getty

The U.S. Bureau of Labor Statistics reported today that the consumer price index (CPI) has increased by 0.4% for August. Over the last 12 months, the index increased 1.3% before seasonal adjustment; this figure has been on the way up since the end of May 2020. In contrast, the chained CPI increased 1.0% over the last 12 months.

The CPI measures the cost of goods and services—in other words, your cost of living. Under the Tax Cuts And Jobs Act (TCJA), the Internal Revenue Service (IRS) now figures cost-of-living adjustments using the “chained” CPI. The chained CPI measures consumer responses to higher prices rather than merely measuring the higher prices.

What that means for taxpayers is that inflation adjustments will appear smaller: Most inflation-adjusted amounts, including the threshold dollar amounts for tax rate brackets, are projected to rise by about 1%.

“As expected, we are projecting small increases for most inflation-adjusted amounts this year. These small increases are due to the use of the chained CPI to measure cost of living adjustments and the slow rise in inflation overall,” said Steven Grodnitzky, practice lead for U.S. Income Tax and IRS Procedure, Bloomberg Tax & Accounting. “Taxpayers and tax planners can get an early start on 2021 tax year strategies by using these projections before the release of figures by the IRS.”

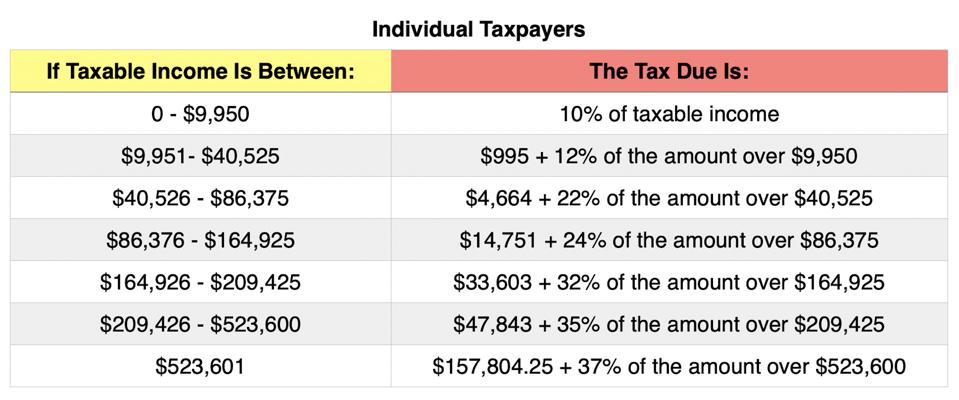

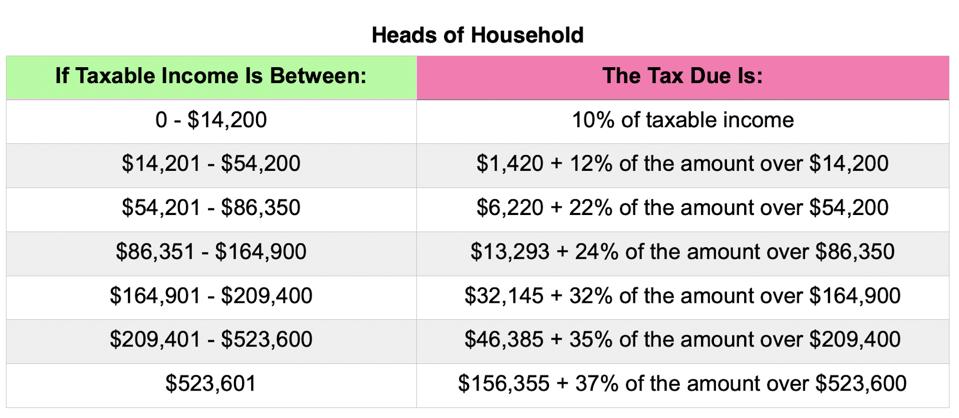

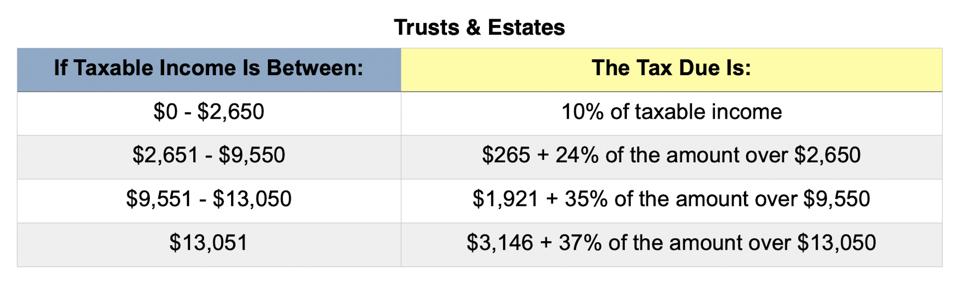

Following is a first look at predicted rates for the next year as calculated by Bloomberg Tax & Accounting for the tax year 2021, beginning January 1, 2021. These are not the tax rates and other numbers for 2020 (you’ll find the official 2020 tax rates here).

