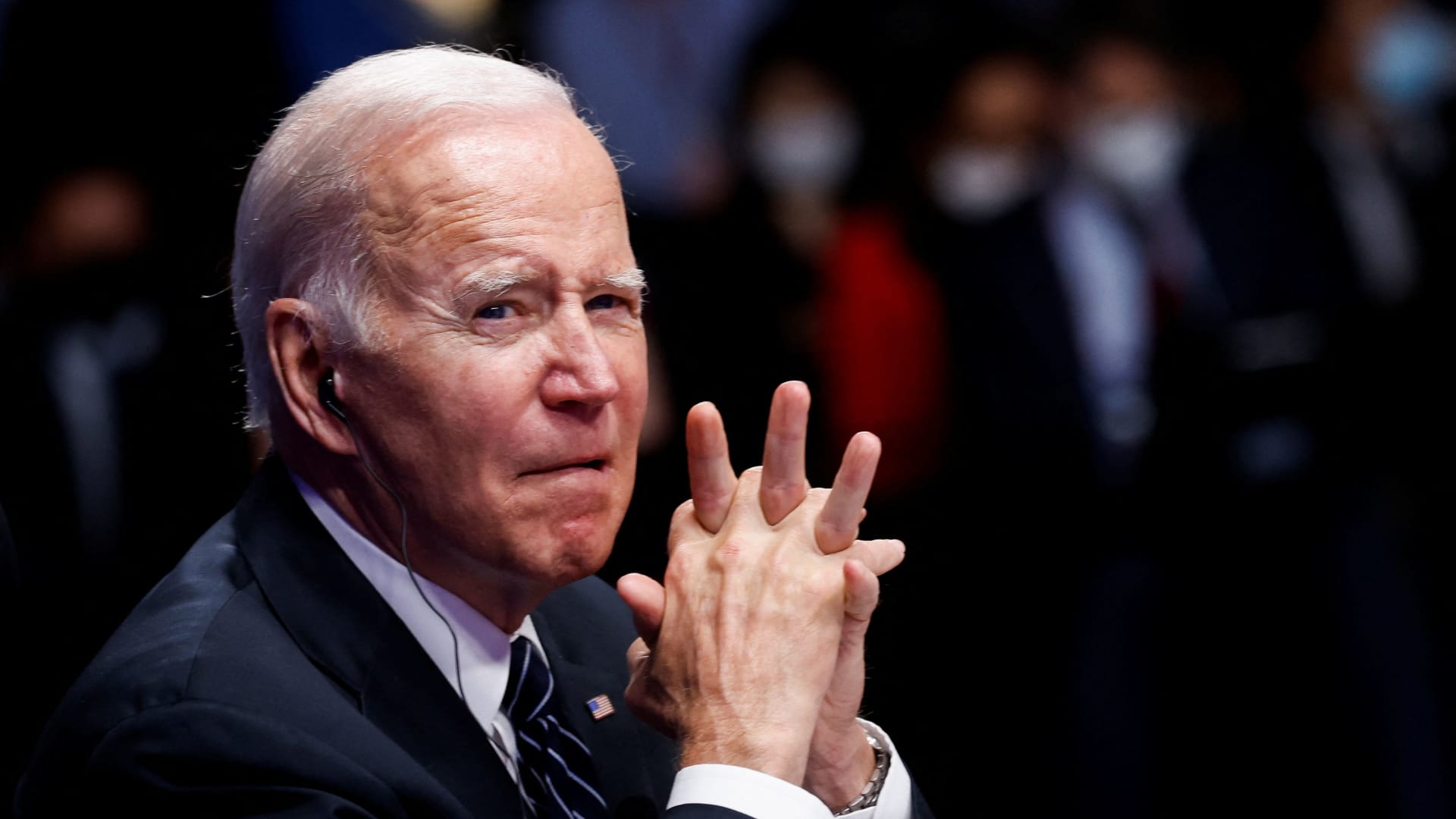

President Joe Biden has said that he’ll soon be making an announcement about student loan forgiveness.

In the meantime, the White House is trying to figure out what shape — if any — that relief should take. The decision could be among the most consequential made by the Biden administration.

More than 40 million Americans owe a collective $1.7 trillion in student debt, a balance that has tripled since the Great Recession. About 25% of those borrowers are in delinquency or default.

More from Personal Finance:

Try these gas-saving tips before you hit the road

How to save money at the grocery store as food prices rise

More Americans are living paycheck to paycheck, report finds

Here’s why the decision isn’t an easy one.

Risks of canceling $10,000 …

On the campaign trail, Biden said he was in support of clearing $10,000 from borrowers’ accounts. Doing so would cost around $321 billion and completely forgive the loans of about one-third of student loan borrowers.

Yet there’s concern that such an announcement would cause more frustration and disappointment than anything else. The average education debt balance, after all, is three times that, at around $30,000. And more than 3 million borrowers owe more than $100,000.

As a result, the Senate’s top Democrat, Chuck Schumer of New York, along with Sen. Elizabeth Warren, D-Mass., and other Democrats, are pushing the president to cancel at least $50,000 for all.

The NAACP has also been vocal about how $10,000 wouldn’t go nearly far enough for Black student loan borrowers. Wisdom Cole, national director of the association’s youth and college division, recently said on Twitter that nixing just $10,000 would be “a slap in the face.”

… and of $50,000 in relief

Canceling $50,000, however, comes with its own potential perils. That level of relief would come with a price tag of more than $900 billion and would leave 80% of student loan borrowers no longer owing anything.

But that larger amount is more likely to be met with political attacks and legal challenges, said higher education expert Mark Kantrowitz.

There are also concerns about a backlash.Mark Kantrowitzhigher education expert

“The biggest criticism of forgiving $50,000 is that it provides forgiveness for borrowers who are capable of repaying their own student loans,” said Kantrowitz, adding that it’s often those with multiple degrees who owe the most.

Republicans, who largely oppose student debt forgiveness, are also less likely to challenge a lower amount of forgiveness simply on the cost factor, he said.

Problems either way

The amount of forgiveness may not matter, though, because the move could be called into question in court if the president bypasses Congress, which he appears to be considering doing.

Challengers may come forward, Kantrowitz said, “to uphold the principle that only the legislative branch can appropriate funds.”

Meanwhile, no amount of forgiveness would leave all borrowers happy.

Even if $50,000 per borrower was erased, the 3 million-plus borrowers who are more than $100,000 in the red would still be stuck with large balances.

“There are also concerns about a backlash from borrowers who have already paid off their loans, people who never borrowed because they saved for college in advance or worked their way through college, and from people who didn’t borrow because they didn’t go to college,” Kantrowitz said.

Still, history shows action on student debt can decide an election.

In 2006, the Democrats pledged to slash interest rates on student loans, Kantrowitz said, “and that helped them gain control over the House and Senate.”

That example is likely a key consideration for Democratic legislators and the White House as the midterm elections approach.