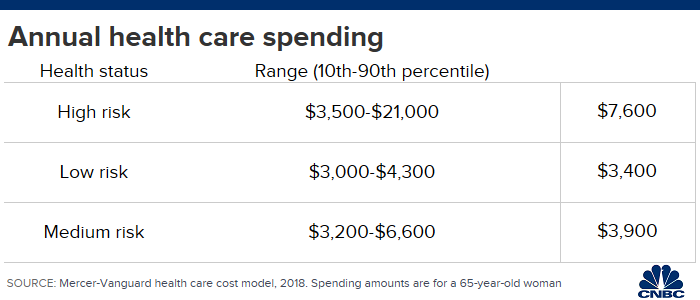

Retirees will spend a significant amount of money on health care. Still, many older Americans don’t plan properly for it.

A healthy male-female couple retiring at age 65 in 2019 can now expect to shell out $285,000 on health-care expenses in retirement, according to Fidelity Investments’ annual analysis.

Fidelity’s analysis, which assumes the couple are eligible for Medicare, includes premiums, copays and other cost-sharing expenses, along with prescription-drug costs.

Two-thirds of retirees said dealing with health issues was among their top worries about retirement, according to a new study by Wells Fargo. Most people assume Medicare will cover their costs, but that is not the case.

Expenses that are not covered by Medicare — dental coverage, basic vision and over-the-counter medicines — would be on top of that $285,000 estimate.

The estimate also excludes long-term care costs.

According to Fidelity, about 15% of the average retiree’s annual costs will be used for health-care-related expenses, including Medicare premiums and out-of-pocket expenses.

Of course, Medicare is the primary insurer for the 65-and-older crowd. Provided that you’ve paid your dues in the workforce for at least 10 years, you’ll qualify for Part A at no cost, which covers hospital stays, skilled nursing facilities and hospice care.

You can opt in to Part B, which covers doctor visits and outpatient care, but requires a monthly premium.

You may also choose to enroll in Medicare Part C, or Medicare Advantage. These are plans from private insurers that can add more coverage such as vision, dental or prescription benefits.

Alternatively, if you have Medicare Parts A and B, you can apply for a supplemental insurance policy, called Medigap, to help cover health costs such as copayments, coinsurance and deductibles.

If you only want prescription coverage, you can opt for Medicare Part D instead of C.

To weigh what’s best, your State Health Insurance Assistance Program, or SHIP, has free counseling to help find the right plan.

More from Invest in You:

Worried about a recession? Here’s how to protect your finances

Those weekly splurges cost $7,400 extra annually

What’s your smart money IQ?

There are also steps you can take to mitigate expenses where Medicare falls short.

For starters, review your plan. There are lots of Medicare plans available, with different levels of coverage. For example, with Medicare Parts A and B, you can see any doctor who accepts Medicare, but with a Medicare Advantage plan, it will be less expensive if you see doctors and go to hospitals that are in the plan’s network.

Medicare open enrollment for 2020 runs from Oct. 15 to Dec. 7. During this time, you can change from original Medicare to a private Medicare Advantage plan or switch back to original Medicare.

Compare prices for plans in your area through Medicare.gov or on your state insurance department site.

Fund a health savings account. Get ahead of health-care costs by investing tax-free dollars in an HSA before you enroll in Medicare.

Not only is the money contributed tax-deductible, but both the earnings and withdrawals — as long as they’re for health-care expenses — are also not taxed.

Once medicare coverage begins, you can no longer contribute to the HSA but you can tap those funds to pay for any medical costs that are not covered, including copays and other out-of-pocket expenses.

Manage your retirement income. Generally speaking, the more you make, the higher your premiums will be for Medicare Parts B and D.

Once you’ve reached retirement, manage distributions from all your taxable, tax-deferred and Roth accounts in a way that will keep you in the lowest tax bracket as possible. Tap the accounts that allow tax-free withdrawals first — such as Roth accounts and brokerage accounts, which are only taxable when you sell appreciated assets to distribute cash.

Distributions from HSA accounts, Roth IRA accounts and cash value life insurance policies don’t count in the formula that determines your Medicare Part B premiums.

“Figuring out optimal withdrawal strategies is where a good accountant or financial planner can help clients save a lot of money,” said physician and certified financial planner Carolyn McClanahan, founder of Life Planning Partners in Jacksonville, Florida.

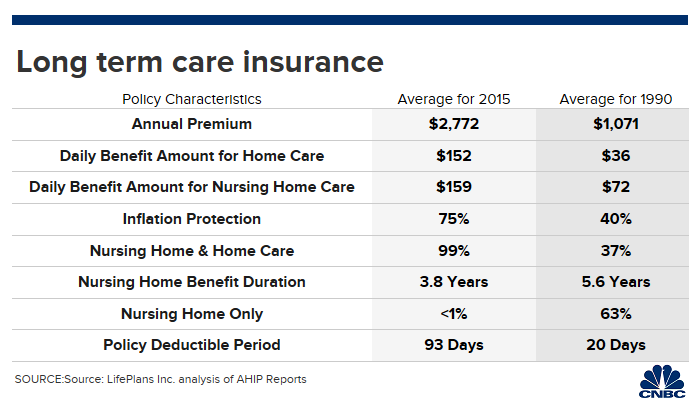

Consider long-term care insurance. If you want to make sure you have funds to cover assisted living, nursing home or at-home care, look into buying a long-term care insurance policy.

These policies help cover the cost of care for two to five years — or longer. Even though insurance premiums have been jumping by double digits, many financial advisors typically recommend maintaining this coverage for now.

See below for a comparison of how policy features and costs have changed over time.

CHECK OUT: 5 questions to ask yourself before buying a home, even if you can afford a down payment via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.