Meet Dylin and Allison Redling. They spent most of their 20s figuring out what they wanted to do when they grew up.

Neither had any serious ambition, or anything that looked like a comprehensive life plan. Dylin categorizes people as either go-getters, which he and Allison certainly were not, and slackers, a group he says the couple fit into quite neatly.

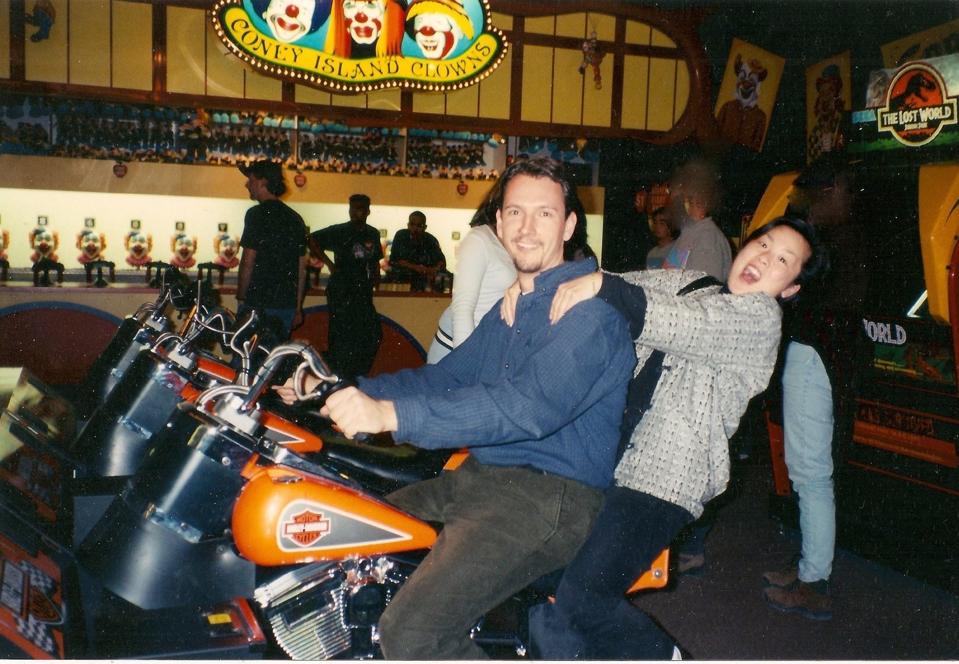

Dylin and Allison Redling – FIRE Movement

Dylin and Allison Redling

But late in their 20s they joined the FIRE movement – Financial Independence, Retire Early – and retired in their early 40s.

That means they went from being young slackers to early middle-aged retirees in a space of less than 15 years. As a Certified Financial Planner, that’s the kind of story I like to tell. It’s a real-life story of what can happen when you start doing the right things with your money.

The Roaring 20s – Dylin and Allison Redling Style

Dylin and Allison followed the traditional route of going to college right after high school. But after graduating from college, neither had a solid idea of what to do next. Both tried to get “real jobs”, but realized very early they weren’t ready for that life.

What came next was typical of many people in their 20s – a life of bouncing from one job and one adventure to another. Dylin’s first job was selling industrial maintenance products. But it didn’t take more than a few months for him to realize that wasn’t his niche.

The next stop was a Mexican restaurant in his hometown of Columbus, Ohio. That was followed by a short-term gig at an upscale Italian restaurant. But with no clear career path, Dylin decided to relocate to New York City.

It wasn’t quite the big jump that moving to the Big Apple can be. Dylin’s father was the super of the building in Manhattan, and Dylin moved in and “helped around the building and paid some rent”.

His first job in New York was as a barback at a gentlemen’s club. From there, he worked as a bartender at a small local bar, and then moved to a sports-themed restaurant in Times Square.

It was there he met Allison, a Dartmouth graduate and his future wife. Her journey after graduation started with being a teacher in Boston. But she quickly found she didn’t like teaching or living in Boston. Then there was the neurotic roommate, and she had all the motivation needed to move back to her native New York City.

Six months after they met and began dating, the couple visited San Francisco. With few serious attachments in New York City, they decided to make the City by the Bay their new home.

Building a Foothold in the Bay Area

Given San Francisco’s notoriously high cost of living, it was a curious choice for a pair of non-career types. They got a studio apartment in a borderline neighborhood of the city, and jobs at a couple local restaurants.

Restaurant work is neither stable nor a career path, and the idea of getting real jobs came back into the picture. Dylin took a job as a customer support agent at a credit card company, while Allison became an administrative assistant in a small law firm.

