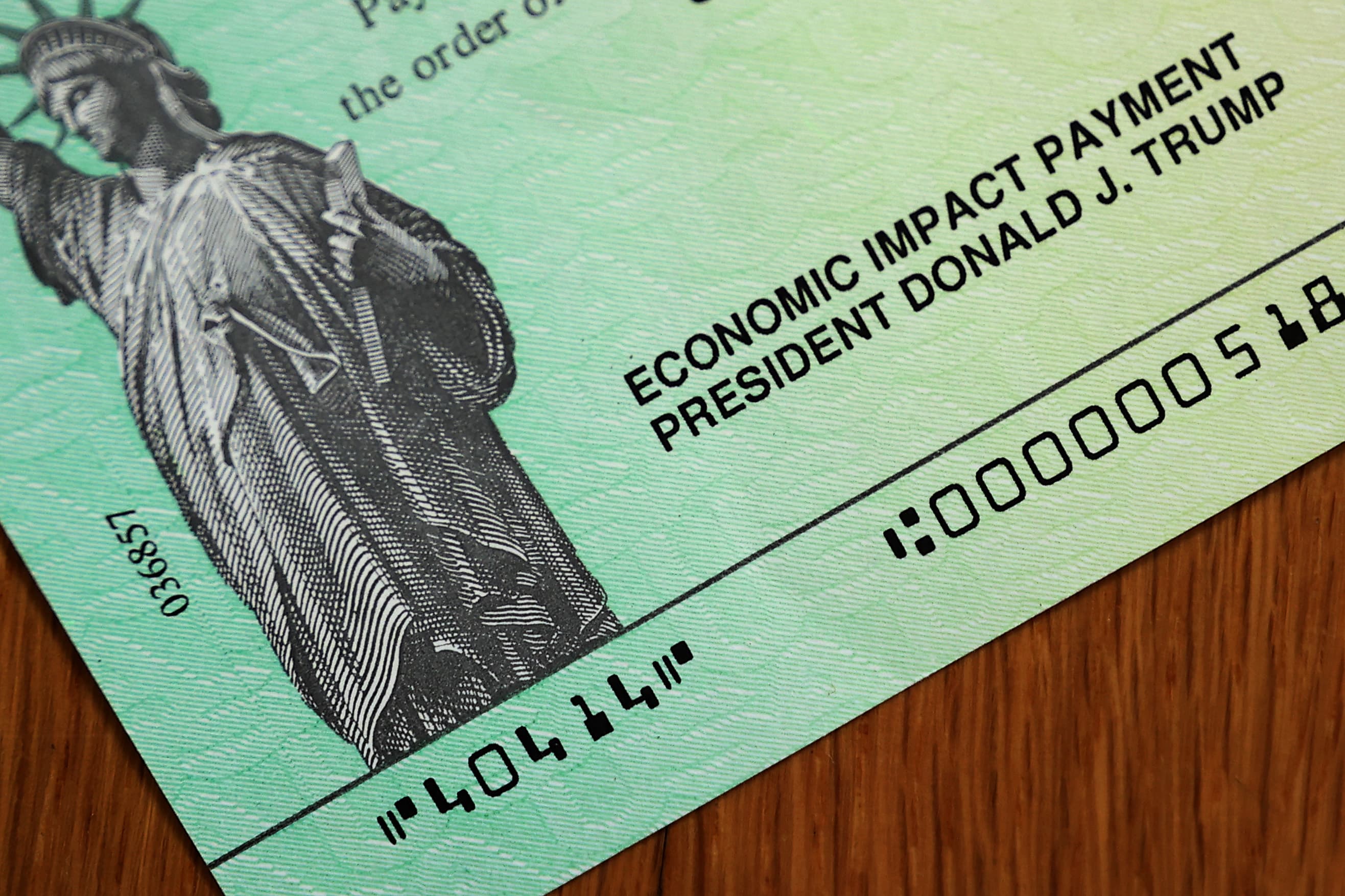

U.S. President Donald Trump’s name appears on the coronavirus economic assistance checks that were sent to citizens across the country April 29, 2020 in Washington, DC.

Chip Somodevilla | Getty Images

News that the U.S. government has deployed millions of stimulus checks for up to $1,200 per individual has made headlines.

But still many individuals are asking, “Where’s my money?!”

Admittedly, that chorus should be quieting down now that the IRS said this week that the government has gotten out a majority of the payments.

The IRS announced this week that a total of about 130 million Americans have received their stimulus checks. That amounts to more than $200 billion in payments in about four weeks.

There are many reasons why payments are coming later than people would hope, and a lot of them are legitimate.

Janet Holtzblatt

senior fellow at the Urban-Brookings Tax Policy Center

In total, more than 150 million payments will be sent out, the IRS projects.

So if you are still waiting, your payment could be on the way.

But there are reasons why you might not have the money in hand yet. These are the top outstanding questions on their checks readers have told us they still have.

Where is my payment?

