Not paying close attention to your medicare Plan’s Annual Notice of Changes could cost you.

getty

If you have a Medicare Advantage or Part D prescription drug plan, you’ll want to read this post.

By now, you should have received an envelope labeled with “Important Plan Information” in bold type. If you’re like most, you probably don’t recall getting this notice, which can be 15-30 pages or more, depending on your plan and the changes, or you didn’t pay attention.

By law, sponsors of Medicare Advantage or Part D drug plans must send an Annual Notice of Changes (ANOC) to all plan members at least 15 days before the start of Open Enrollment on October 15. This notice outlines changes in the plan’s benefits, coverage, formulary, premium and/or costs that will take effect January 1. It is your chance to determine whether your plan will meet your needs and be cost-effective in 2021. If you determine the plan won’t work, you have the chance to check out other plans and make a switch by December 7. If you don’t pay attention, the plan will renew automatically and then you’re stuck with the changes for another 12 months. (Sometimes experience is the best teacher. Last year, many missed the fact that the premium of their drug plan would double.)

The Centers for Medicare and Medicaid Services (CMS) sets some very specific requirements, including formatting, adding a logo, renumbering sections, and providing a table of contents. Every plan’s notice looks very much the same. Because this is an important document, you need to read it and be able to interpret it.

Understanding the notice

Here are some tips for what you’ll find in the notice and why it’s important.

- Checklist of what you should do. The first two pages summarize the process for plan review and the questions you should answer. Basically, determine the impact of any changes in your plan, compare your plan to others, and choose whether to keep it or make a change by December 7.

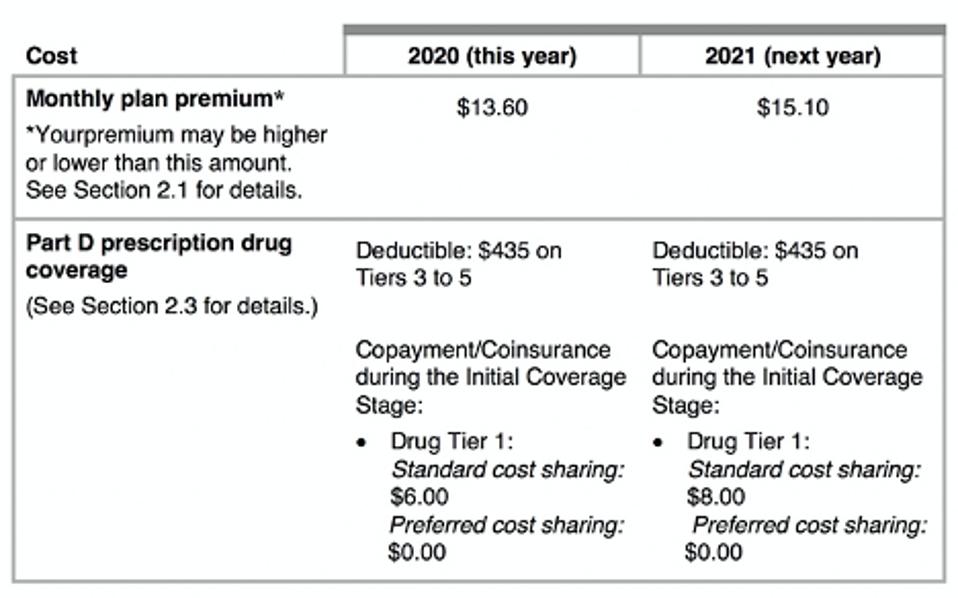

- Summary of important costs for 2021. This section compares this year’s costs with what you’ll pay in 2021. For a Medicare Advantage plan, the page notes monthly premium, health plan deductible, maximum out-of-pocket limit and cost sharing for hospital stays and doctor visits. For Part D drug coverage, either a stand-alone plan or as part of a Medicare Advantage plan, the page notes monthly premium, drug deductible and cost sharing (copayment or coinsurance) during the Initial Coverage payment stage. (Costs during the Coverage Gap (donut hole) and Catastrophic Coverage are the same across all plans.)

Summary of Important Costs

65 Incorporated

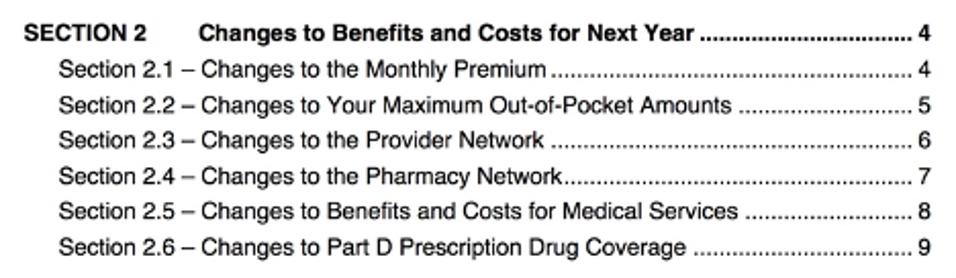

- Table of contents. This list of topics is customized by each plan. The most important information will likely be in the changes to benefits and costs next year.

Table of Contents

65 Incorporated

- Details by topic. Details for each topic follow the Table of Contents and alert you to changes. Unfortunately, you will likely have to go to the plan website to learn more specifics. For example, “There are changes to the network of pharmacies for next year. An updated Pharmacy Directory is located on our website at ….” Or, “A copy of our Drug list is provided electronically. We made changes to our Drug List, including changes to the drugs we cover and changes to the restrictions that apply to our coverage for certain drugs.”

- Deciding which plan to choose. You’ll find how to proceed for any decision you make. If you decide to enroll in a different plan, you will be disenrolled from your current one. If you want to drop an Advantage plan and return to Original Medicare, you can call Medicare.

- Deadline for changing plans. If you want to change to a different plan, you can do that at any time between October 15 and December 7.

If you didn’t get a notice from your plan, call a customer service representative today. If you did get one but didn’t read it, dig it out of your recycling bin. Plans can make big changes to benefits, coverage and costs. You need to know about those changes now so you can make good decisions and ensure the best coverage for yourself in 2021. If you don’t pay attention, you’ll keep the plan you have through 2021, for better or worse.