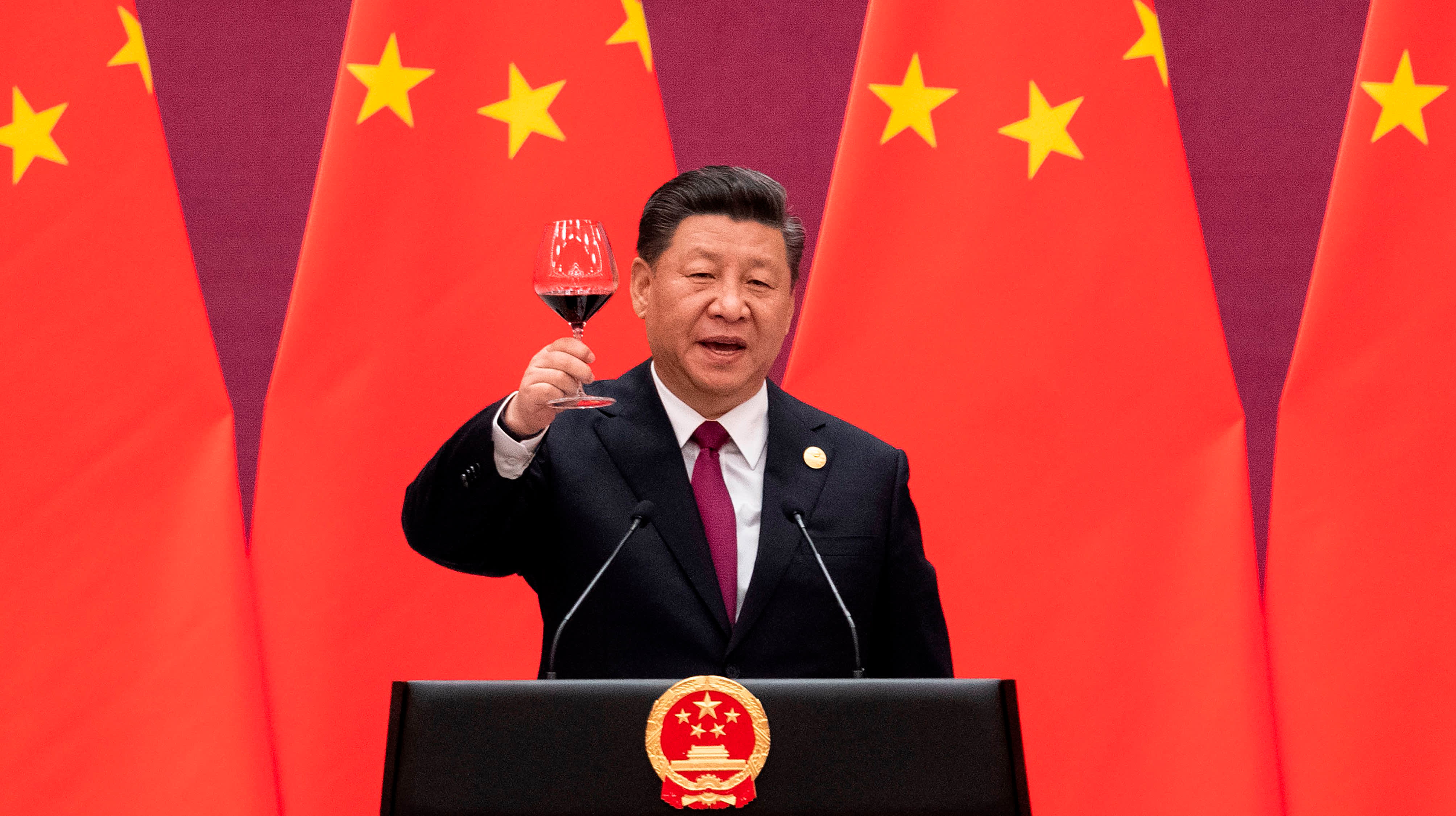

China’s President Xi Jinping raises his glass and proposes a toast at the end of his speech during the welcome banquet for leaders attending the Belt and Road Forum at the Great Hall of the People in Beijing on April 26, 2019.

