017 to 11% in 2018.

While certain itemized deductions are subject to limitation — for example, the deduction for state and local income and property taxes is capped at $10,000 — there is no longer any overall limitation on a taxpayer’s itemized deductions as there was prior to 2018.

Biden’s Plan: Biden would make two changes to itemized deductions. First, for those earning in excess of $400,000, he would reinstate the Pease limitation. This provision, which was eliminated by the TCJA, reduces a taxpayer’s total itemized by 3% for every dollar that income exceeds $400,000.

In addition, Biden would cap the benefit of itemized deductions at a 28% rate. At first blush, this could run afoul of Biden’ promise to prevent tax increases on any taxpayer earning less than $400,000, because, for example, a single individual who earns $200,000 currently pays a top rate of 32%. Thus, if the 28% limit were applied to this taxpayer, he or she would pay a 32% rate on their last dollar of income, but receive a 28% deduction from their last dollar of, say, mortgage interest expense or charitable contribution. That, of course, would amount to a tax increase.

To prevent this result, Biden has promised that the 28% benefit limitation on itemized deductions would not kick in until income exceeds $400,000.

Corporate Tax

Current Law: The hallmark of the TCJA was the reduction in the corporate rate from 35% to 21%.

Biden’s Plan: Biden would return the corporate rate to 28%. In addition, he would implement a new form of the “alternative minimum tax” by requiring corporations with financial statement income in excess of $100 million to —at the very least — pay tax of 15% on its financial statement income.

Understand —when the economists get done “scoring” the Biden tax plan, despite the safeguards put in place to prevent tax increases on those earning less than $400,000, the distributional analysis will in fact show increases at the lower levels. These increases, however, will all be attributable to the increase in the corporate tax rate. While that may not make sense to a lot of readers, the theory is that when corporate taxes are increased, workers – and not just shareholders – bear the burden of a piece of those corporate taxes. How much they bear has long been subject for debate, but when the tax policy wonks get through with the Biden plan, if it shows ANY increase at all for those earning less than $400,000, it will be an indirect increase attributable to the rising corporate rate.

Tax Cuts

What makes the tweets and memes about the Biden plan even more misleading is that they ignore the tax cuts Biden has proposed in the form of additional tax credits. Credits are better than deductions, because 1) they reduce tax liability dollar-for-dollar, and 2) they are often refundable, meaning even if you don’t owe taxes, the credit will increase the size of your refund.

Biden is proposing a bevy of new credits, including:

- A new $5,000 credit for caregivers of elderly relatives,

- A credit for small businesses that provide retirement plans for their employees,

- A new credit of up to $15,000 for first-time homebuyers,

- An expansion of the existing premium tax credit that makes state-sponsored health plans more affordable,

- A renter’s credit to reduce rent and utilities to 30 percent of income

- An expansion of the earned income credit to older taxpayers, and

- A credit for parents with children in childcare of up to $16,000 per family.

Summary

I know that in today’s world it’s tough to parse fact from fiction, but hopefully this article helps you do just that with regard to the Biden tax plan. In summary, no, despite what MAGAPATRIOT69 says on Twitter, your taxes will not be doubling if you earn $75,000, or anything less than $400,000 for that matter. In fact, given the menu of new proposed tax credits, your tax bill will possibly go down.