©Tim – stock.adobe.com

The most popular index is the best performer, just like before the Dot-Com Bubble

When you talk about the “stock market” or your “stock portfolio,” what do you really mean? For many investors, the S&P 500 is “the market.” After all, the majority of the total value of all stocks on U.S. exchanges are included in it. And, with so much money having flowed into S&P 500-linked index funds over the past decade, it is on the tip of most investors’ tongues.

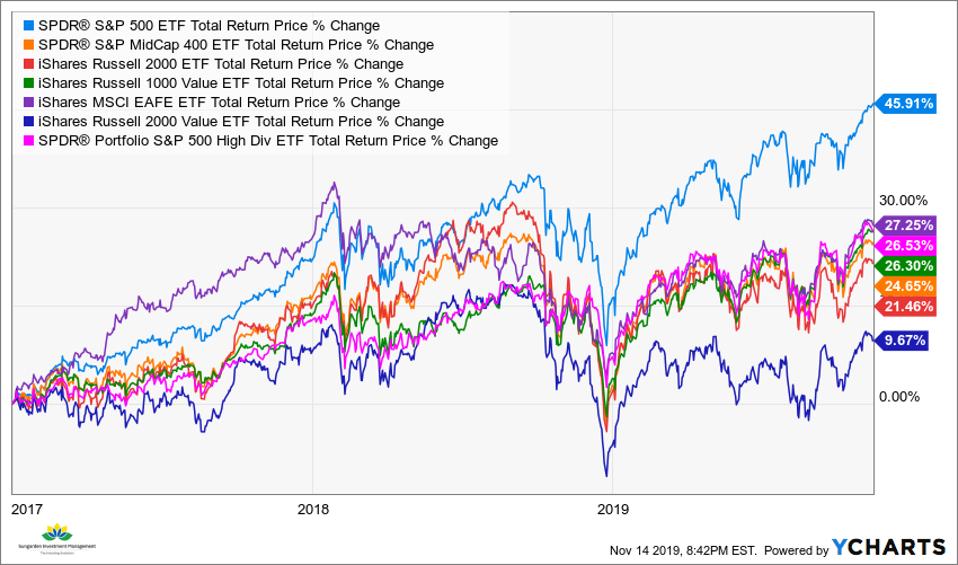

As it turns out, the S&P 500 has outperformed nearly every major market index since the start of 2017. Here is a look at that.

SPY_MDY_IWM_IWD_EFA_IWN_SPYD_chart

The S&P 500 has gained more than 45% since the start of 2017. Other stock market segments, such as MidCap, SmallCap, Value stocks, High Dividend Stocks and Non-U.S. Stocks have all lagged. Each one has earned at least 18% less than the S&P 500 over that time. Small Cap Value stocks, a traditional jewel of certain asset allocation theories, have been particularly poor recent performers. Their returns the past few years are under 10% in total. The rest are all bunched together, way down from the mighty S&P 500.

This goes a long way to explaining why, if you choose your own investments instead of just investing in an S&P 500 fund, your own stock portfolio may be lagging that mighty index.

If you can’t beat ‘em, join ‘em?

So, why not just join the crowd and pile into S&P 500-linked investments? Invest in the “market” instead of trying to beat it? That sounds good in the rear-view mirror. And, there is no denying that it has been a top strategy the past few years. However, it is also possible that at this stage, it’s a trap. That trap could crush your retirement portfolio if you are not careful. Here is some history to show you why.

