CONCERNING: The IRS says up to 800,000 taxpayers may have mistakenly thrown their Covid-19 stimulus … [+]

getty

At a recent online meeting for tax professionals in the New England region, IRS staffers gave updates on IRS operations and, more significantly, on the Covid-19 Economic Impact Payments (stimulus checks) that the IRS issued to taxpayers. Remarkably, the IRS revealed that the agency recently sent about 800,000 notices to taxpayers who have not yet activated the stimulus-payment debit cards they were mailed. The IRS staffers on the call said this probably means many taxpayers accidentally “threw out the debit card thinking it was junk mail.”

I find these meetings helpful, not only for the substance they provide but also for this type of human face they put on the overworked tax experts at the IRS and the real-world side of their efforts. The IRS also uses these calls to get feedback from tax professionals to help resolve issues with federal tax policies, practices, or procedures.

Using the written recap of the online meeting, in this article I summarize the presentation. While it was mainly for tax practitioners, such as CPAs and Enrolled Agents, it offers broad insights.

Stimulus Payments

In their presentation, the IRS staffers explained that as of mid-August the agency had sent out over 160 million Economic Impact Payments, informally called stimulus checks. They admitted during the call that a small percentage of payments have presented challenges for the US Treasury and taxpayers. As mentioned above, the IRS has sent about 800,000 notices to taxpayers who have yet to activate the stimulus payment debit cards. The staff’s interpretation of this data is that many taxpayers probably thought the debit card was junk mail and threw it out in the trash.

An IRS statement in May reported that “nearly 4 million people are being sent their Economic Impact Payment by prepaid debit card, instead of paper check.” As 800,000 notices were recently sent, evidently 20% of the cards remain inactivated and unused.

For card-reissue instructions, the IRS refers taxpayers to the EIPcard.com FAQs. The relevant FAQ states: “If your Card is discarded or destroyed, it is important that you call Customer Service at 1.800.240.8100 (TTY: 1.800.241.9100) immediately and select the ‘Lost/Stolen’ option. Your Card will be deactivated to prevent anyone from using it and a new replacement Card will be ordered. Your first reissued Card will be free and then a $7.50 fee will be applied for each additional reissued Card. Please refer to the material in your Welcome Packet or see your Cardholder Agreement online at EIPCard.com for more information.”

The IRS meeting then turned to missing payments and incorrect payments for taxpayers who did not file a 2018 or 2019 tax return and did not receive Social Security, Railroad Retirement, or Department of Veteran Affairs benefits via direct deposit. They noted that you have until October 15 to use the non-filer tool on the IRS website to get your stimulus payment. (On August 15, the IRS reopened the registration period for federal benefit recipients of Social Security, SSI, RRB, or VA who didn’t receive a stimulus payment of $500 per qualifying child earlier this year.)

The IRS presenter said that “from this point forward I think practitioners will only be dealing with clients who have yet to receive their stimulus payment.” For taxpayers who qualify but did not receive a stimulus check, the IRS told the tax-return preparers on the call that their clients can claim the payment with their 2020 tax return as a tax credit when they file that return in 2021 (see line 30 for Recovery Rebate Credit in the August 18 draft Form 1040).

IRS Operations

All IRS campuses were back open as of July 13, reported the officials during the meeting. However, the IRS is still unable to fully staff its campuses because of social-distancing measures. Ongoing Covid-19 outbreaks in some areas have led to temporary closures of recently reopened campuses, with both campus and field employees transitioned to working at home.

Unopened Mail And Uncashed Checks

The IRS estimates that, at the height of the coronavirus shutdowns, the agency had between 10 million and 13 million pieces of unopened mail. Each location is working through this backlog on a first-in-first-out basis. Uncashed paper checks for payments made during the pandemic are “not all that uncommon,” said the IRS staffers. They suggested to the tax pros on the call that they should show clients the Electronic Federal Tax Payment System (EFTPS) and encourage them to use it.

Delays are the inevitable result of the current limited staffing. As the IRS explains on its Covid-19 Operations Status page, those who mail tax returns and other correspondence to the IRS during this period should expect to wait longer than usual for a response. The agency processes paper returns in the order it receives them. The IRS says it does not want nervous or impatient taxpayers to “file a second tax return or contact the IRS about the status of your return.”

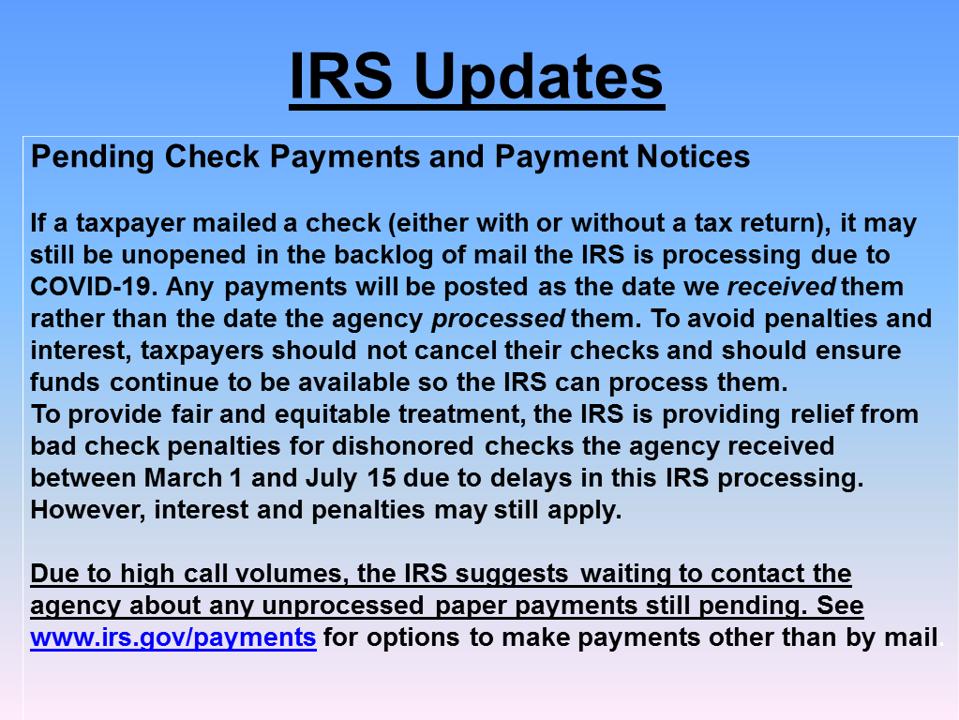

In their presentation, the IRS staffers provided more details and advice for those who have sent a tax-payment check to the IRS that has still not been cashed, and on avoiding penalties:

IRS

Visiting IRS Offices

Some IRS Taxpayer Service Centers are open for in-person visits. The IRS emphasizes that service is provided only by appointment and the agency requires the wearing of face masks. It’s important to check the IRS website before you go, as not all of the centers are open, and those that are may not provide all services.

Balance Due Notices

As a result of office closures from Covid-19, the IRS was unable to mail some previously printed balance due notices. These notices are currently being delivered to taxpayers. Some of the notices taxpayers will receive have due dates that have already passed. The IRS confirmed on the call that each notice will include an insertion confirming that the due dates printed on the notices have been extended (see Notice 1052A).

On August 21, the IRS announced that to avoid confusion from the delay in processing unopened mail, it has put on hold the mailing of three notices that go to taxpayers who have a balance due on their taxes: the CP501, the CP503, and the CP504.