Claire Rhee is a third-year student at Stanford Medicine.

Source: Claire Rhee

Claire Rhee describes the experience of applying for medical school as “relatively cheap.”

Between the Medical College Admission Test, or MCAT; application fees at 15 different schools; and other related expenses, she and her family spent close to $9,000.

And that was before the 24-year-old even became a student at Stanford University School of Medicine. Rhee is now in her third year.

“I had some savings and tried to be as frugal as possible, but it is definitely very financially stressful,” she said.

Median pay for physicians and surgeons can top $208,000 a year, depending on the discipline, according to the Bureau of Labor Statistics. But the road to get that well-paying job is a costly one.

Students take on a median debt of $200,000 to get through medical school, according to the Association of American Medical Colleges.

Rhee’s situation isn’t uncommon. Just applying to these schools is a costly undertaking.

“I counsel my students to budget a lot of money for this — usually between $5,000 and $10,000,” said McGreggor Crowley, a pre-medical counselor at admissions counseling company IvyWise.

Potential costs

Pierce Curran is a first-year student at the Penn State College of Medicine

Source: Pierce Curran

Applicants can expect to spend $2,800 on application fees alone, according to Swarthmore College’s guide to applying to medical school. Typically, students apply to 15 to 20 schools, the guide notes.

There are two parts to the application process. First, students pay $170 to file an application through the American Medical College Application Service, which verifies and distributes applicant data to one medical school that a student selects.

Prospective students can forward their data to additional schools for an extra cost of $40 per institution.

The second part of the application process is specific to each school: Students are expected to detail why they want to go there. These fees will vary by the college.

More from Personal Finance:

Where the 2020 Democratic candidates stand on student debt

College graduates owe $29,000 in student debt now

What you should know before giving a debit card to your kids

Med school hopefuls also pay $315 to take the MCAT, and many take it more than once. Prospective students can also shell out more money for exam prep. For instance, Kaplan’s live online prep class costs $2,499.

Once students are brought in for interviews at the schools, they must also pay for their travel expenses and lodging.

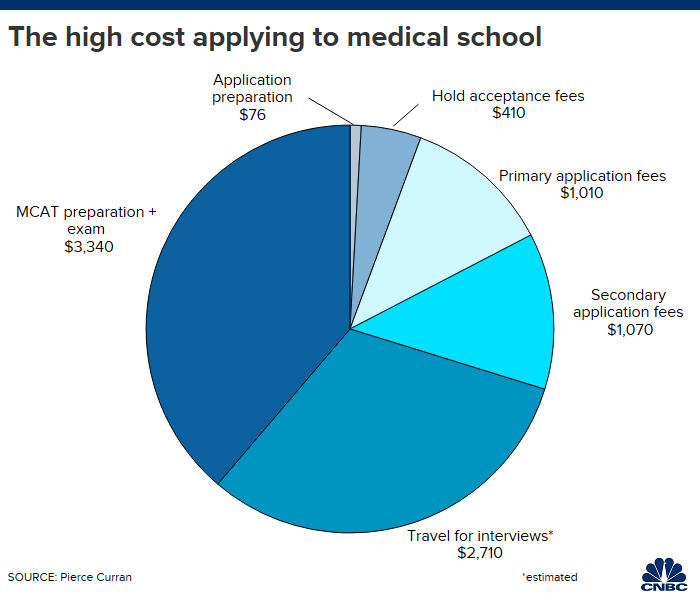

Pierce Curran, who applied to 21 schools before starting at Penn State’s medical school this year, said he paid an average of $500 for each interview.

See below for a breakdown of all his expenses.

Curran once spent $800 to travel from Hayesville, North Carolina, to attend an interview at Case Western Reserve University in Cleveland.

“I purposely did not apply to any schools in California or on the West Coast because I just knew that I wouldn’t be able to fly across the country — flight costs and time investments would be too expensive,” he said.

Applicants who are accepted to a school must put down a deposit, usually around $100, to reserve their seat. Sometimes, they may pay deposits at multiple colleges to hold their spot while they continue applying.

The financial strain post-college

xavierarnau | E+ | Getty Images

When it’s time to pay for those medical school application fees, prospective students may already be encumbered with student loans.

For instance, Rhee deferred payment on her undergraduate loans — which approached $15,000.

She said her pre-med advisement in college did not prepare her for the cost of applying.

“They don’t mention [it] because they think that, because you know med school is expensive, the cost of applying will be small,” Rhee said. However, “for some people, it’s a prohibitive cost,” she added.

For a student who has made their way through college on an already limited financial aid system, it’s either is going to put them off applying or is going to stretch them significantly.

Eddy Conroy

assistant director of community engagement and research application at the Hope Center for College, Community and Justice.

Curran was already about $80,000 in debt from his undergraduate and master’s degrees when he started applying for medical school.

Despite setting money aside to cover expenses, he still had to ask his family for help to manage the cost .

“I don’t know what I would have done if I hadn’t gotten in because now I’ve sunk $9,000 into this process and so much of my time,” Curran said.

Tuition-free schools

Some medical schools are making headlines for gifting students tuition or other associated costs, such as living expenses, in an attempt to lower the debt students face.

Last year, New York University announced it will cover the full tuition cost for all medical students regardless of need, which amounts to $56,272 for the 2019-20 school year.

In 2017, Columbia University’s medical school guaranteed students will graduate debt-free.

This September, Weill Cornell University announced that it will offer a full ride to medical students who qualify for financial age, including tuition, room and board, books and other related expenses.

Because the IRS doesn’t consider room and board to be “qualified education expenses,” it’s possible students could be taxed on some of the scholarship, said Tim Steffen, director of Advanced Planning at Baird Private Wealth Management in Milwaukee.

Tuition and course-related expenses such as books would likely be tax-free, he added.

While you can use a tax-advantaged 529 college savings plan to help pay for medical school, you can’t tap those funds for application costs.

Barrier to entry

USA, Oregon, Portland

Cavan Images | Cavan | Getty Images

Some people with the same medical school dreams as Curran and Rhee aren’t even able to apply.

“When you put up barriers like very high application fees, that is almost always going to make it more difficult for low-income, first-generation and students of color to access these types of programs,” said Eddy Conroy, assistant director for community engagement and research application at the Hope Center for College, Community and Justice.

Low-income applicants may be eligible for a fee assistance program through the Association of American Medical Colleges.

To qualify, each household reported on the application must have 2018 total family income that is 300% or less than the 2018 national poverty level for that family size. For a one-person household, that would be $36,420.

Applicants must also be a U.S. citizen or permanent resident, or have been granted asylum or Deferred Action for Childhood Arrivals (DACA) status.

The fee assistance program includes MCAT preparation products, a reduced fee for the exam to $125 from $315 and complimentary access to the Medical School Admission Requirements (valued at $54). The program also waives the initial application cost for up to 20 schools.

The fee assistance program doesn’t cover the cost of traveling to interviews, which can often be the most expensive aspect of the process — Rhee spent around $4,000 on this and Curran, around $2,710.

“For a student who has made their way through college on an already limited financial aid system, it’s either going to put them off applying or is going to stretch them significantly,” Conroy said.