getty

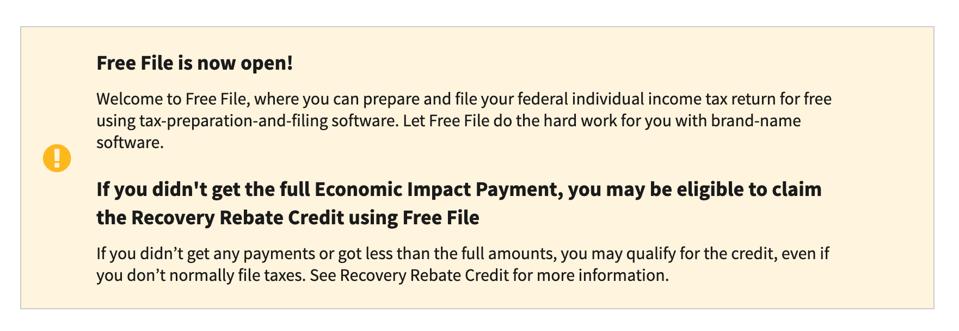

Ready to file your 2020 tax return? The Internal Revenue Service (IRS) hasn’t officially announced the start date to the new season, but the website indicates that Free File is officially open.

IRS

Free File is available to taxpayers whose adjusted gross income (AGI) was $72,000 or less in 2020. You can find your AGI by looking at line 11 on Form 1040. The amount includes income less any adjustments (sometimes called above-the-line deductions) and is calculated before claiming the standard or itemized deductions. That means that it applies to most taxpayers.

Even though there’s no official IRS start date published, if you use Free File, you can do your taxes now. The Free File provider will then submit the return once the IRS officially opens tax season and starts processing tax returns.

Since its 2003 debut, Free File has served tens of millions of taxpayers. Free File is a public-private partnership between the IRS and Free File Inc. (FFI). Free File has been the center of some controversy in recent years, with allegations that some providers were leading taxpayers to paid services when they should have been directed to the free services. That should be changing: As of last year, tax preparation software companies are prohibited from hiding free filing services from Google or other search results pages. Additionally, if you don’t qualify for an IRS Free File offer after visiting a company’s Free File website, you can head back to the Free File website to find another offer. Each IRS Free File company must provide you information when you don’t qualify, with a link back to the IRS.gov Free File site.

MORE FOR YOU

So how does it work? Click over to IRS.gov/freefile to see all Free File options. If you know which software partner you want to use, you can click straight through. Otherwise, you can use a “lookup” tool to help you find the right product.

Not every Free File partner has the same eligibility criteria: it may vary based on income, age, and state residency. However, most companies provide a special offer for active-duty military personnel who earned $72,000 or less regardless of the company’s other eligibility standards.

Additionally, some but not all partners offer free prep and filing for state returns. Check the fine print before you start your return. Any state preparation or non-qualifying fees are required to be disclosed on the company’s Free File landing page.

If you used Free File last year, you should receive an email from the same company product that you used, welcoming you back to Free File. The email should include a link to the company’s Free File online program and explain how to file with the program. You don’t have to use the same company: it’s intended to help you get started if you want to use the same program.

You can only file your current year tax return using IRS Free File. You cannot process a prior year return using IRS Free File.

Free File is typically available through the extension date, which is October 15, 2021.