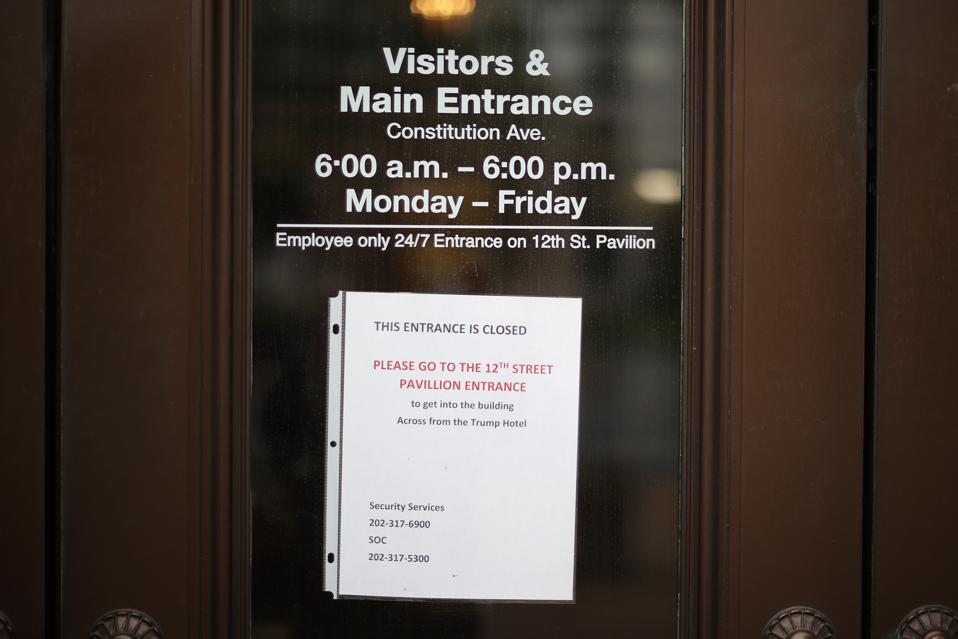

WASHINGTON, DC – APRIL 27: The Internal Revenue Service headquarters building appeared to be mostly … [+]

Getty Images

Baby steps. The Internal Revenue Service (IRS) is reopening, albeit slowly.

IRS Commissioner Charles Rettig explained earlier this month that the IRS is reopening operations for employees with non-portable work. So far, employees with non-portable work returned to offices in Kentucky, Texas, and Utah on Monday.

Additional IRS offices and centers are opening in the coming weeks, including:

- Georgia and Tennessee beginning June 15

- Missouri and Michigan beginning June 15

- Indiana and Ohio beginning June 29

- California, Puerto Rico, Oregon beginning June 29

These re-openings include key processing centers, notice print facilities, and call center operations.

The IRS also announced some changes to operations. Here’s a look at some of what’s open or opening soon:

Telephone Lines. Automated phone lines are available now. But if you want to talk to a real person, including the EIP phone line for those who received an EIP letter (Notice 1444), you should expect to wait. If you’re looking for an update for your regular tax refund, you can call the automated number at 1-800-829-1954. And before you dial: this line has no information about the status of your stimulus checks (Economic Impact Payments).

Practitioner Priority Service (PPS). My colleagues have been rejoicing about the reopening of the Practitioner Priority Service (PPS) line, but I’ve yet to talk to a representative. That may be because the PPS line is open but has limited staffing.

Centralized Authorization File (CAF). The IRS says that it’s processing some Centralized Authorization File (CAF) requests on a limited basis. However, anecdotally, I’ve not spoken with any tax professionals who have managed to get through (my request failed again today). According to the IRS, only the CAF unit at Ogden is operational at this time, which would explain my issues: Ogden services mostly west coast taxpayers.

Web services. IRS.gov remains open. That means:

- Practitioners with e-Services accounts and client authorization can access the Transcript Delivery System (TDS) to obtain taxpayer transcripts.

- Taxpayers can also access “Where’s My Refund?” and “Get Transcript Online.”

- Taxpayers can check the status of their Economic Impact Payment at Get My Payment, their refund status at Where’s My Refund? or obtain a tax transcript at Get Transcript Online.

- Taxpayers also can make tax payments through Direct Pay.

- Taxpayers who previously have been issued an Identity Protection PIN but lost it must use the Get an IP PIN tool to retrieve their numbers.

Taxpayer Protection Program: If you received correspondence (Letters 5071C, 5447C, or 5747C) from the IRS asking if you filed a suspicious tax return, you can use the online Identity Verification Service to validate your identity. If you received a Letter 4883C, follow its instructions. While online services are available, phone assistance is limited.

Office of Chief Counsel. The Office of Chief Counsel continues to work to resolve cases in litigation, including those recently canceled by the U.S. Tax Court. Although Counsel is not meeting with taxpayers or their representatives in face-to-face meetings or taking depositions, attorneys are available to discuss their cases by telephone.

Independent Office of Appeals. Appeals employees are continuing to work their cases. Appeals is not currently holding in-person conferences with taxpayers, but conferences may be held over the telephone or by videoconference.

Taxpayer Advocate Service (TAS) Local Numbers. TAS is open, in theory, to receive phone calls at the local phone numbers (visit taxpayeradvocate.irs.gov to find yours). I have personally not had any success reaching anyone (I have been able to leave voice mail messages).

Tax-exempt Sector Determinations, Rulings, and Closing Agreements. The IRS continues to process applications for recognition of tax exemption for exempt organizations and continues to work rulings and determinations for employees plans and closing agreements for municipal issuers (this does not include paper applications for tax exemption and paper filed information returns submitted after March 26, 2020)

And here’s a look at what’s not open:

Services by mail. The “Get Transcript by Mail” is not operational since the offices that print and mail the transcripts are closed.

Most other mail processes. The IRS is receiving and storing mail, but they’re not really opening and processing mail. Officially they say, “our mail processing functions have been scaled back to comply with social distancing recommendations.” Mail correspondences could take a while to process, or in some cases, correspondence sent to IRS offices may be returned to the taxpayer if that office is closed and no one is available to accept them.

Most phone lines. As noted earlier, some specific phone lines have resumed service, but most have not.

U.S. Residency Certification: The Philadelphia Accounts Management Campus is closed, so the U.S. Residency Certification Program’s processing is temporarily suspended.

Taxpayer Advocate Service (TAS) Toll-Free Number and Walk-in Services. The centralized toll-free number is unavailable until further notice. Additionally, there are no walk-in services.

Paper Tax Returns: All taxpayers should file electronically through their tax preparer, tax software provider, or IRS Free File if possible. The IRS is not currently able to process individual paper tax returns. If you have already filed via paper, do not file a second tax return or write to the IRS to inquire about the status of your return or your stimulus check.

Ordering Forms: The IRS’s National Distribution Center cannot take any orders for forms or publications to be mailed during this time. Most forms and publications are available for download electronically at IRS.gov/forms.

The IRS hopes to continue to resume operations as the country re-opens. Check back for updates and more information.