Nicholas Asfouri | AFP | Getty Images

During the Cold War, it would have been unthinkable for the U.S. government to force members of the military and federal employees to invest their retirement savings in funds that included Soviet companies working against U.S. interests and values.

Yet the Federal Retirement Thrift Investment Board—the body that manages the Thrift Savings Plan (TSP), the 401(k) for federal employees—wants to funnel the retirement savings of these Americans directly to a regime that poses one of the greatest threats to our nation’s long-term security and prosperity: the Chinese Communist Party.

The Board’s short-sighted, foolish decision to use the MSCI All Country World ex-U.S. Investable Market Index as a benchmark means TSP retirement accounts will effectively fund companies that engage in human rights abuses and support China’s efforts to undermine America. It exposes nearly $50 billion in assets to severe and undisclosed material risks associated with many Chinese companies listed on the index.

Last month, we urged the Board to swiftly and publicly reverse its decision and provide information on how it was reached. The Board’s response was not only wholly inadequate, but also informed us that it is outsourcing its review to a Wall Street consultant.

Wall Street has consistently ignored the long-term risks of transferring capital to China in pursuit of short-term gains. Despite the clear risks, the Board and its outsourced advisors failed to consider the national security implications of the decision to transfer TSP funds to Beijing.

Many Chinese companies included in MSCI indexes are state-owned or state-directed enterprises Beijing uses to undermine American workers. They are also involved in China’s military, espionage, human rights abuses, and “Made in China 2025” industrial policy.

The Board’s short-sighted, foolish decision to use the MSCI All Country World ex-U.S. Investable Market Index as a benchmark means TSP retirement accounts will effectively fund companies that engage in human rights abuses and support China’s efforts to undermine America.

One such company is Hikvision, a state-run technology firm that supplies surveillance cameras used in Xinjiang to monitor Uyghurs and other groups brutally oppressed by China. Constituent entities of Hikvision’s controlling shareholder, the China Electronics Technology Group Corporation, were added to the U.S. Commerce Department’s Entity List last year for “acting contrary to the national security or foreign policy interests of the United States.”

As of August 2019, the U.S. government is prohibited from procuring equipment from Hikvision and next year will implement a statutory ban on federal contracts with businesses using the company’s equipment or services.

Several companies our federal workers could potentially invest in are also engaged in flagrant violations of U.S. laws, including Aviation Industry Corporation of China (AVIC), which U.S. Trade Representative Robert Lighthizer has described as “the sole domestic supplier” of bombers, fighter jets, and other aircraft for the People’s Liberation Army.

The U.S. government has repeatedly sanctioned AVIC and its subsidiaries for proliferation activities. Similarly, Zhongxing Telecommunications Equipment Corporation, or ZTE, has violated U.S. law frequently enough to be banned across U.S. government agencies by the FY 2019 National Defense Authorization Act.

Congress and the administration are actively working to counter the long-term threats these companies pose, many of which will soon receive investments directly from the paychecks of our own federal government employees. America’s investors should never be a source of wealth funding the Chinese Communist Party at the expense of our nation’s future prosperity. If the Board refuses to publicly reverse this decision, Congress must act.

China’s economy is intentionally opaque, and Beijing uses state-owned and state-directed enterprises to control production, compete in global markets, and serve the Chinese Communist Party’s military, political, and economic goals. China also routinely blocks U.S. regulators from viewing the full audit reports of publicly-traded companies headquartered in Hong Kong and mainland China.

The Board’s decision to force our nation’s public servants to invest TSP retirement funds in unscrupulous Chinese companies raises serious fiduciary concerns because it ignores a fundamental tenet of our securities laws: investor protection. It’s our responsibility to ensure that U.S. service members and federal employees do not unwittingly undermine the American interests they work hard everyday to protect.

Commentary by U.S. Senators Marco Rubio (R-FL) and Jeanne Shaheen (D-NH).

For more insight from CNBC contributors, follow @CNBCopinion on Twitter.