Hill Street Studios

“Generally, there are many reasons why payments are coming later than people would hope, and a lot of them are legitimate,” said Janet Holtzblatt, senior fellow at the Urban-Brookings Tax Policy Center.

To get the quickest payment, the IRS would need to have your direct deposit bank account information on file. Without that information, the government will send you a paper check.

If the government has the wrong bank account information for you, the payment would bounce back, at which point officials would issue you a paper check, Holtzblatt said.

Reasons for that could be that you closed your account or had a temporary account provided through a tax preparer.

Because the government is only issuing about 5 million paper checks per week, it may take some time for that money to reach you.

It could take up to 20 weeks – or five months – for all of the paper checks to be sent, according to a Congressional timeline.

Once you do receive a payment, you should receive a letter in the mail from the government confirming it was sent.

Why is my check less than I thought it would be?

Oxford | Getty Images

Some readers have written in to express their disappointment that their checks totaled less than they had anticipated. Or, they found out they’re ineligible for payments altogether.

The reasons for this are dictated by the CARES Act, the law that Congress passed in March that authorized the $1,200 stimulus payments.

While the checks are often referred to as a $1,200 sum per adult, the truth is that they could be more or less.

The amount you receive is based on your adjusted gross income for either your 2018 or 2019 tax return, whichever is most recent.

If you’re an individual earning up to $75,000, you qualify to get the full $1,200. But if your income is above that, your payment will be reduced. If you earn more than $99,000, you will not get a check at all.

Married couples who file jointly stand to get up to $2,400 for up to $150,000 in income. But if their income is more than $198,000, they won’t get a check.

Individuals and couples who qualify for payments are also eligible to receive $500 for each child under age 17.

Your check could fall short if the government just has information on you and not your dependents. That goes particularly for people who typically don’t file taxes, either because they have little to no income.

Your check could also be offset if you are behind on child support. It could also be taken by creditors if you are behind on debts.

Why didn’t I get a check?

David Paul Morris | Bloomberg | Getty Images

Certain individuals were shut out of receiving stimulus payments, according to the CARES Act.

That includes dependents age 17 or over, such as college students and adults.

The rules also dictate that someone must have a Social Security number in order to be eligible to receive the stimulus money. Therefore, if you file taxes with an Individual Taxpayer Identification Number or are a non-resident alien, you don’t qualify.

Plus, if you are an American who files jointly with a spouse who is an unauthorized immigrant, you also don’t get an automatic payment. (There may be hope to get money later. See below.) The same goes for non-American children.

Recently proposed legislation by House Democrats aims to reverse that for both dependents ages 17 and up and non-citizens. If passed by Congress, both groups would be eligible for retroactive payments through the CARES Act, as well as a second round of checks. But the proposal would need Republicans’ approval.

Is there any way to get more money?

Cabania | iStock | Getty Images Plus

If you should have received more money than you did, you will be eligible to receive the extra funds when you file your 2020 tax return next year.

That goes particularly if you have dependents younger than 17 who weren’t counted in your check.

But it’s a bit more complicated for other groups.

If you received less than you think you should, either because you’re married to a non-citizen or someone else claimed you as a dependent, you may be able to correct the situation when you file in 2020.

If your spouse is a non-citizen, you may be able to file a separate tax return for 2020, and therefore be eligible for your own stimulus check, according to Holtzblatt.

“But it may not be worth it if your other tax payments go up with the cost of filing separate returns,” Holtzblatt said.

More from Personal Finance:

House Democrats’ bill includes a second round of $1,200 checks

Here’s which states got the most stimulus check money

Democrats want to keep $600 unemployment checks rolling until 2021

You could also try filing on your own next year if someone else previously claimed you as a dependent. But there the rules there are less flexible.

That’s because it’s really a factual question based on what you’re required to do, said Jeffrey Levine, director of advanced planning at Buckingham Wealth Partners.

That includes tests to determine whether you are a qualifying child or relative.

“The result of those tests is what should be filed on the return,” Levine said. “If you’re not providing your own support, then you really shouldn’t claim yourself.”

Will there be additional stimulus payments?

House Speaker Nancy Pelosi, D-Calif., delivers a statement on the Heroes Act aid package on May 12, 2020 on Capitol Hill.

Graeme Jennings-Pool/Getty Images

The answer to that question is likely yes, based on the latest information from Washington, D.C.

Democrats in the House of Representatives unveiled a $3 trillion stimulus bill called the Heroes Act this past week.

The proposed legislation calls for another round of $1,200 payments with the same income requirements used in the CARES Act. But it increases the money for dependents to $1,200 each for a maximum of three. That brings a family’s total payment to as much as $6,000.

The legislation also seeks to make more people eligible for financial help. That would include non-U.S. citizens and dependents ages 17 and above.

The fate of the Democrats’ sweeping proposal depends on Republicans, who may wait until June to evaluate providing further aid.

President Donald Trump has signaled that he would be open to additional stimulus checks.