getty

The Internal Revenue Service (IRS) continues to take steps forward in efforts to protect taxpayer data. Two years ago, the IRS moved to provide more privacy for individual taxpayers; now, beginning on December 13, 2020, the IRS will start masking sensitive data on business tax transcripts.

If you’re scratching your head because that doesn’t feel like new news, you’ve been paying attention: the IRS began talking about this change during the summer Nationwide Tax Forums. Now, they’re moving it into practice.

Tax Transcripts

A tax transcript is a summary of your tax return. There are different kinds of transcripts available depending on the need, and they can be used for everything from preparing prior-year tax returns to income verification for mortgages and student loans.

As you can imagine, that’s a lot of information. In addition to your financial details, a transcript traditionally included your name, address, and other identifying information, like your Social Security Number (SSN), Individual Tax Identification Number (ITIN), or Employer Identification Number (EIN).

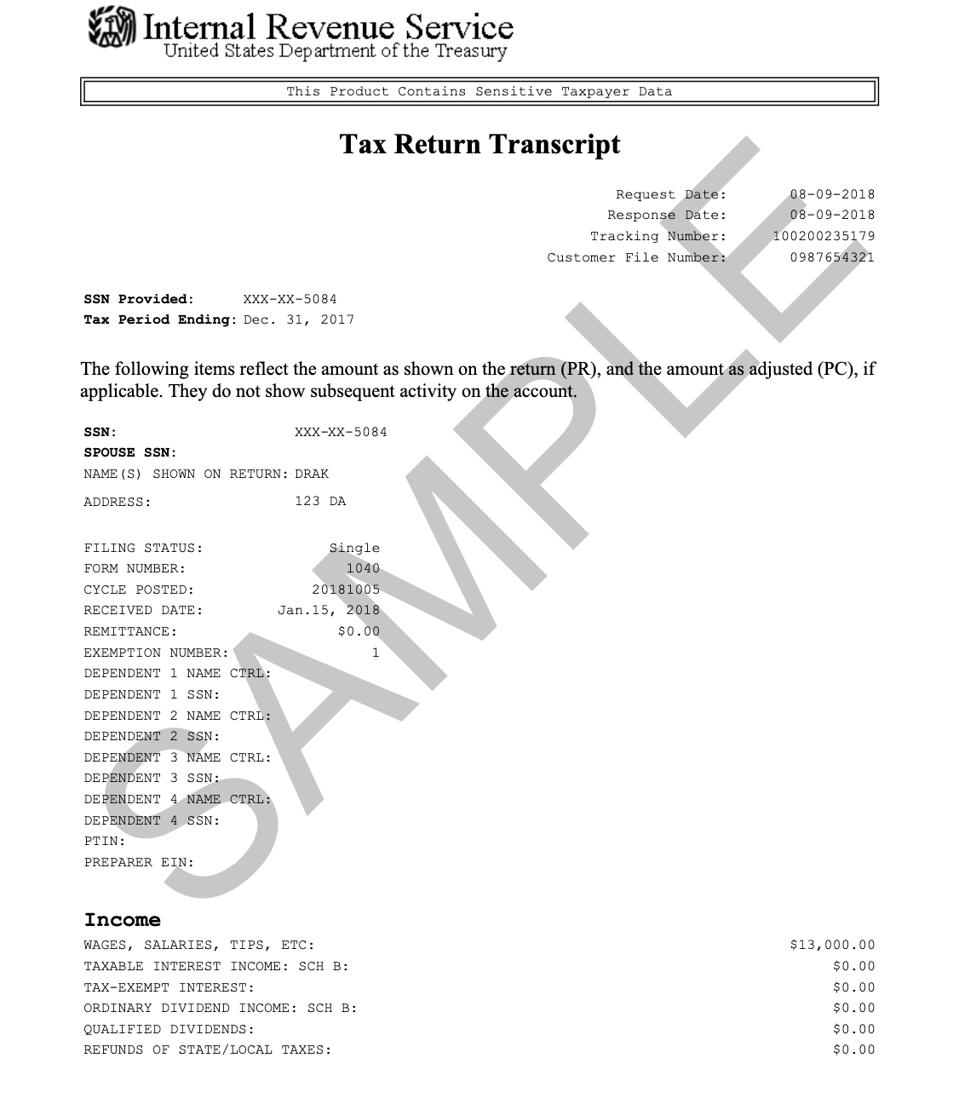

With the latest changes, here’s what is visible on the new tax transcript:

- Last four digits of any EIN listed on the transcript: XX-XXX1234;

- Last four digits of any SSN or ITIN listed on the transcript: XXX-XX-1234;

- Last four digits of any account or telephone number;

- First four characters of the first and last name for any individual (first three characters if the name has only four letters);

- First four characters of any name on the business name line;

- First six characters of the street address, including spaces; and

- All money amounts, including wage and income, balance due, interest, and penalties

MORE FOR YOU

It looks like this:

Sample Unmasked Tax Return Transcript

IRS

Customer File Number

There is also now a space for a Customer File Number. The Customer File Number is an optional 10-digit number that can be created by third parties that allow them to match a transcript to a taxpayer.

What’s the point? It leaves a digital trail.

Consider a transcript request from a lender. The lender will now assign a Customer File Number directly on Form 4506-T, Request for Transcript of Tax Return, and Form 4506T-EZ (you’ll see it on line 5). That number will also appear on the transcript: it serves as the tracking number to match the taxpayer.

Get Transcript Online Or Get Transcript By Mail

What about transcripts requested using the Get Transcript Online or Get Transcript by Mail feature? Taxpayers can manually enter a Customer File Number assigned to them, for example, by a lender or college financial office. That number will display on the transcript either when it is downloaded or mailed to the taxpayer.

Third Party Reporting

And while I know the use of a fax machine is a running joke these days, the IRS still uses it to communicate. Last year, however, the IRS stopped faxing service for most transcript types to both taxpayers and third parties. They also stopped third-party mailing service via the Forms 4506, 4506-T, and 4506T-EZ. Lenders and others who use those forms to obtain transcripts for income verification purposes should consider other methods, like participating in the Income Verification Express Service (IVES).

What Does It Mean For Tax Pros?

The news about masking initially worried some tax pros who rely on account transcripts for taxpayer business. But, the IRS says there’s no need for concern: those with proper authorization may now request unmasked Wage and Income Transcripts for tax preparation and e-filing purposes through Transcript Delivery System (TDS). TDS can also be used in connection with the optional Customer File Number: you can input a number that will automatically populate on the transcript provided through TDS. This process allows high-volume users to match the transcript to the taxpayer.

Tax pros can also contact the Practitioner Priority Service (PPS) line for transcripts. If you have proper authorization, an unmasked transcript will be sent to your Secure Object Repository (SOR), available through e-Services. The requested transcript will remain in the SOR for a limited time, and is automatically removed after three days once you view it or after 30 days if it is not viewed. Don’t forget to print or save the transcript if you want to keep a copy.