Gassman, Crotty & Denicolo, P.A.

Yesterday the SBA released the new Form 3508S (you can remember the new Form by the poem shown at the end of this article), together with an interim final rule, which is a very nice surprise for PPP borrowers who received loans of $50,000 or less. This comes on the eve of the recently released PPP Notice 5000-20057. To read more about the new PPP Notice, click here.

The Form is available on the U.S. Treasury website. You can view the Form by clicking here, but please be sure to come back for important information!

Tony Nitti has released a great article on this that you can view by clicking here.

This new form and rule relieves those borrowers from having to reduce forgiveness if they had a reduction in payroll, or have reduced any employees’ compensation during the Covered Period.

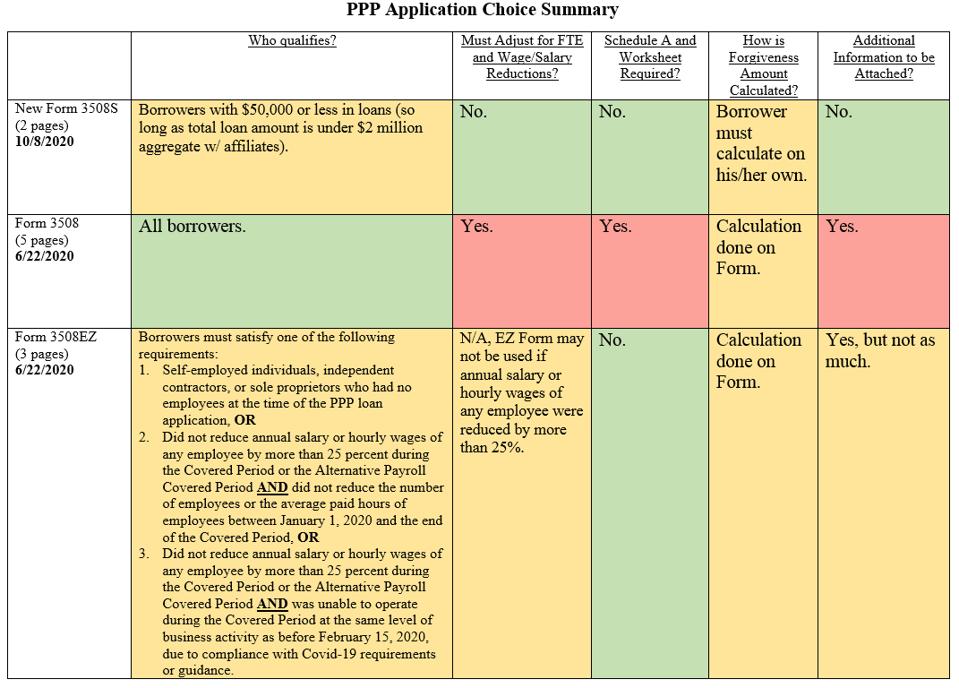

This chart compares the three PPP loan forgiveness application forms and may help you determine which application is best for you:

Gassman, Crotty & Denicolo, P.A.

In addition, those borrowers who can file Form 3508S can provide fewer details in their forgiveness applications, and can assume that there is a good chance that their forgiveness application approval will be streamlined by banks and the SBA.

On Monday, October 12, my colleagues and I will review the impact of this guidance in a free webinar. Email the subject line “50” to info@gassmanpa.com to receive an invite.

Almost all readers are aware that the Paycheck Protection Program was enacted as a part of the CARES Act to provide businesses and professionals loans that were generally based upon 2 and ½ months average compensation and permitted “payroll expenses” for the previous year. The loan can be forgiven to the extent that the loan proceeds are used for qualifying expenses within the first 24 weeks of receipt, with at least 60% of the loan amount used for payroll costs. Entities seeking loan forgiveness must have attempted to keep their workforce with little-to-no reduction in pay in order to achieve full forgiveness.

Since the passage of the CARES Act, the PPP program has allowed for more than 4.4 million loans totaling over $500 billion to be distributed to individuals and businesses across the U.S.

