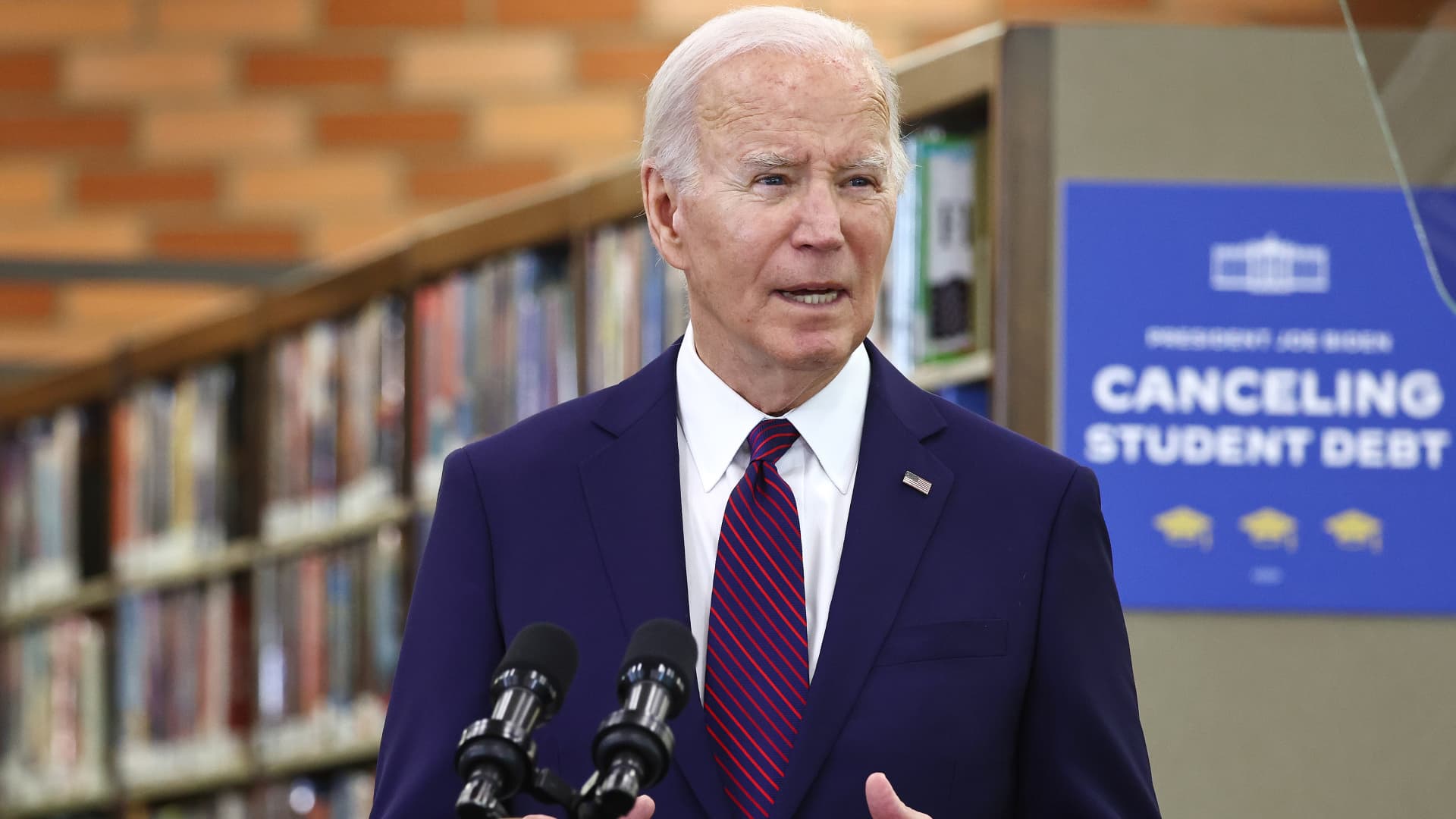

President Joe Biden has announced his student loan forgiveness do-over plan.

Biden rolled out the details of his Plan B less than a year after the Supreme Court struck down his first attempt at delivering wide-scale education debt relief.

“The ability for working- and middle-class folks to repay their student loans has become so burdensome, a lot can’t repay it for even decades after being in school,” said Biden on April 8 at an event in Madison, Wisconsin.

More from Personal Finance:

What Biden’s new student loan forgiveness plan means for your taxes

‘Proceed with caution’ before tapping AI chatbots to file your tax return

There’s still time to reduce your tax bill or boost your refund before the deadline

Here’s how Biden’s revised aid package differs from his first.

A more targeted forgiveness program

Biden‘s 2020 campaign promise to erase student debt was thwarted at the Supreme Court last June.

The majority-conservative court ruled that Biden’s $400 billion loan cancellation plan was unconstitutional. Biden had tried to forgive the debt of nearly all 40 million federal student loan borrowers, with many people getting up to $20,000 in cancellation. In general, only high earners were excluded.

This time, the Biden administration has narrowed its aid by targeting specific groups of borrowers. It hopes that move will help the new plan survive legal challenges.

“I think it would be easier to justify in front of a court that is skeptical of broad authority,” said Luke Herrine, an assistant professor of law at the University of Alabama, in an earlier interview with CNBC.

Tens of millions of borrowers may still benefit if the program endures.

The plan would forgive the debt of borrowers who:

- Are already eligible for debt cancellation under an existing government program but haven’t yet applied

- Have been in repayment for 20 years or longer on their undergraduate loans, or more than 25 years on their graduate loans

- Attended schools of questionable value

- Are experiencing financial hardship

It’s not entirely clear yet how financial hardship will be defined, but it could include those burdened by medical debt or high child-care expenses, the Biden administration said.

The new plan also calls for borrowers to get up to $20,000 of unpaid interest on their federal student debt forgiven, regardless of their income.

For critics, deja vu

For critics of broad student loan forgiveness, Biden’s new plan looks a great deal like his first.

After Biden touted his revised relief program, Missouri Attorney General Andrew Bailey, a Republican, wrote on X that the president “is trying to unabashedly eclipse the Constitution.”

“See you in court,” Bailey wrote.

Missouri was one of the six Republican-led states — along with Arkansas, Iowa, Kansas, Nebraska and South Carolina — who brought a lawsuit against Biden’s last debt relief effort.

The red states argued that the president overstepped his authority, and that debt cancellation would hurt the bottom lines of lenders. The conservative justices agreed with them.

Once the Biden administration formally releases its new student loan forgiveness plan, more legal challenges are inevitable, said higher education expert Mark Kantrowitz.

“Lawsuits will likely follow within days,” Kantrowitz added.