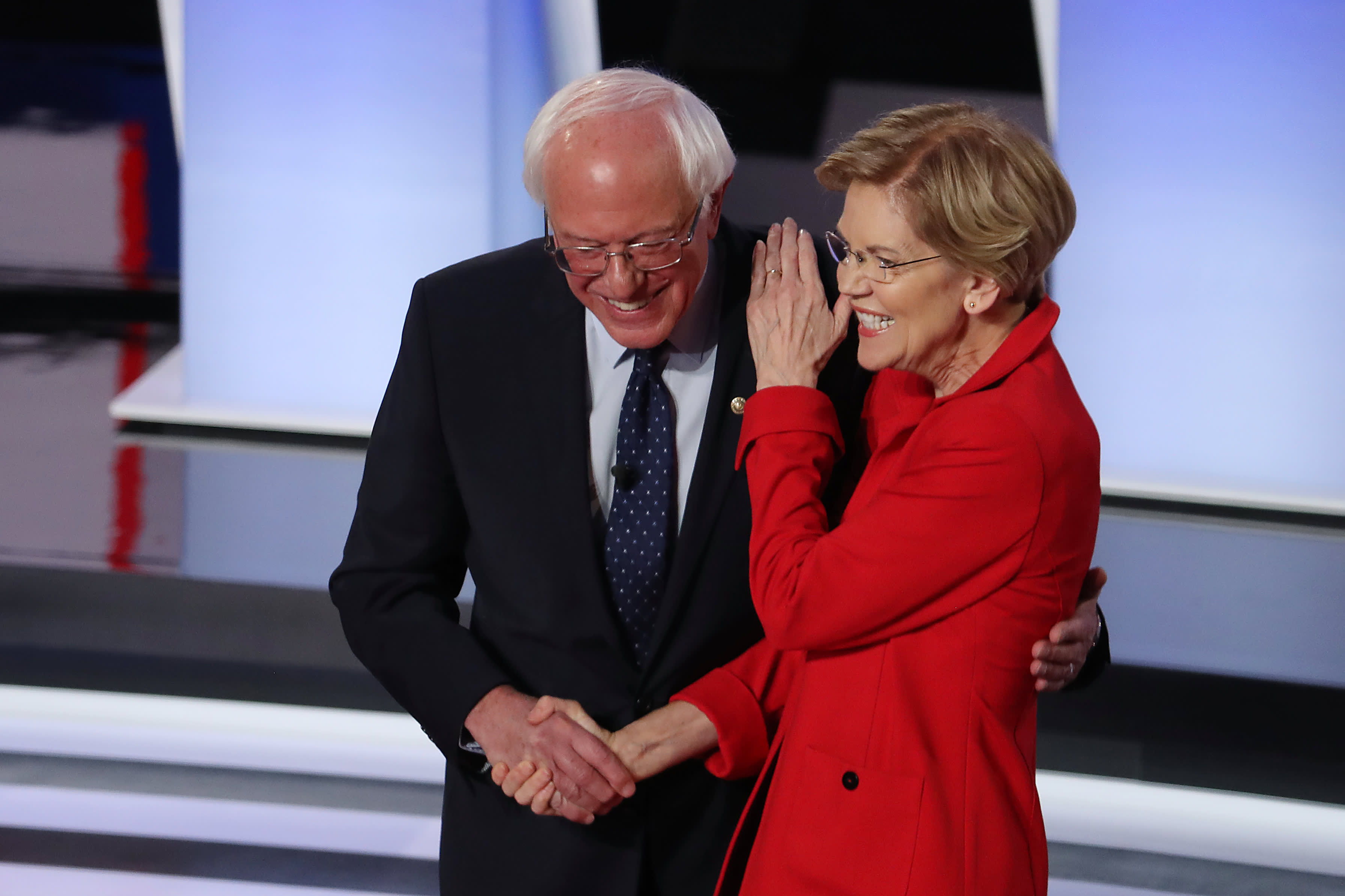

Democratic presidential candidate Sen. Bernie Sanders (I-VT) (R) and Sen. Elizabeth Warren (D-MA) greet each other at the start of the Democratic Presidential Debate at the Fox Theatre July 30, 2019 in Detroit, Michigan.

Justin Sullivan | Getty Images News | Getty Images

Sen. Bernie Sanders unveiled a tax on wealth Tuesday as he aims to cut income inequality and fund his sprawling social programs.

The 2020 Democratic presidential candidate’s proposal follows a similar plan from Sen. Elizabeth Warren of Massachusetts, who has made a wealth tax a centerpiece of her White House campaign. But the measure from Sanders, who has long railed against an economic system that he says favors corporations and the rich, would tax the richest Americans’ assets more heavily than his rival’s.

The Sanders campaign said the levy would apply to net worth above $32 million and raise an estimated $4.35 trillion over the next 10 years. It plans to put the funds toward an affordable housing plan, universal child care and “Medicare for All” — the candidate’s signature proposal. The campaign said the tax would cut the wealth of billionaires in half over 15 years.

In a pair of tweets after he released the proposal, Sanders said “billionaires should not exist.” He added: “We are going to tax their extreme wealth and invest in working people.”

The Vermont independent senator’s plan adds another wrinkle to a primary race shaped by Democrats’ efforts to rein in the excesses of the largest U.S. businesses and wealthiest Americans. Pockets of the business and investing community have warned about Sanders and Warren’s policies hurting the economy — though the candidates have worn the criticism as a badge of honor.

Democrats have also looked for ways to finance vast expansions in government spending on health care and student loan forgiveness, among other programs. Sanders and Warren, two of the top contenders for the presidential nomination, have usually ranked as the top choices among primary voters who identify themselves as liberal.

Under his wealth tax, Sanders proposes these rates for married couples:

- A 1% tax on net worth above $32 million

- A 2% tax on net worth of $50 million to $250 million

- A 3% tax on net worth of $250 million to $500 million

- A 4% tax on net worth of $500 million to $1 billion

- A 5% tax on net worth of $1 billion to $2.5 billion

- A 6% tax on net worth of $2.5 billion to $5 billion

- A 7% tax on net worth of $5 billion to $10 billion

- An 8% tax on net worth above $10 billion

- All of those brackets would be cut in half for single filers

By comparison, Warren’s plan would slap a 2% annual tax on net worth above $50 million. It would tax household net worth above $1 billion at 3%.

Her campaign said it would raise an estimated $2.75 trillion over a decade.

It is unclear if either candidate would even be able to impose a wealth tax or if the Supreme Court would strike it down before they could. Warren’s campaign has pointed to arguments from scholars in justifying the legality of her plan. The Sanders campaign did the same Tuesday.

It leaned in large part on a column from Yale Law School professors Bruce Ackerman and Anne Alstott arguing for a wealth tax.