Carl Icahn at the 6th annual CNBC Institutional Investor Delivering Alpha Conference on September 13, 2016.

Heidi Gutman | CNBC

If you’re thinking of following Carl Icahn from high-tax New York to sunny Miami, you’ll need to do more than just change your driver’s license to make it official.

The billionaire investor has told his staff that he will close the Manhattan office of Icahn Enterprises in March 2020, according to The New York Post. He will open a new office near Miami, where he’s had a residence, in April 2020, the Post reported.

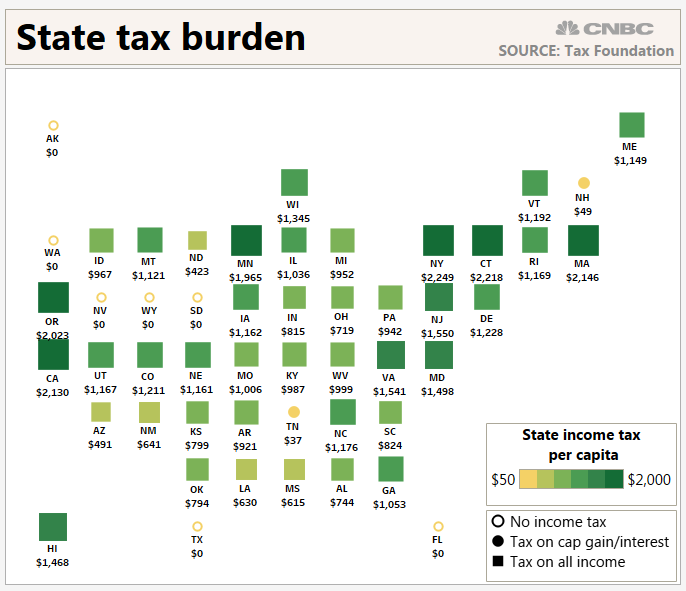

Aside from enjoying mild winters in Florida, Icahn will likely nab significant savings on income taxes by packing up for the Sunshine State.

The top New York State income tax rate is 8.82%. Residents of New York City are also subject to a top rate of 3.8% on income.

Florida, on the other hand, doesn’t tax personal income.

Making the move is even more appealing now that there’s a $10,000 cap on the state and local tax deduction.

State tax auditors are aware of the appeal of income-tax free havens, and they’re not likely to let you leave without a fight.

“The best way to do it is to give up all ties to New York and sell your home, so there is no possible question that you’ve moved,” said Bruce D. Steiner, an attorney at Kleinberg Kaplan in New York City.

Residency tests

States generally have two tests to assess residency.

To be considered a statutory resident — and taxed as a resident of that state — you had to have spent 183 days there during the year and you must maintain a permanent place of abode there.

The domicile test considers five key aspects that determine whether your true home — the place you return to after you’ve been on the road — is in fact in that state.

These are the five factors that determine your domicile and that are likely to be studied in any audit.

1. Your domicile

A potential home buyer reviews paperwork during an open house in Columbus, Ohio.

Ty Wright | Bloomberg | Getty Images

You can have many residences but only one true domicile.

“If you want to lose your case with the auditor, you keep your big and beautiful home in Minneapolis, but you rent in Boca Raton,” said Mark S. Klein, tax attorney and partner at Hodgson Russ in New York City.

Sell the abode in your original home state and show you’ve made a commitment to leave.

In one case, Klein had a client who sought to move from western New York to Florida, with the plan of selling stocks and paying no state taxes on capital gains.

While moving south, this client decided to maintain his fishing license in western New York, where he paid $12 as a resident. Had he purchased a fishing license for visitors, he would have ponied up $75.

An auditor would seize on this slip-up and cite it as evidence that this individual was still a resident of the Empire State.

“He was so cheap that he only paid for the $12 license, and that came to bite him,” said Klein.

2. Your business

Compassionate Eye Foundation | DigitalVision | Getty Images

Got a business headquarters in New York or in California? Do you maintain an office there?

If so, your state’s auditor might also argue that you’re spending plenty of time there.

Icahn strengthened his case that he’s moving to Florida by shutting down the office in Manhattan. “If I close my office in New York and open an office in Florida, how can they say I’m based in New York when I live and work in Florida?” asked Steiner.

3. Time in your new state

Spending 183 days in your new state generally isn’t enough.

“What I tell people is this, you need to have your head on the pillow for two nights in the new home for every one you spend in the old,” said Klein.

“You spent 120 days in your old home? You need at least 240 days in the new home.”

Other questions that might come up in an audit include “Where do you spend your weekends? Where does your spouse wait for you when you travel?” according to Klein.

4. Your cherished belongings

Amy Eckert | Photonica | Getty Images

When people move, the objects they hold dear will go with them.

State income tax auditors want to know where you keep the things that are most valuable to you, including your family photos and your grandmother’s china set, Klein said.

“Auditors expect to see moving bills,” he said. “I’ll tell clients with as much effort as I can: Please find something to move.”

5. Your family

kate_sept2004 | E+ | Getty Images

Where you, your spouse and your minor children reside will tip auditors off to where you’re truly based.

“The presumption is that spouses share a life together and thus share their domicile together,” said Klein.

A situation in which one spouse has business activities in New York, while the retired spouse is residing in Florida could draw attention from an auditor.

More from Personal Finance:

Why the concept of universal basic income is gaining ground

Your Social Security check could get bigger in 2020

Self-employed? Why your retirement savings are falling short

“If they’re constantly traveling together, it’s hard to say that one’s a Floridian and the other’s a New Yorker,” said Klein. “How do they not share a domicile?”

Couples who assert that they live in different states need to walk the walk.

“It’s possible for them to not share a domicile together, but it’s unusual and difficult to prove,” said Klein. “They have to start living separately if they’re going to make this argument.”