But that didn’t mean the couple were necessarily on a career track. Dylin took a detour into acting, even playing the lead role in an independently produced horror movie. But he quickly realized acting wasn’t in his future either.

That’s when luck intervened in his life. A former boss began working at an Internet startup, and invited Dylin to join him doing customer support. His tenure there wasn’t long, as he switched to another Internet company as a marketing manager.

Meanwhile, Allison took a new job as an administrative assistant at Accenture, that eventually transitioned into a consulting position.

It looked as if Dylin and Allison were finally on a career path.

Then the Dot-com bust hit, and Dylin’s employer closed its doors. But because of his experience at two Internet companies, he was able to quickly find work at another. It was an even better position with higher pay.

By this time, Dylin and Allison were in their late 20s, and bought their first home. Progress at last!

The Redlings Get Bitten by the FIRE Bug

Dylin and Allison were married in 2001. After learning to live on a shoestring budget throughout their 20s, they continued the practice by having only a small wedding.

Shortly after, both began to advance further in their careers. Allison became a technical project manager at eBay, and Dylin moved up to director of marketing at yet another Internet company.

Armed with more solid occupations – and the higher income those brought – they began investing in stocks for the first time. This started with their 401(k) plans, which both maxed-out. Allison also participated in eBay’s employee stock purchase program. They added to that by making contributions to IRAs as well.

But here’s something interesting about their initial dive into investing: neither of them knew anything about how to do it.

Nevertheless, they took the initiative by getting started. That’s always the most important step. After all, once you begin, you’ll learn what you need to as you move forward. And with the couple’s enthusiasm for saving the maximum amount in each plan available, success was all but guaranteed.

The Real Estate Empire that Wasn’t

Given the explosion in housing prices in the San Francisco Bay area over the past 20 years, it would be easy to assume the Redlings were able to retire on the strength of some shrewd real estate investments. But like everything else about Dylin and Allison’s journey, there was an interesting story here as well.

The first house they bought was a one-bedroom condominium in 1999. They held it for just one year, which meant there was no significant profit on the sale. After that, they bought a small home in a working-class neighborhood in the city. That was followed by purchasing another condo in Nob Hill. But that condo was quickly sold in favor of a large loft in the Mission District of the city.

Just two years later, in 2006, the loft was sold in favor of a three-family house in the Castro district. They moved into one unit, and rented the other two out.

In the space of seven years, they bought five houses, and sold four. They didn’t make money on any of the sales, but they were earning a decent income from the rentals.

Overall however, the Redlings didn’t make a killing in real estate. “The high cost of purchasing property and rent control laws in San Francisco prevented us from making any profit,” Dylin explains. “In fact, after taking expenses into account, we barely broke even in all of our real estate endeavors.”

A lot of members of the FIRE community do earn a substantial portion of their wealth from real estate investments. The Redlings aren’t among them.

The FIRE Journey Moves into High Gear

At this point, the Redlings weren’t doing anything dramatically different, but just committed to doing what they already were, and doing it well.

They did have one major advantage working in their favor: they were “DINKs” – dual income, no kids. During their last five years before retiring, each was earning in excess of $125,000 per year. The combination of DINK status, high incomes, and a commitment to long-term saving and investing, moved them toward retirement in the space of just a few years.

They also had something else going in their favor. Dylin created a side business, one that provided largely passive income. The side hustle, DR Marketing, generated a “mid-six-figure income” for several years. It became the couple’s third income source, with a big slice of the profits directed into a SEP-IRA.

But here’s the really interesting part of the Redling’s early retirement story: they never planned on it.

This makes them unique in the FIRE movement. Most participants have early retirement as a very specific goal. Dylin and Allison didn’t.

Even without a specific early retirement plan, you can see from their story they were headed for a bright future. High paying jobs, in combination with a profitable side business, a solid real estate investment, and the rapid accumulation of financial investments, is the perfect combination for building wealth.

Confesses Dylin, “We didn’t know anything about the rules of thumb for retirement, such as the 4% rule or saving a nest egg of at least 25 times your annual expenses. Our goals were simply to eventually pay off our mortgage and build up our nest egg as much as possible. We figured that, living in the Bay Area, we would need “a couple” million dollars to retire, but we had never quantified it specially”.

The Early Retirement the Redlings Never Actually Planned For

Early retirement came in 2015. Allison was 44 and Dylin, 43. That’s about 20 years earlier than the average couple crosses that line.

But this is where this story gets really interesting.

Early retirement was something of an accidental development. Or maybe it’s better described as a happy accident.

Retirement was forced on them by the loss of their jobs. But after analyzing their financial situation, they realized they didn’t need to go back to work.