Two of the most complicated and challenging provisions under the original CARES Act that apply to all borrowers with employees are that: (1) a reduction in the number of employees employed by the borrower entity, or (2) a reduction of more than 25% in the “per hour or salaried” compensation of employees could cause a reduction in loan forgiveness, even if significantly more monies were spent on forgivable expenses than the amount borrowed. To review the 25% reduction rule click here.

There are a number of exceptions to allow borrowers who had to reduce their workforce to receive full forgiveness, and the only exception to the 25% reduction in compensation rule described above was the ability for borrowers to restore employee wages to their original rate prior to December 31st, but only if the reduction occurred prior to April 26th.

Under this welcomed announcement, borrowers who had less than a total of $50,000 in PPP loans have the following new rules that apply to them.

- There will be no reduction in loan forgiveness for a reduction in the number of FTE Employees the borrower has on its payroll.

- There will be no reduction in loan forgiveness if salaries/wages are reduced by more than 25%.

- There will be no need to report any employee information on the simplified application.

- Borrowers do not have to make any calculations of their loan forgiveness amount on the form, and can simply input their loan forgiveness amount on the “honor system” (Note – borrowers are still responsible for providing calculations in the event of an audit so records must be kept).

While this is welcome news, it would have been even more welcome if it had been received weeks or months ago before smaller borrowers spent as much energy, time, and money as they have on these issues. Unfortunately, borrowers who received more than $50,000 must wait to see what the SBA or Congress will do for or against them.

Further, this new Form, while a step in the right direction, is not as simple as the automatic loan forgiveness for loans under $150,000 that was proposed as a part of the Rubio-Collins Bill in late July. To read more about this proposed forgiveness provision, and other aspects of the Rubio-Collins Bill, click here.

Owners of multiple businesses who received $50,000 or less in PPP loans for a business can still use the SBA Form 3508S for each business under $50,000, so long as together with its affiliates, total loans received is less than $2 million.

This form marks a huge deviation from the much lengthier Form 3508, with the biggest change being that the newly released Form does not contain any calculations and no Schedule A to report employee hour and salary information.

The new Interim Final Ruling that was released alongside this new Form 3508S also adds to the responsibility of lenders. Whenever a borrower submits a Form 3580S (or the lender’s equivalent form), the lender must (1) “[c]onfirm receipt of the borrower certifications contained in the [Form][,] and (2) confirm the receipt of the additional documentation required from borrower as specified in the instructions to the Form 3508S (or the lender’s equivalent).”

This Interim Final Rule also clarified that the borrower’s forgiveness amount “cannot exceed the principal amount of the PPP loan.” While this may seem obvious, in some cases borrowers may submit to a lender their eligible costs that exceed the amount of the borrower’s loan.

Borrowers whose loans are at or below the $50,000 threshold will have a much easier time qualifying and applying for full forgiveness, although it remains to be seen what, if anything, is going to be done for the rest of the PPP borrowers.

As the below chart from the SBA indicates, the average borrower is taking out a loan amount double that of the threshold for the new Form 3508S. PPP loan advisor, Barry Portugal, who works with SCORE (a nonprofit resource partner of the SBA), had this to say about the new Form and Interim Final Rule:

I think an unanswered question is just how many PPP borrowers will benefit by the $50,000 cap. As you know, many in Congress wanted to have the forgiveness cap to be $150,000. I’m guessing that when Treasury and SBA leaders analyzed the data, the “automatic forgiveness” amount was not economically sound based on today’s debt levels, and the other constituencies fighting for a piece of the pie.

One benefit for other borrowers is that banks and the SBA will be less tied up with these smaller loans and will be more able to help the bigger borrowers with their longer forms.

With the last handful of attempts at passing COVID-19 legislation through Congress failing it is unlikely that meaningful help will come anytime soon, though Treasury Secretary, Steve Mnuchin, recently said that he favors “additional legislation to further simplify the forgiveness process.”

With Form 3508S

You will be glad you borrowed less

Now your forgiveness will not be a mess

Or cause you or your accountant unrest

Time will tell what happens next

But when it does, we will cover it by text

Don’t forget our free webinar

Watch it on your phone, but not while driving a car