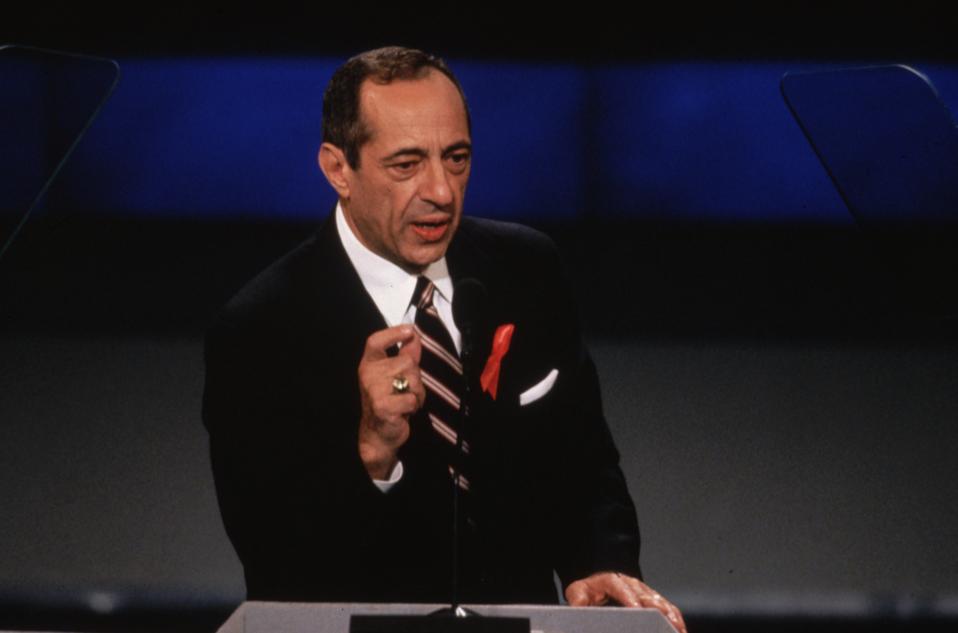

15th July 1992: Democratic politician and Governor of the state of New York, Mario Cuomo, … [+]

Getty Images

When I write about well-funded pension plans, it’s generally to make a plea for risk-sharing plans, such as that of Wisconsin (with the “purest” risk-sharing mechanism) or South Dakota (which bases COLA adjustments on the fund’s financial strength), or other states with a legacy of fiscal conservatism and prudence. But there’s a state which, in all appearances, is an outlier: New York. In Pew’s most recent analysis, they are 98% funded, bested only by South Dakota’s 100%. How did they manage this?

Turns out, New York and Illinois have one characteristic in common: they both have specified, in their state constitutions, the protection of both past and future pension accruals. (Arizona has a similar provision, but its story is unique and deserving of a separate article.) So why are their paths so different? Why is New York the second-best and Illinois (according to the same data) second-worst?

Little of the history of New York’s pension are available online, but one key development can be traced by reading the relevant New York Times reporting from 1989 – 1990, two years when the state was facing budget cuts in the recession.

It’s a story that sounds familiar: politicians who want to avoid budget cuts decide to cut pension contributions instead.

In 1989, New York Governor Mario Cuomo proposed to save $300 million in its state budget by eliminating its pension contributions. As an unnamed staff member said (New York Times, “Cuomo Proposes Pension Changes,” Jan. 7, 1989),

”This is where the big money is. . . . All the other stuff is peanuts.”

After initially opposing the changes, the state’s Comptroller, Edward Regan, struck a bargain: at a two-year savings of $600 million, he would agree to increasing the fund’s expected return on assets from 8% to 8.75% and to lowering the expected salary increase rate from 7.3% to 7.0%. In return, Cuomo abandoned his prior proposal to change the actuarial pension funding method in order to reduce contributions. In agreeing to the changes, Regan wrote (”Cuomo-Regan Pension Pact: How They Agreed to Changes in the System,” Jan. 14, 1989), that the plan ”could send the wrong signal that pension fund earnings are a painless and permanent budget balancing tool” and this action ”leave[s] the state terribly vulnerable to an economic downturn” and ”must not be used again.”

MORE FOR YOU

But the next year, the state had another budget gap, and was back for more cash — this time, a contribution reduction of $273 million, by making the same change in pension funding that Cuomo had proposed, then relented on, the prior year. This shift, from an Aggregate Cost Method to the Projected Unit Credit, is technical enough that the news reporters (e.g., Newsday, Aug. 17, 1990) don’t even try to explain it, but it’s essentially the difference between, if you’re saving for your own retirement, saving a level percentage of your pay every year, and saving more as you get closer to retirement. Regan again opposed it, but the legislature approved the change.

Joseph McDermott, president of the Civil Service Employees Association, opposed it, saying, “you can’t use the pensions as a piggybank every time you do run into a problem . . . . it’s unfair to the members of the system.” And when a lawsuit was filed by McDermott and the CSEA, Regan issued an I-told-you-so statement: “the inevitable has occurred . . . . Our warnings were ignored and now the state faces a costly and potentially protracted lawsuit.”

And it was indeed protracted: the Court of Appeals found for McDermott in November of 1993. While there were certain technical issues regarding the decision-making authority of the Comptroller vs. the legislature, the court’s decision was much broader: it determined that, within the guarantee of the state’s constitution that pension benefits must not be “diminished or impaired,” is a guarantee that their funding must be secure:

“In sum, chapter 210 [the funding method change provision] impairs the benefits of the existing pension fund. Said legislation allows employers to deplete moneys in the existing pension fund by reducing the amount of employer contributions. Employers are allowed a credit of a portion of the existing moneys, and need not contribute to the pension until the reserved moneys are drastically reduced. To later replenish the fund, employers and employees must increase the amount of their contributions to the pension fund. As such, the reserve moneys will not be available for immediate investment, the return on investment of moneys in the existing fund will be significantly decreased, and the additional security provided by the reserve moneys in the pension funds will be impaired.”

This is, in fact, the polar opposite of the Illinois Supreme Court’s decisions on that state’s constitution requirement, despite its identical wording. In that court’s 2015 ruling rejecting a 2013 attempt to reform pensions, they explicitly rejected any such link, noting that at the time that the Illinois provision was added in 1970, there was no interest in adequately funding pensions, and that this constitution provision was viewed by its authors as a means of guaranteeing future pensions without obliging themselves to fund them.

Of course, this is only one small snapshot of history — but one that’s worth knowing about.

As always, you’re invited to comment at JaneTheActuary.com!