Shutterstock

We expect investment experts to have crystal balls that allow them to see how the stock market is going to perform in the future. Of course, they don’t have crystal balls, and their predictions often aren’t helpful.

The problem with expert predictions of the stock market isn’t that they are wrong — which they often are — the future is uncertain, and we shouldn’t expect anyone to predict it. The problem is that investors often listen to these predictions and base investment decisions on them.

There are better ways to cope with the uncertainty of the 2020 market than listening to predictions. Before we get to those, let’s review what we can predict and what we cannot.

What We Can Predict

While the stock market follows a cycle but defies prediction, history can provide insight into what we might expect from the markets in any given year.

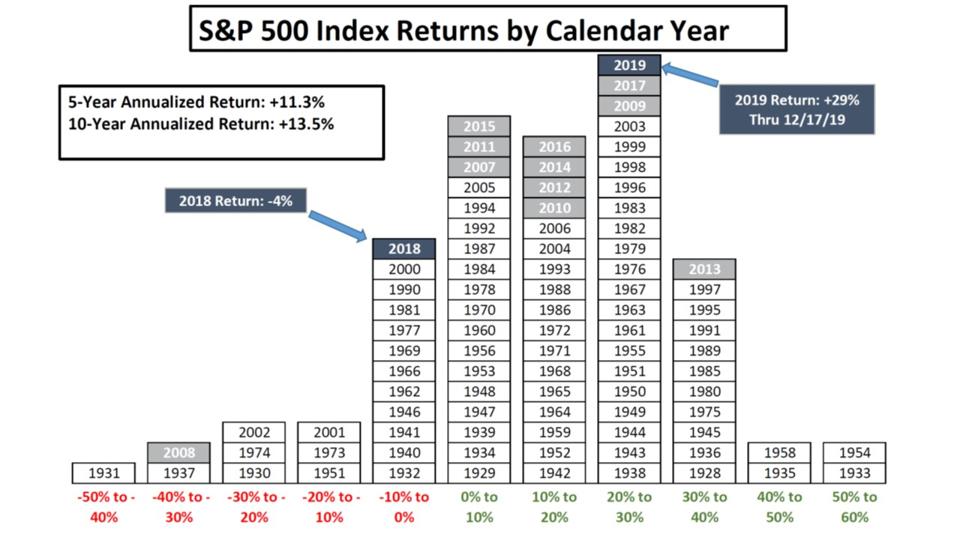

The histogram below displays the dispersion of returns on the S&P 500 since 1928:

Source: The St. Louis Trust Company. Data from Factset.

As you can see, in about two-thirds of the years, the market is up and about one-third of the time it is down. The distribution is roughly a bell curve with a positive skew and a fat left tail (meaning large negative returns happen more often than a bell curve would predict).

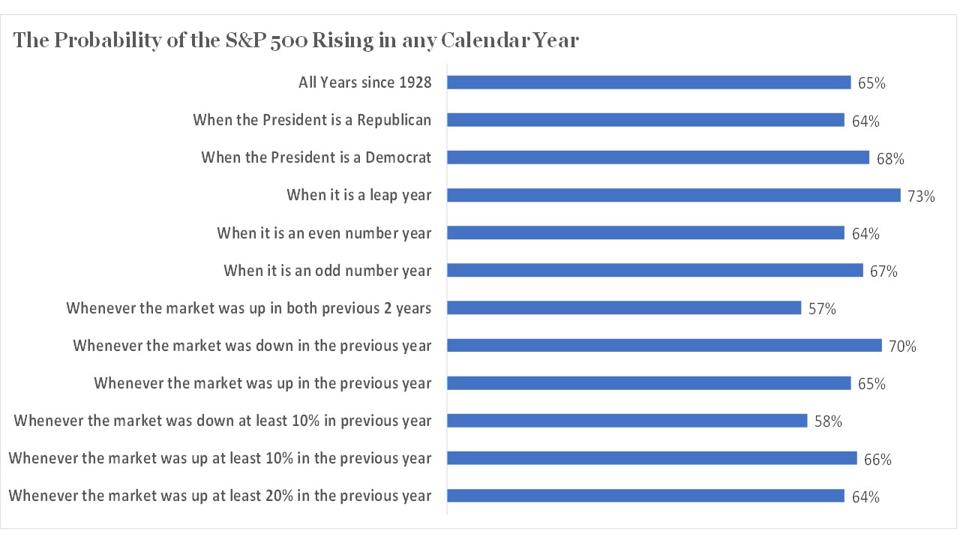

This next chart shows the percentage of years the market had a positive return plotted against various independent variables:

Source: The St. Louis Trust Company. Data from Factset.

The key points to be gleaned from this chart are:

· In any given year, we can expect the market to be up: the chances are about two in three, no matter what happened the prior year.

· On the flip side, there is about a one in three chance the market will be down in any given year.

The above two points taken together mean that investing in the stock market is like flipping a weighted coin that comes up heads most of the time, but also tails sometimes. That is about as specific as we can be about predicting market returns with any accuracy. Predictions that are more specific than that will not be accurate, and may mislead investors.

We’ve long felt that the only value of stock forecasters is to make fortune-tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.