There’s an important message in that development. Even if you have no intention to retire early, it’s still worth it to be ready at any time.

In the case of Dylin and Allison, the catalyst was a simultaneous job loss by both. But in some cases, it could be forced upon you by a serious downturn in the economy, a health issue, or a personal crisis.

The point is, even though the Redlings were specifically planning to retire early, the scenario presented itself even earlier than they could have imagined. 15 years of committed savings and investing put them in a position to retire, even though that wasn’t on their radar screen.

Life in Early Retirement

There are other details about Dylin and Allison’s path into early retirement that are interesting for anyone who hopes to achieve that goal.

Chief among them:

The road to early retirement wasn’t a straight line. Like a lot of investors, the Redlings got clobbered by the 2008 stock market crash. Dylin says they lost about 50%, but confesses, “To be honest we don’t know the exact amount because it was too scary to keep track”. Then there was Dylin’s near death experience in the same year, when a severe case of pneumonia had him in the hospital for two weeks.

Health insurance. This is perhaps the biggest hurdle for would-be early retirees. You’re too young for Medicare, but you’re no longer covered by a company plan. Living in California, the Redlings participate in a high deductible plan under Covered California, the state’s edition of the Affordable Care Act. They’re paying just $200 per month. But health insurance is something every early retiree needs to consider in their plans.

Keep living expenses low. Most FIRE strategies focus primarily on asset accumulation. But the less popular side of the equation is learning to live on less. Despite earning well into six figures during their 15-year accumulation phase, the Redlings now live on only about $40,000 per year. Years of allocating most income to investments helped prepare them for a low-cost lifestyle. For example, they still drive a 2003 Volkswagen Jetta with more than 100,000 miles on it.

Not tapping retirement plans early. In addition to loading up their retirement plans, the Redlings also allocated some of Dylin’s side hustle income into a Target Date Fund in a taxable account. Dividends from this account supply about 50% of their current living expenses.

Early Retirement Strategies You Need to Know

Retiring at 65 comes with financial concerns. Those concerns are magnified when you retire early. There are simply more years to provide for.

I asked the Redlings to address some common retirement concerns:

Maintain ongoing earned income sources

I mentioned in the last section that dividends from their taxable account supply about 50% of their living expenses. But the other half comes from Dylin’s side hustles. That’s the part of his work life he hasn’t retired from. It’s very typical of FIRE success stories to do something similar.

Dylin reports that he continues to work about 20 hours per week on their blog, Retire By 45, and at speaking engagements. They also earn some income from the sale of online courses.

Have a plan to not outlive your money

Dylin and Allison have no plans to begin tapping their retirement accounts until they need to begin taking required minimum distributions at age 70 ½. Between now and then, they plan to continue living on withdrawals from their taxable account and income from part-time business sources.

That’s a solid strategy. “When you retire in your 40’s, one thing to acknowledge is that the 4% rule, the concept that you can safely take out 4% of your portfolio annually without outliving your assets, was designed to be secure over a 30-year time horizon,” says Morgan Ranstrom, a Certified Financial Planner with Trailhead Planners LLC, in Minneapolis. “If your money needs to last longer, you likely need to take on more risk in your portfolio or to consider a lower withdrawal rate. For example, a 3% withdrawal rate will have a higher probability of lasting for 50 years than a 4% or 5% rate of withdrawal.”

Prepare for the potential for a stock market crash

The Redlings experienced that in the 2008 Crash, and maintain a fairly conservative asset allocation as a result. When they initially retired, about 95% of their investments were in stocks. But in the years since, they’ve reduced the stock position to 60%, while moving 35% into bonds, and 5% into alternatives, like real estate investment trusts and precious metals. There’s no absolute protection from a crash, but you can reduce your exposure.

Stay out of debt

The Redlings had their debt well under control during their FIRE accumulation phase. But it becomes even more important once you actually retire. If keeping living expenses low is critical, staying out of debt is an important part of that strategy.

Final Thoughts

As a certified financial planner and blogger, I’m intimately connected to the FIRE movement. Dylin and Allison’s FIRE story is different from most because it wasn’t something they planned. But it goes to show how you can produce unexpected, positive outcomes just by mastering the financial basics.

Coming from their confused and directionless 20s, they gradually moved into career path jobs, steadily increased their incomes, committed to saving an out-sized percentage of their earnings, and stayed out of debt. But when the curtain came down on both their jobs at roughly the same time, they found themselves in a position to move into a new lifestyle – one that most people only dream about.

The moral of their story: it pays to prepare for early retirement, even if you have no plans to do it.