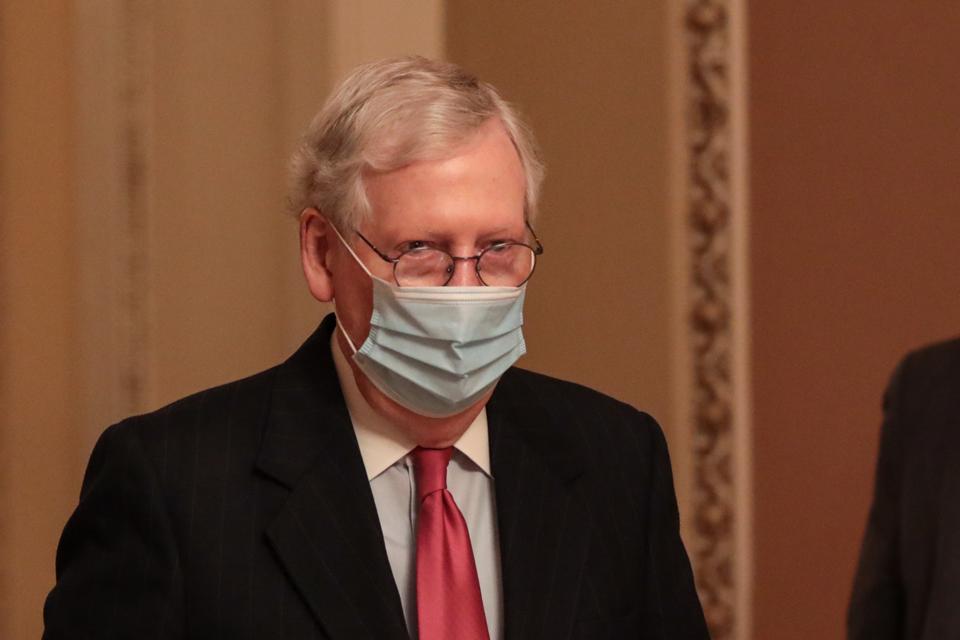

Senate Majority Leader Mitch McConnell walks to his office after leaving the Senate Floor on … [+]

Getty Images

On Sunday, President Donald Trump signed a $900 billion stimulus bill expected to address the health and economic fallout of the COVID pandemic. The relief measure includes a one-time $600 payment per eligible adult and child — but those $600 “economic impact payments” aren’t the only provision seniors should know about, and in fact, only account for about 18 percent of the bill’s total cost. The coronavirus relief package was included as a part of a $1.4 trillion omnibus spending bill, which also contained changes to key senior programs. Here, we break down some of the legislation’s most important provisions for older Americans.

$600 Stimulus Checks

The stimulus bill authorizes a one-time $600 relief payment for eligible adults and children. Income cut-offs are $75,000 for individual taxpayers, and $150,000 for couples, with smaller payments authorized for taxpayers whose income falls just above the cut-off point. As was the case this spring, social security recipients, railroad retirees, and those receiving federal veterans benefits should expect to get their payment automatically, whether or not they filed a tax return. Seniors who are claimed as a dependent on someone else’s tax return won’t get a payment. But a new group is eligible for the first time: those in “mixed-status” families. In the spring, citizens and permanent residents were excluded from the relief payment if they had a family member without a social security number, for example, if their spouse was an undocumented immigrant. Undocumented immigrants still aren’t eligible for relief payments, but in the December stimulus package, citizens won’t lose their payment based on the status of their spouse, and can apply for a retroactive payment for the spring check that they missed.

House Democrats and President Donald Trump have agreed that the $600 relief payments are insufficient, and on Monday, the House voted 275-134 in favor of an amendment that would increase the stimulus payments to $2,000. But on Tuesday, Republican Senate Majority Leader Mitch McConnell blocked the Senate from considering the proposal for $2,000 checks, aligning himself with other Senate Republicans like Sen. Jim Inhofe of Oklahoma and Sen. John Cornyn of Texas who are opposed to the increased spending.

$25 Billion In Rental Assistance, and Eviction Moratorium Extended to January 31st

According to the Joint Center for Housing Studies at Harvard University, more than a quarter of renters aged 65 and older reported a loss of income due to the COVID pandemic. Any disruption of income puts older Americans at risk for homelessness, because well over half of seniors who rent their homes are “cost-burdened,” meaning that at least a third of their income is spent on housing.

The relief bill allocates $25 billion for state and local governments to distribute as assistance to households struggling with rent, and extends the federal moratorium on evictions until January 31. But the eviction moratorium may not be enough to keep low-income seniors in their homes: not every renter knows about the protection, and some landlords and sheriffs have defied the federal order.

MORE FOR YOU

To be eligible for protection under the federal moratorium, tenants must sign an affidavit saying that they’ve done what they can to pay their rent on time, including making partial payments if possible, and present their affidavit to the judge presiding over their eviction case. Amber Christ, directing attorney at Justice in Aging, recommends that low-income seniors facing eviction contact their local legal services affiliate to see if no-cost legal representation or other resources are available. The CARES Act, passed in March, expanded funding for the Legal Services Corporation, an organization whose local affiliates provide lawyers for low-income Americans facing civil issues like eviction, domestic violence, or wage theft. Although there is some federal funding available, most tenants facing eviction don’t have an attorney’s help: New York City is among the only cities in the country to have passed legislation guaranteeing tenants facing eviction the right to a lawyer.

