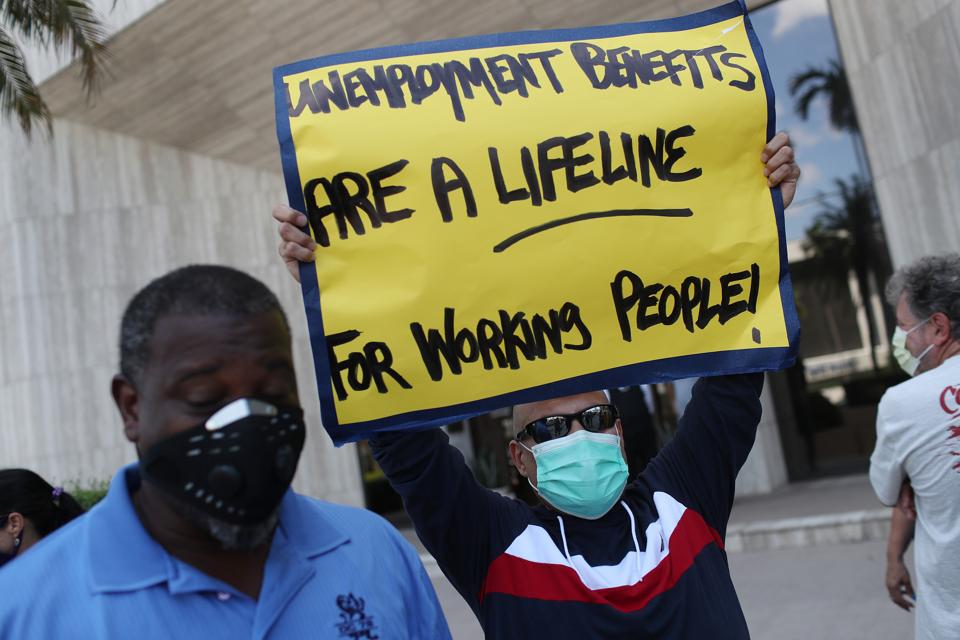

MIAMI SPRINGS, FLORIDA – JULY 16: Carlos Ponce joins other demonstrators participating in a protest … [+]

Getty Images

As Congress scrambles to pass another COVID-19 relief bill, it must decide how best to put money into the hands of people who are suffering from the economic fallout of the pandemic. The three leading choices appear to be: extending enhanced federal unemployment benefits, expanding refundable tax credits, or another round of direct economic impact payments. A fourth idea, President Trump’s plan for a payroll tax holiday, appears dead. But which is best?

Unemployment benefits. In theory, continuing enhanced jobless benefits is a strong choice. It targets aid to those who need it most—people who lost their jobs. But in practice, distributing money through the unemployment system has problems.

The CARES Act included a temporary $600 per week boost in federal jobless benefits, and there is broad agreement to extend that assistance, though lawmakers are split on how big the enhanced payment should be.

Republicans argue that $600 on top of state unemployment benefits is higher than the pay of many workers, and thus is a disincentive for people to return to work. Democrats say that in much of the country, people either cannot work because of the ongoing pandemic or have no jobs to return to. In this week’s TPC webcast The Prescription, Michigan State University economist Lisa Cook said that, with the pandemic still spreading in many states, her advice is to “keep people at home.”

In addition, 10 million workers have had hours or pay cut. Some states, but not all, provide partial unemployment benefits to those whose hours have been reduced. Workers who voluntarily trim their hours so they can care for children at home do not qualify at all.

But there is a bigger problem with jobless benefits. State unemployment systems, many burdened by outdated technology, have collapsed under the weight of more than 1 million applications each week for the past 18 weeks.

A study by the Century Foundation found that, as of late May, states had paid only about 57 percent of claims. While processing time has improved, there remains significant variation among states. For example, as of last week, Nevada had paid only about one-third of claims for the special federal payment.

A federal bump in jobless benefits won’t provide timely help for those still waiting for their applications to be approved.

Expanding refundable tax credits. There are good reasons to improve the earned income tax credit (EITC) and the child tax credit (CTC). My TPC colleague Elaine Maag has described many useful fixes, here and here, such as making low-income workers with no children living at home eligible for a more generous EITC or redesigning the CTC. One big change would be required to make enhanced credits beneficial in today’s economy: The IRS would need to distribute credits regularly, say quarterly or monthly, rather than making beneficiaries wait until they file their tax returns to get one big payment.

In the long run, these are valuable ideas. But is it not likely that a Republican Senate or Trump would support expanding either the EITC or the CTC now. In part, that’s because they fear (probably rightly) that these would become permanent changes, not temporary adjustments to help people weather the pandemic

Another stimulus check. This one takes the most work by the federal government. But the Treasury and IRS have just distributed 159 million payments that were authorized under the CARES Act. They know how to do it by direct deposit, checks, and debit cards. Sure, the program needs some tweaks to both expand eligibility and make sure all those eligible for the payments get them. But those changes mostly are doable.

There are downsides. A single check of, say, $1,200 is far smaller than what many people would get through enhanced unemployment benefits. At the same time, these payments represent a sort of rough justice. They are a windfall for many who still are employed at pre-COVID-19 wages. But Congress could better target the payments to those with lower incomes or simply tax the payments as income in 2021.

A payroll tax cut. While it is a favorite of the president, the idea has attracted little support on Capitol Hill and appears dead for now. While such a tax cut would be easy to distribute, that advantage is outweighed by its flaws. The biggest, of course, is that the unemployed—who have no wages—receive no benefit from the tax holiday.

The other big problem: A cut in the payroll tax would further drain the already-troubled Social Security trust fund. That could be fixed if Congress transfers general fund revenues to the trust fund or if workers and firms pay higher payroll taxes in the future to make up for today’s tax holiday. If neither happens, the already-deep Social Security hole will end up even deeper.

What will Congress do? Very likely mix and match all of these ideas (except for the payroll tax hike).