What We Can’t Predict

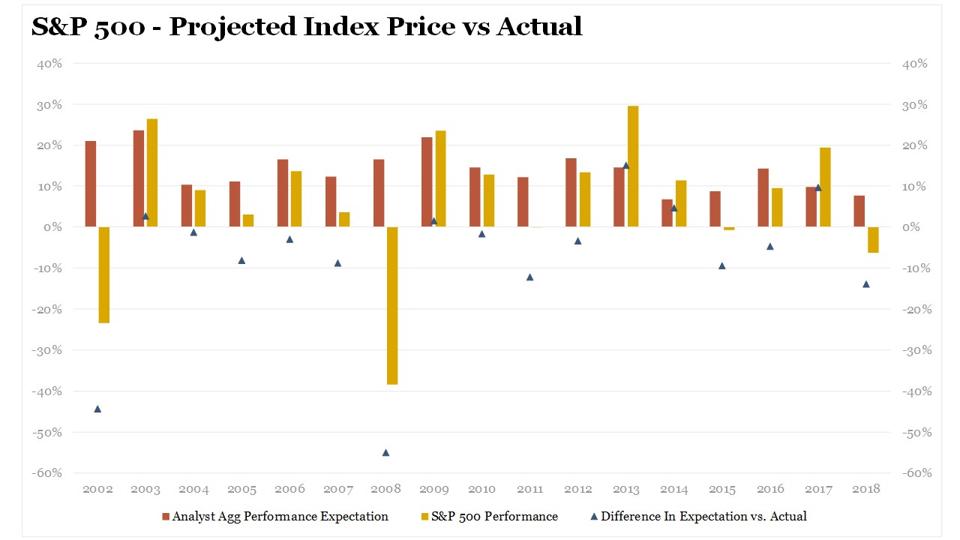

Expert market predictions can be relatively close some years, but are way off in other years. Here’s a chart of consensus predictions versus actual performance for every year since 2002:

Source: The St. Louis Trust Company. Data from Factset.

The consensus expectation of the S&P 500 price change was only within 10% of the actual change in about half the years. The other half were off by more than 10% and in two years were wrong by over 40% (2002 and 2008). Also, the forecasts were typically too bullish as the market underperformed the predicted price increases 12 out of the 17 years.

Experts are especially wrong when the market is down, which is when we need them the most – when we might act on accurate predictions to avoid significant drawdowns.

Similarly, a recent study of 6,627 forecasts made by 68 experts found that the forecasters performed in line with what chance would dictate and overall their forecasts were not quite as good as a coin flip. As expected, a handful of forecasters were pretty good, and a handful were terrible. Everyone else was in-between. The study authors noted:

Since markets by definition incorporate the collective judgments of many thousands of participants worldwide . . . it follows that most major markets are reduced to time series that exhibit many of the statistical characteristics of a random walk. And one key characteristic of a random walk is unpredictability — the impossibility of prediction, based on the past history of the time series, of the future course the time series will take.

Why Experts Predict and Why We Listen to Them

Human nature is the driver behind why we make and listen to predictions of the future. A primary human motive is the reduction of uncertainty. In response to uncertainty, cortisol is released, which causes us to feel stress. In contrast, resolving uncertainty releases dopamine, which is pleasant and acts as a reward. It is tough for us to overcome these innate responses with rational thought. Of course, investing in the stock market necessarily involves uncertainty, which is why it causes stress and worry. Seeking out expert opinion about what the markets will do in the future is a way to trick ourselves into thinking that we have reduced uncertainty. A shot of dopamine is our reward.

Some investment experts believe they can predict future stock market performance while others know they can’t. But even those who know they can’t predict future returns feel pressure to put forth predictions because their clients expect it.

A case in point occurred at an investment conference I attended a few years ago. A keynote speaker was the Chief Investment Officer of a large investment firm who presented his firm’s forecast of domestic and international markets for the coming one and five years. He suggested that investors overweight some areas of the market and underweight others based on their various market predictions. It was an impressive presentation with a plethora of supporting charts and data.

I ended up next to the CIO at the hotel bar a few hours later, and after we each enjoyed a few Manhattans I asked him how he invested his own money. He said he was mainly in index funds, only looked at his portfolio about once a year and tried not to tinker. I was surprised by his answer, given his talk about basing portfolio shifts on market forecasts. He explained that he didn’t think his firm or anyone else could predict the market. They only did so because clients weren’t happy unless they gave them predictions and suggestions on how to tweak their portfolios in response to the predictions. I’ve heard similar statements from other investment professionals when they are off the record.

Even though listening to market predictions is a fool’s errand, we still listen. Including me. I know that stock market predictions are worthless, but still sometimes I click on them.

Thousands of experts study overbought indicators, oversold indicators, head-and-shoulders patterns, put-call ratios, the Fed’s policy on money supply, foreign investment, the movement of constellations through the heavens, and the moss on oak trees, and they can’t predict the markets with any useful consistency, any more than the gizzard squeezers could tell the Roman emperors when the Huns would attack.

How Should We Cope with the Uncertainty of 2020?

What should we do instead? The answer is simple but not easy: we must learn to sit in the discomfort of uncertainty. We should admit to ourselves that we do not know what the market will do next year. The probability is that it will be up, but it might be down. Nobody knows for sure.

In the face of this uncertainty, we should create all-weather portfolios that will share in the upside when the market is up but also preserve value in down markets. We should take a long-term view of the markets and not look very often at our portfolios. We’d also be better off spending less time reading market news and drinking from the firehose of financial and economic data (which is mostly noise), and more time reading books about investing (which are more likely contain wisdom). Above all else, we should stop listening to expert forecasts.