null

Albert Einstein, iconic genius and one of the greatest minds of the last century, had one puzzle he found baffling: “The hardest thing in the world to understand is the income tax.”

If he found taxes enigmatic, it’s no surprise that the rest of us have difficulty following along. The end of the year offers you a few concrete things you can do to clear some of that confusion and take control of your tax life.

The fourth-quarter stretch should draw your attention to tax realities surrounding itemizing, retirement and charitable giving. Even though tax season won’t officially be upon us until after the holidays, there are a few details to be aware of now.

Itemized vs. Standard Deduction Planning

The Tax Cuts and Jobs Act (TCJA) passed by congress in 2017 moved the goalposts in the tax game. Knowing these changes is vital to how you play.

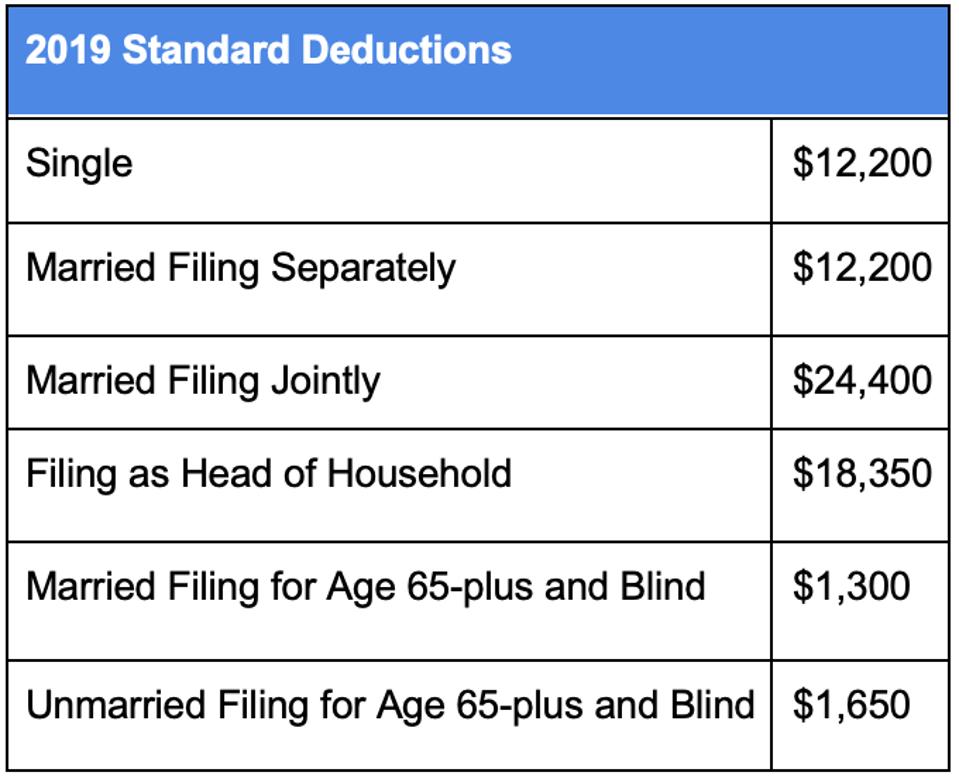

Individual filers can either take the standard deduction or itemized deduction. However, because the Tax Cuts and Jobs Act almost doubled the standard deduction amounts, fewer people are able to take advantage of itemized deductions.

So, as you wrap up this year, go back and look at last year’s federal income tax returns. Were you an itemized or standard deduction filer last year? If you were a standard deduction filer and not much changed in your life this year, there is a good chance you will take the standard deduction again.

But, if you bought a new home, had a lot of medical bills or gave a lot to charity, it is possible you now could benefit from itemized deductions. Additionally, if you were close in itemized deductions last year to passing the standard deduction amounts, you might want to consider looking for some more itemized deductions by year-end to improve your tax situation.

Carson

Tax-loss Harvesting

How did your investments do this year? Some of your investments might’ve done well as the S&P 500 had a good year, or maybe you had some securities that suffered a loss.

A smart tax planning strategy is to:

· Sell off some of your stocks with gains, realizing the gains.

· Then, sell off some of your stocks with a loss, realizing the loss.

With your capital investment assets you can offset gains with capital losses.

The IRS also allows you to offset $3,000 in non-investment income from capital losses. You can then rebalance your portfolio and stay invested in the market with a similar risk profile but offset some potential taxable gains.

Roth Conversion

Roth conversions are one of the most popular and powerful tax planning strategies available today. As of 2010, anyone – regardless of income levels – can convert traditional IRAs to Roth IRAs.

Roth conversions help you do three things:

1. It allows you to pay taxes today instead of in the future. If you believe your tax rates or tax rates in general are going up, it can make sense to do a Roth conversion today.

2. Roth IRAs are not subject to Required Minimum Distributions (RMD) at 70.5 so you have more control over money in retirement.

3. Qualified Roth IRA distributions are not taxable income, allowing you to keep down taxes on your Social Security Benefits and to minimize Medicare premiums in retirement.

So how exactly do Roth conversions work? Traditional IRAs and qualified plans can be converted into a Roth IRA. By converting a traditional IRA to a Roth IRA, any untaxed amounts that are rolled over or transferred to a Roth IRA are subject to income taxation.

Dec. 31 Deadline!

To convert money to an IRA and have the taxable income included in a given year, the conversion must take place by Dec. 31. While you do still have 60 days to get the money into a Roth IRA, the transaction must be started by the end of the year.

So, if you want to convert an IRA to a Roth IRA for 2020 – and have that income included for 2019 – the conversion must take place by Dec. 31, 2019.

Charitable Planning

If you want to give money to a charity and receive a tax deduction for this year, you need to make this gift by the end of the year. But it’s important to remember that only those who itemize their deductions for federal income tax purposes can take advantage of the charitable deduction.

As such, if you are a standard deduction filer and give to a charity you likely will not receive any tax benefits for your gift.

Bunching Contributions

Let’s say you give $10,000 a year to charity but your overall itemized deductions just add up to $22,000 as a couple this year, just below the standard deduction amount. In this case, your $10,000 of charitable contributions won’t provide a tax benefit.

“Bunching” or bundling charitable contributions can help with this. If you bunch your next five years of contributions into this year, and you make a $50,000 gift, along with your other $12,000 of itemized deductions, you would have a $62,000 itemized deduction, giving you thousands of dollars in tax savings by bunching your contributions into one year as opposed to spreading them out over the next five.

Accounting for Your Health – FSAs and HSAs

A flexible spending account (FSA) is a special type of tax-deductible account that can be used for certain types of expenses. Talk to your employer about your FSA so you know how to best utilize it as plans can vary from employer to employer.

One other issue with FSAs is that often the money needs to be used by the end of the year, or you lose it. FSA money can be used for medical and certain dental expenses.

A Health Care Savings Account (HSA) is triple tax-advantaged – contributions, growth and qualified withdrawals aren’t taxed. Unlike the FSA, the HSA rolls over every year and has no “use it or lose it” policy. Your limit for HSA contributions will be $7,100 in 2020.

Wrapping Up the Year

Taxes are unavoidable, but you can approach them with a semblance of strategy and control. Many of these tax moves you can make are probably already part of your life – charitable giving, retirement savings – and just need to be connected to your overall tax approach. It is also a good time to review things like your estate plan, savings goals and personal goals for 2020. Take the time and give yourself the gift of future financial security by getting your tax and financial planning in order by end of year.