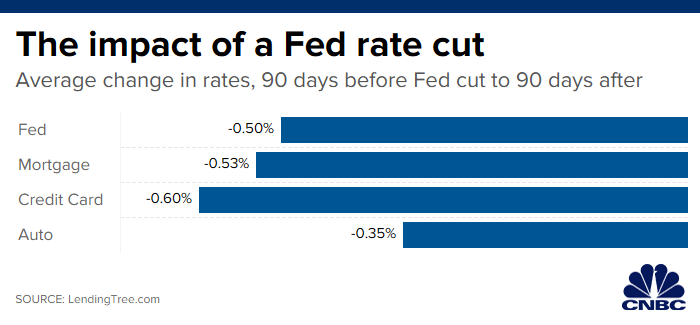

For consumers, lower rates do mean cheaper loans, which can impact your mortgage, home equity loan, credit card, student loan tab and car payment.

On the flip side, consumers likely will earn less interest on their savings accounts, and in some cases, lose buying power over time.

Here’s a breakdown of how it works:

Credit cards

For starters, the prime rate, which is the rate that banks extend to their most creditworthy customers, is typically 3 percentage points higher than the federal funds rate. That not only determines your savings rate, it also is the rate used for many types of consumer loans, particularly credit cards.

With a rate cut, the prime rate lowers, too, and credit cards likely will follow suit. Most credit cards come with a variable rate, which means there’s a direct connection to the Fed’s benchmark rate.

As a result, cardholders could see a reduction in their annual percentage yield, or APR, within a billing cycle or two.

However, that may not help much with APRs still near all-time highs.

A quarter-point decrease from the record-high of 17.8% only saves someone making minimum payments toward the average debt about $1 a month, according to Ted Rossman, industry analyst at CreditCards.com.

Better yet, shop around for a zero-interest balance transfer offer and “transfer your existing high-rate credit card debt to a new card with no interest,” Rossman advised.

At any time, cardholders to can also reach out to their issuer directly to request a break on interest rates.

Savings

Only recently have savers started to benefit from higher deposit rates — the annual percentage yield banks pay consumers on their money — after those rates hovered near rock bottom for years. After the rate cut, those rates likely will come down to some extent.

Because the central bank raised the federal funds rate nine times in three years, the highest yielding accounts are now paying over 2.5%, up from 0.1%, on average, before the Fed started increasing its benchmark rate in 2015.

With an annual percentage yield of 2.5%, a $10,000 deposit earns $250 after one year. At 0.1%, it earns just $10.

“Savers are in a position now where they can earn more on their savings than the rate of inflation,” said Greg McBride, the chief financial analyst at Bankrate.

More from Personal Finance:

What Trump’s call for 0% interest rates would mean for you

Here’s one easy way to pay less to your credit card company

Don’t pat yourself on the back for saving

Online banks are able to offer higher-yielding accounts because they come with fewer overhead expenses than traditional bank accounts and savers can snag significantly higher savings rates by shopping around.

“If you have your money at an online savings account, that rate will probably fall but you are still earning 20 times more than someone at a big bank,” McBride said.

Alternatively, consumers can lock in an even higher rate with a 1-, 3- or 5-year certificate of deposit (top yielding rates average 2.45%, 2.68% and 2.88%, respectively) although that money isn’t as accessible as it is in a savings account and, for that reason, does not work well as an emergency fund.

Mortgages

Federal funds and mortgage rates are not directly linked. Rather, the economy, the Fed and inflation all have some influence over long-term fixed mortgage rates, which generally are pegged to yields on U.S. Treasury notes.

Recently, mortgage rates have edged higher on the heels of stronger than expected economic data, noted Tendayi Kapfidze, the chief economist at LendingTree, an online loan marketplace.

The average 30-year fixed rate is now close to 4%, according to Bankrate, although that remains relatively low compared to recent years.

This means that there is still an opportunity to refinance at a lower rate. “Cutting your monthly mortgage payment by $150 a month might be the pay raise you didn’t otherwise get,” McBride said.

Many homeowners with adjustable-rate mortgages, which are pegged to a variety of indexes such as LIBOR or the 11th District Cost of Funds, may see their interest rate go down as well, although not immediately as ARMs generally reset just once a year.

The Fed’s second consecutive rate cut will also make it slightly cheaper for consumers to borrow money from a home equity line of credit or pay back their current HELOC loan. Unlike an ARM, HELOCs could adjust within 60 days so borrowers will benefit from smaller monthly payments within a billing cycle or two.

Auto loans

For those planning on purchasing a new car, the Fed decision likely will not have any big material effect on what you pay. For example, a quarter-point difference on a $25,000 loan is $3 a month, according to Bankrate.

Auto loan rates have remained low, even after years of rate hikes. Currently, the average five-year new car loan rate is 4.62%, up from 4.34% when the Fed started boosting rates, while the average four-year used car loan rate is 5.32%, up from 5.26% over the same time period, according to Bankrate.

This rate cut also lowers financing costs for car manufacturers and dealers as well, which means car shoppers may see more favorable rates to come, Kapfidze said, although other factors will play a role in the overall cost of a car in the months ahead, including increased tariffs on materials.

Student loans

While most student borrowers rely on federal student loans, which are fixed rate, more than 1.4 million students a year use private student loans to bridge the gap between the cost of college and their financial aid and savings.

Private loans may be fixed or may have a variable rate tied to the Libor, prime or T-bill rates, which means that when the Fed cuts rates, borrowers will likely pay less in interest, although how much less will vary by the benchmark.

If you have a mix of federal and private loans, consider prioritizing paying off your private loans first or refinance your private loans to lock in a lower fixed rate, if possible.

(A college education is now the second-largest expense an individual is likely to incur in a lifetime — right after purchasing a home. The average graduate leaves school $30,000 in the red, up from $10,000 in the early 1990s.)