Photo by Hero Images via Getty Images

If you’re planning on punching in at your job well into your 60s, pay close attention to your workplace benefits.

That’s because if you mismanage them, it could cost you.

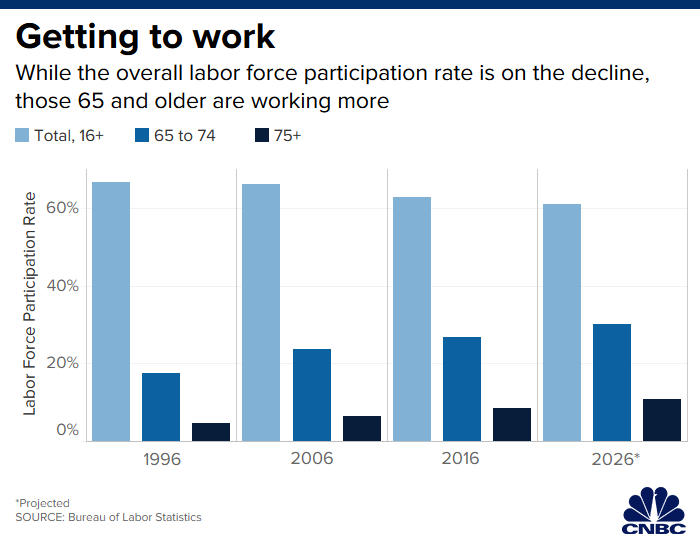

The over-65 crowd is expected to become a growing share of the workplace in the future. The labor force participation rate for workers aged 65 to 74 is expected to reach 30.2% in 2026, according to the U.S. Bureau of Labor Statistics.

That’s up from 26.8% in 2016.

There are numerous reasons why older people keep working, from squirreling away a few more dollars for their retirement accounts to maintaining their employer-subsidized health insurance.

Often those workers find their labor to be fulfilling, so they stick around.

“We have a client who didn’t quit working until 83,” said Carolyn McClanahan, a physician and director of financial planning at Life Planning Partners in Jacksonville, Florida. “Another client who owned a construction firm worked until he was 94.”

Regardless of why you choose to stick around, you’ll need to navigate your benefits enrollment very carefully.

Here are three common areas where older employees might make a mistake when selecting their workplace benefits.

Health insurance and Medicare eligibility

Workers celebrating their 65th birthday in 2020 are also becoming eligible for Medicare.

The catch is that they must coordinate their workplace coverage with their participation in the federal health-care program.

Whether you’re required to enroll in Medicare depends on the size of your company.

People who work at employers with fewer than 20 employees will generally need to sign up for Medicare, as it becomes their primary coverage.

Companies with workers over that number must continue to provide insurance to their employees, regardless of their age.

Opting to continue working will also affect the enrollment process once you sign up for Medicare later.

For instance, people who are newly eligible to enroll and are no longer working have a seven-month initial enrollment period to sign up for Medicare.

Those who miss that window may be subject to a 10% late-enrollment penalty on their Medicare Part B premiums, applicable for each 12-month period for which they were eligible but didn’t sign up.

People who are older and still employed are eligible for a penalty-free eight-month special enrollment period once they or their spouse lose workplace coverage.

Do a side-by-side comparison of your workplace benefits versus Medicare before you proceed. If your workplace plan is affordable and includes dental and vision coverage, it might make sense to stick with it.

Retiree health benefits and coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985, or COBRA — the extension of employee benefits to people who would have otherwise lost them due to job termination — don’t count as qualified employer coverage.

That means you may still face Medicare penalties if you fail to enroll in a timely fashion.

HSA contributions

Photo by Hero Images via Getty Images

Be aware that if you have a high-deductible plan with a health savings account at work, you cannot contribute to it once you’ve signed up for Medicare.

You can save money on a pretax or tax-deductible basis in a so-called HSA and have it grow free of taxes. When you make withdrawals for qualified medical expenses, those distributions also are tax-free.

Next year, account holders with self-only coverage can put away up to $3,550 or $7,100 for family plans. If you’re 55 and older, you can save an additional $1,000.

“If you don’t sign up for Medicare and you don’t have to because you have health insurance through a large employer, you can continue to contribute to the HSA,” said McClanahan.

If you’re planning on enrolling in Medicare in 2020, and you’re turning 65, you’ll need to prorate your contributions to this account.

That means if you turn 65 in July 2020, you can only make six months’ worth of contributions that year.

Required Minimum Distributions

If you happen to be on the verge of age 70½, it will soon be time to take required minimum distributions from your 401(k) and individual retirement accounts. These distributions are taxable.

Older people who are still working have an advantage. If they are participants in a 401(k) plan, they may not have to take this distribution until they retire — if the plan allows it.

There are a couple of catches. First: If you own more than 5% of the company where you work, then you’ll still need to take those RMDs.

More from Personal Finance:

3 tips to get the most out of your employee benefits

Traveling this holiday? Where people are headed

Who’s most likely to go into debt this holiday season

Second, those who are still working can only postpone RMDs from the 401(k) at their current employer. If they have IRAs and other 401(k)s from former employers, they’ll still need to take the distribution from those accounts.

“There’s a potential solution here that many aren’t aware of,” said Oscar Vives Ortiz, CPA and member of the American Institute of CPAs’ personal financial specialist committee.

“If you don’t need the RMD, you can roll your IRA back into the 401(k) and delay it altogether,” he said. You may also be able to roll those old 401(k) account balances into the plan at your current employer.

Be aware that you can only take this step if your company’s retirement plan allows it.

Before you move the money, compare the costs and investment options available in the 401(k) and the IRA.

“You’ll want to make sure that it’s a good plan that will take the rollover so you can hold off on the RMD,” said McClanahan.