Tax Brackets

The tax brackets by filing status and income are as follows:

KPE

KPE

KPE

KPE

KPE

Capital Gains

As with income tax rates, capital gains rates will not change for 2021, but the brackets for the rates will change. Most taxpayers pay a maximum 15% rate, but a 20% tax rate applies to the extent that taxable income exceeds the thresholds set for the 37% ordinary tax rate. Exceptions also apply for art, collectibles and section 1250 gain (related to depreciation).

Bloomberg Tax anticipates that the maximum zero rate amounts and maximum 15% rate amounts will break down as follows:

KPE

Personal Exemption Amounts

As part of the TCJA, there are no personal exemption amounts for 2021.

Personal exemptions used to decrease your taxable income before you determined the tax due. You were generally allowed one exemption for yourself (unless you could be claimed as a dependent by another taxpayer), one exemption for your spouse if you filed a joint return and one personal exemption for each of your dependents—but that’s no longer the case.

For purposes of the definition of a qualifying relative, the exemption amount is projected to be $4,250 ($4,300).

If the two amounts are confusing, here’s the skinny: the first amount, $4,250, is the amount that Bloomberg Tax believes is the literal application of the applicable IRC provision, but the amount in parentheses is the amount they expect the IRS to publish.

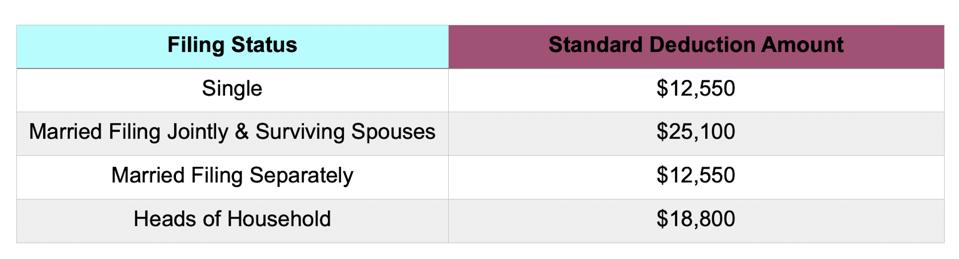

Standard Deduction

As part of the TCJA, the amount of the standard deduction doubled for most taxpayers in 2018. With inflation, those amounts remain the same for most taxpayers next year. Here are the projected standard deduction amounts for 2021:

KPE

Also, for 2021, it’s predicted that the standard deduction for an individual who may be claimed as a dependent by another taxpayer will not be more than (1) $1,100, or (2) the sum of $350 plus the individual’s earned income.

The additional standard deduction amount for the aged or the blind will be $1,350. The additional standard deduction amount will increase to $1,700 if the individual is also unmarried and not a surviving spouse.

For those high-income taxpayers who itemize their deductions, the Pease limitations, named after former Representative Don Pease (D-OH) used to cap or phase out certain deductions. However, as a result of the TCJA, there are no Pease limitations in 2021.

Section 199A deduction (also called the pass-through deduction)

As part of the TCJA, sole proprietors and owners of pass-through businesses are eligible for a deduction of up to 20% to bring the tax rate lower for qualified business income. The deduction is subject to threshold and phase-in amounts. For 2021, those amounts will look like this:

KPE

Alternative Minimum Tax (AMT)

The AMT exemption rate is also subject to inflation. Bloomberg Tax anticipates that the exemption amounts will look like this in 2021:

KPE

Kiddie Tax

For 2021, the standard deduction amount for an individual who may be claimed as a dependent by another taxpayer cannot exceed the greater of (1) $1,100 or (2) the sum of $350 and the individual’s earned income (not to exceed the regular standard deduction amount).

Under the TCJA, your child must pay taxes on their unearned income, but if that amount is more than $1,100, but less than $11,000, you may be able to elect to include that income on your return rather than file a separate return for your child.

Student Loan Interest

For 2021, the $2,500 deduction for interest paid on student loans begins to phase out when modified adjusted gross income (MAGI) hits $70,000 ($140,000 for taxpayers filing a joint return) and is completely phased out when MAGI hit $85,000 ($170,000 for taxpayers filing a joint return).

Health Flexible Spending Arrangements

For 2021, the dollar limitation for contributions to health flexible spending arrangements is $2,750. If the plan permits the carryover of unused amounts, the maximum carryover amount is $550.

Foreign Earned Income Exclusion

For 2021, the foreign earned income exclusion amount is $108,700.

Revocation or Denial of Passport

For 2021, the threshold amount for seriously delinquent tax debt before your passport is certified to the State Department to be revoked is $54,000.

Federal Estate Tax Exemption

The federal estate tax exemption for decedents dying will increase to $11.7 million per person or $23.4 million per married couple in 2021.

Gift Tax Exclusion

The annual exclusion for federal gift tax purposes will remain at $15,000 in 2021. That means that you can gift $15,000 per person to as many people as you want with no federal gift tax consequences in 2021; if you split gifts with your spouse, that total is $30,000 per person.

Remember that these are just projections.

The Internal Revenue Service (IRS) will publish the official tax brackets and other tax numbers for 2021 later this year, likely in October.

The 2021 tax projections are just one of the features from Bloomberg Tax & Accounting. The full report is available here (registration required). Bloomberg Tax & Accounting provides comprehensive global research, news and technology to tax and accounting professionals.