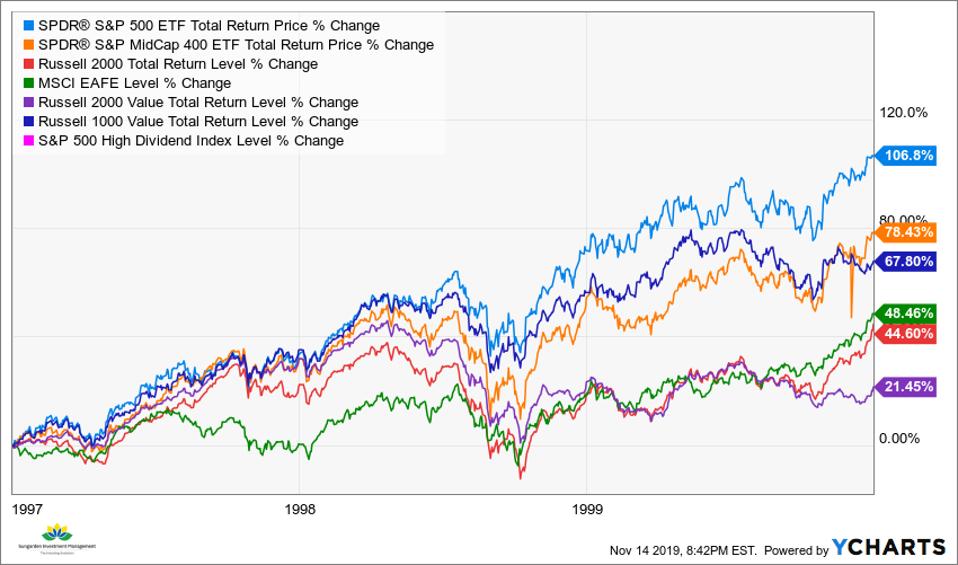

SPY_MDY_^RUTTR_^MSEAFE_^RUJTR_^RLVTR_^SPXHD_chart

To me, this is the period of contemporary stock market history that reminds me most of the current inter-market performance trend. It is the 3 years that preceded the bursting of the Dot-Com bubble, 1997-1999. As with recent times, the S&P 500 was in a performance class by itself.

Here’s what happened next.

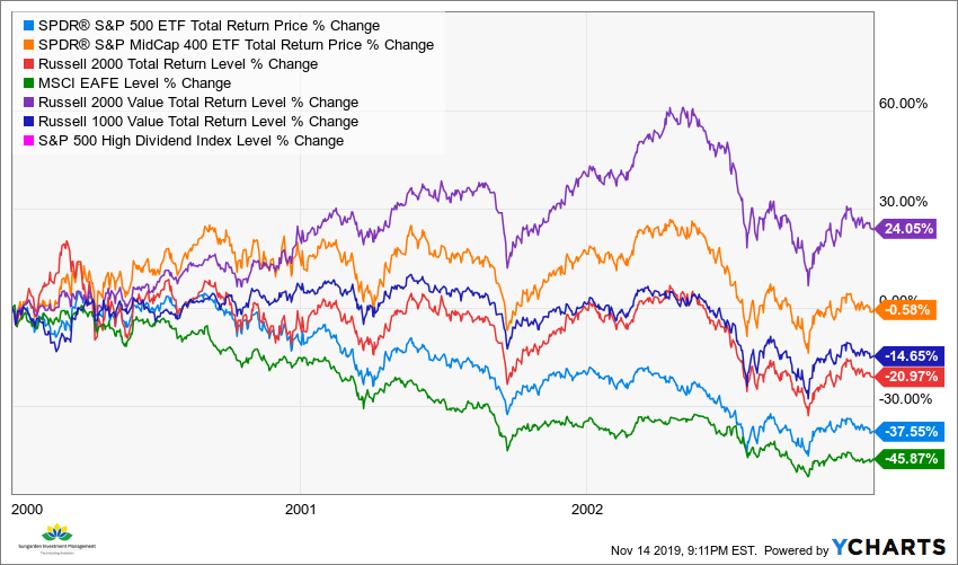

SPY_MDY_^RUTTR_^MSEAFE_^RUJTR_^RLVTR_^SPXHD_chart (1)

If you are looking for the S&P 500 in this chart of indexes from January 2000 through March of 2003 (”The Dot-Com Bust”), keep going down until you hit the one that dropped over 37% in 39 months. Of course, history does not repeat itself. However, this is a simple reminder that investing what just did well, or what you wish you had just invested in, is not a strategy. It’s a performance-chase. Don’t do it.

What to do

Do some introspective thinking about what you really want out of your stock portfolio. Do you want “the market” for better or worse? Or, do you want to use the market as a tool to engineer the return stream you need to get you retired or keep you retired? That may involve an allocation to S&P 500-type investments. But most likely, there will be a heavy emphasis on risk management, so that you don’t end up with a volatile retirement portfolio.

Then, do your research. Don’t just settle for what has been working. Seek to understand why it is working and why it isn’t. Heck, during the Dot-Com Bust (the last chart above), those same Small Cap Value stocks went from laggards to leaders. However, that may not be the case the next time around. Conditions are different today. Applying some common sense and deductive reasoning when you invest for retirement is very helpful to your process. It can also help you keep your sanity when “the market” again becomes a threat to retirement dreams, instead of the boost it has been the past few years.

Comments provided are informational only, not individual investment advice or recommendations. Sungarden provides Advisory Services through Dynamic Wealth Advisors