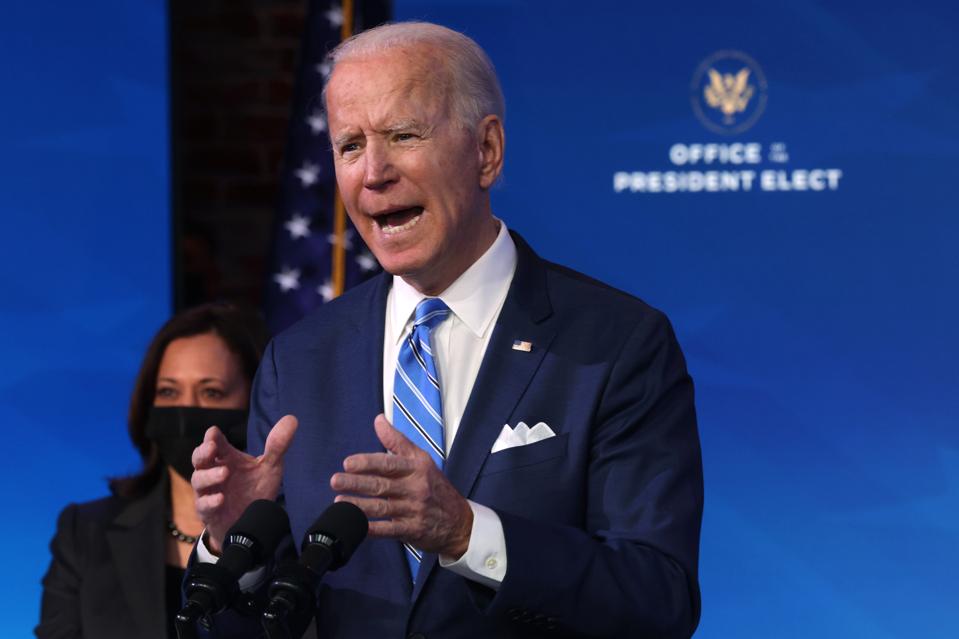

WILMINGTON, DELAWARE – JANUARY 14: U.S. President-elect Joe Biden (R) speaks as U.S. Vice … [+]

Getty Images

President-elect Joe Biden proposed a new $1.9 trillion pandemic relief plan last night that would substantially cut taxes for low- and moderate-income households, especially those with children, and provide more than $600 billion in aid to state, local, and tribal governments.

Biden’s plan would compete with the Coronavirus Aid, Relief, and Economic Security (CARES) Act as the biggest relief bill in US history. On top of the total $3.4 trillion in pandemic relief Congress passed last year, it would mean the federal government would provide more than $5 trillion in assistance to households, business, and state and local governments.

To his credit, Biden’s “American Rescue Plan” focuses primarily on ending the pandemic—by far the most important step he could take to restore a strong economy. And in the short term, it aims to assist low-income workers—those households hurt most by coronavirus. But his package goes well beyond immediate relief. One goal: Cut child poverty in half.

It seems unlikely that Biden will be able to muster the 60 votes he needs to win approve of this entire plan in the narrowly divided Senate. With vice-president Kamala Harris tie-breaking vote, Democrats have only a 51-50 majority there. Most likely, this plan will be split into immediate relief that Biden will try to move quickly, and those longer-term initiatives that may have to wait to be included in a budget reconciliation bill that requires only 51 Senate votes.

Biden’s plan would:

· Increase the $600 per person direct payments approved by Congress in December by an additional $1,400. Biden did not say whether the eligibility rules would be the same as for the $600 payments.

MORE FOR YOU

· Increase weekly federal unemployment assistance to $400 through September and temporarily extend other jobless benefits.

· Provide additional renters’ assistance through September.

· Make the Child Tax Credit (CTC) fully refundable for 2021, increase the credit to $3,000 per child ($3,600 for each child under age 6) and make 17-year olds eligible.

· Expand the Earned Income Tax Credit (EITC) in 2021 by raising the maximum benefit for childless workers to nearly $1,500, raising the income limit to about $21,000 and allowing older workers to claim the credit. He’d also hold harmless families who would otherwise see their EITC decline because of a drop in earnings.

· Expand the Child and Dependent Care Tax Credit (CDCTC) to cover half of child care costs up to $4,000 for one child or $8,000 for two or more. Families making up to $125,000 annually would be eligible for the full 50 percent credit, while those making up to $400,000 could claim a smaller credit.

· Provide $350 billion in unrestricted funding for state and local governments, plus $170 billion for schools, $30 billion for the National Guard disaster relief efforts, $20 billion for public transit, $20 billion specifically for tribal governments, $20 billion to support state and local vaccination efforts, and additional unspecified federal Medicaid funding to further support state vaccination programs.

While Biden casts the EITC and CTC expansions as temporary, congressional Democrats are widely expected to try to make them permanent, either in this bill or in the near future. House Ways & Means Committee Chair Richard Neal (D-MA) and incoming Senate Finance Committee Chair Ron Wyden (D-OR) both are strong supporters of expanding both the EITC and the CTC.

While Biden proposed about $3 trillion in tax increases on high-income households and corporations during the campaign, the plan he released last night included no tax hikes or offsetting spending cuts. His focus was entirely on pandemic relief.

Biden’s plan is huge and ambitious. While some economic provisions could be better targeted, it provides the necessary funding to distribute desperately-needed COVID-19 vaccines and tests. Those provisions may well win quick congressional backing. The fate of his proposed tax credit expansions is less certain.