This article is part 2 of a series. Read part 1 by clicking here.

The ability for the insurance company’s general account assets to earn returns that exceed what households could otherwise obtain, combined with the tax deferral provided by the insurance policy, means that it is possible for life insurance to serve as an attractive long-term fixed-income investment even net of its insurance costs for a lifetime death benefit. It is worth exploring the simple possibility that life insurance cash value can be a viable alternative to include in a household’s fixed-income investment portfolio. It is possible for the net returns on cash value to exceed the net returns on other fixed-income investment opportunities.

Exhibit 7.10 Whole Life Insurance Cash Value as a Fixed-Income Alternative

Exhibit 7.10 provides the details for this analysis. These numbers could be modified to account for different circumstances. I consider the case for a 40 old who could either pay a higher premium for whole life insurance to support a permanent death benefit while also growing cash value in the policy, or who could pay a lower premium to support his preretirement death benefit needs with term insurance and then invest the difference between the whole life and term life premiums into a fixed-income portfolio. In this example, I maintain the assumption that interest rates remain fixed at 3%, and I do not assume any additional yield premium for investments in the general account relative to what is available to the household on their own. As explained, the insurance company’s general account may be positioned to yield higher returns than available to households.

Woman hand holding stack of coins money putting on stack of coins and wooden alarm clock as long … [+]

getty

For bonds, the gross yield is 3%, but I must account for the impact of taxes, fees, and life insurance needs to determine the net yield. Assuming this individual will remain in the 25% tax bracket, the net yield on fixed-income assets must be reduced by 25%, or 0.75% of the 3% bond yield to pay the annual tax bill. As for fees, to be consistent in this example I assume that bonds can be obtained without fees as I do not otherwise charge fees within the insurance policies. Finally, in the term life scenario, the premium for term insurance is one-third of the premium for whole life insurance. Assuming this individual seeks life insurance through retirement at 65, only two-thirds of the potential funds are available to be invested into the bond portfolio. This reduces the net returns on bonds by an additional 1%. Overall, the net return on bonds in this example has fallen to 1.25%.

As for the returns on cash value, the problem is slightly more complex because the insurance costs vary over time (recall the discussion of Exhibit 7.2). The complexity is accounted for by using an internal rate of return calculation. The internal rate of return is the compounded growth rate required on policy premiums to generate the cash value of the policy. These returns can be calculated both for the cash value and for the death benefit. I specifically seek to calculate them for the cash value growth shown in Exhibit 7.2.

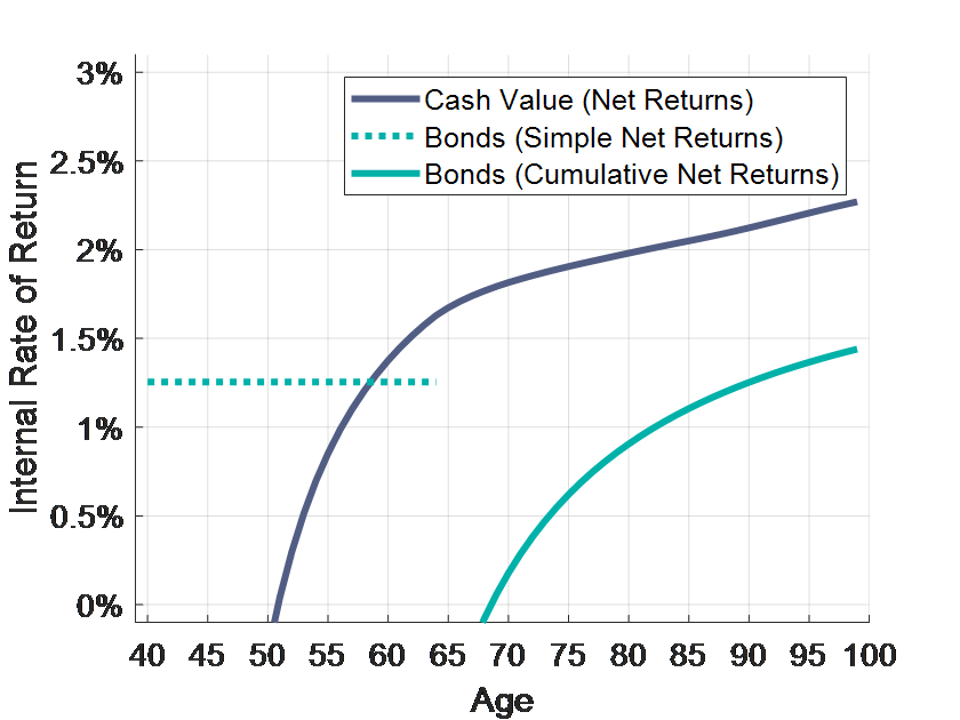

Life insurance cash value is not meant to serve as a short-term investment. Exhibit 7.11 tracks the net returns for cash value over the life of the policy through age 100. Cash value returns remain negative until age 51. This is when the cash value amount ($82,665) first exceeds the cumulative premiums paid up to that point ($82,476). It took 11 years. Then, at age 59 the net returns on cash value exceed those of the bond portfolio for the first time. As time passes, the net returns on cash value continue to grow. They exceed 2% at age 82 and are 2.27% at age 99. Meanwhile, the life insurance also supports a permanent death benefit.

As for bonds, the death benefit with the term policy ends at age 65. Subsequent net bond returns at age 65 could be higher (2.25%) if life insurance is no longer used, but this would not cause cumulative net returns to immediately jump to this higher level. If I account for the term premiums that did not enter into the bond portfolio in the same manner that part of the whole life premiums are used to fund the life insurance, I find that the net returns on bonds would trail the cash value returns for life, despite the term strategy not providing a permanent death benefit. Expressing the internal rate of return on the value of the bond portfolio relative to the cash flows used to invest in bonds and pay for term life insurance, the net return on bonds reaches only 1.44% at age 99 in this scenario.

With term insurance, there is no cash value to help offset future insurance costs as happens with whole life. This leaves the “buy term and invest the difference” strategy lagging behind permanently. Exhibit 7.11 further shows the net lifetime internal rates of return on the bond investments after also accounting for the term premiums. Bonds do not have an opportunity to catch-up to the permanent life insurance approach even after the term insurance ends and the subsequent net returns become higher in absence of the continuing death benefit.

Exhibit 7.11 Net Returns on Whole Life Insurance Cash Value and on Bond Investments

Exhibit 7.11 Net Returns on Whole Life Insurance Cash Value and on Bond Investments

Retirement Researcher

This analysis has demonstrated the potential for the net returns on cash value to exceed those on other fixed-income assets. It is important to remember that this is accomplished with less risk as well, because cash value is not exposed to interest rate risk. We must also not forget that a permanent death benefit also accompanies this cash value even after age 65. Moving away from our simplified world, comparisons would have to consider the potentially higher returns on the general account, the impacts of fees for both insurance and investments, and the interest rate risk experienced for bond assets.

All considered, net cash value returns may be quite competitive with net bond returns, so that even aside from the death benefit, whole life insurance could provide a preferable way to invest in fixed-income assets for the household with a long-term focus.

*This is an excerpt from Wade Pfau’s book, Safety-First Retirement Planning: An Integrated Approach for a Worry-Free Retirement. (The Retirement Researcher’s Guide Series), available now on Amazon.