Larger Food Stamp Payments

The stimulus bill will increase the size of SNAP payments, colloquially referred to as “food stamps,” by 15% for six months beginning on January 1. Prior to the boost, typical SNAP payments for seniors were roughly $105 per month. The increase in SNAP payments should be particularly welcome news for the seniors across 46 states and the District of Columbia who are using their federal food assistance to order their groceries online.

Extension Of Programs For Seniors To Receive Care At Home

The legislation signed Sunday extends two important programs that allow seniors to receive in-home care in lieu of living in a nursing home or assisted living facility, the Money Follows the Person Program, and a rule related to the asset limits for receiving in-home care.

Seniors can only qualify for Medicaid funding to receive in-home care if they have very little money in the bank: until 2010, married couples had to exhaust nearly all of their cash before either partner could receive in-home care under Medicaid. The asset limits for receiving care at a nursing home weren’t as strict, which means that married seniors who could remained in their homes with a little extra help were instead steered into assisted living facilities. The recently renewed provision makes sure that married seniors can choose to receive care at home, without putting their spouse in financial hardship. The Money Follows the Person Program provides assistance to help seniors currently living in long-term care facilities transition back into living at home. According to the National Council on Independent Living, many states had slowed or ended their MFP programs because of uncertainty about whether the funding would be reauthorized.

Both provisions had been set to expire in December, and have now been extended until 2023.

Fewer Surprise Medical Bills

Americans are often shocked by the size of their healthcare bills, especially when they are treated by an out-of-network physician at an in-network hospital. When a patient is incapacitated or is receiving emergency-room care, they usually aren’t in a position to choose which doctor will treat them, and surprise bills from out-of-network providers at in-network hospitals can top $100,000. A provision in the stimulus bill, which will take effect in 2022, will require health care providers to settle on a fair price in those situations. In a statement, Andrew Scholnick, senior legislative representative for the AARP welcomed the changes, saying, “While not perfect, the legislation preventing surprise billing offers strong protections for consumers. Americans will no longer be stuck with expensive out-of-network bills from providers they didn’t choose or had no control over.” Some of the practices covered by the legislation were already banned when providers billed Medicare, so the surprise billing provisions will make the biggest difference for older adults with private insurance.

Medicare Turns To Physicians Assistants

A provision called the Physician Assistant Direct Payment Act will now allow Medicare to directly reimburse physician assistants who provide medical care to older adults, instead of needing to reimburse a supervising physician or employer. Advocates for this change, like Congresswoman Terri Sewell (D-AL) who co-sponsored the provision along with her Republican colleague Congressman Adrian Smith (NE), say that giving physician assistants more autonomy will make it easier for seniors, especially those living in rural areas, to find medical care.

What’s Missing For Older Americans

State and local governments are expected to face major budget shortfalls in 2021. The Brookings Institution estimates that COVID will reduce the amount of taxes and fees state governments collect in 2021 by $189 billion. A major sticking point in negotiations for the December stimulus bill was whether the package would include money to help state and local governments bolster their budgets. This assistance was ultimately excluded, based on Republican opposition. While the economic contraction has caused states to lose tax and fee revenue, they’re also facing new expenses, like a growing number of Americans enrolling in Medicaid, a program whose funding comes from both state governments and the federal government.

Low-income seniors could suffer if states make up their budget short-falls by cutting dental or vision benefits from their Medicaid programs, said Amber Christ, explaining that these benefits are among the few that states have the freedom to reduce or eliminate. According to data from the Center from Budget and Policy Priorities, 1 in 7 seniors enrolled in Medicaid and Medicare missed necessary dental care in 2018 due to cost.

The final bill also stripped out a $1.8 billion package included in a previous draft that would reduce COVID risks for seniors living in nursing homes and other congregate settings. Nearly 40% of all U.S. COVID-19 deaths have occurred in nursing homes or assisted living facilities. Some of these deaths have been traced to the fact that many nursing homes have limited paid sick leave and family leave programs for their staff members, which increases the likelihood that staff members go to work when sick, or when household members are sick. Moreover, outbreaks can spread quickly between nursing homes, when low-wage certified nursing assistants need to work multiple jobs at separate facilities to pay their bills.

The funding package from the previous draft of the bill would have been used in part by nursing homes to “secure adequate staffing through the provision of workforce supports, such as premium or hazard pay, overtime pay, enhanced payment rates, paid sick leave, paid family leave, paid medical leave, paid quarantine leave, childcare, travel expenses, and temporary housing.”

Sen. Bob Casey (D-PA), ranking member of the Senate Special Committee on Aging said, “Last week, deaths among residents and workers in long-term care settings due to COVID-19 eclipsed 120,000. That’s more than 120,000 grandparents, parents, sons, daughters, neighbors and friends lost to this terrible virus. Meanwhile, Congress’s year-end deal failed to deliver targeted solutions to save lives in nursing homes, to provide the dedicated funding for home and community-based services needed to keep people safe at home, and to support the heroes on the front lines who provide this vital care”

The funding package would have also been available to help seniors currently living in long-term care facilities safely transition back into living in their own homes. Given the dangers Americans have faced in long-term care facilities, Amber Christ said, “the fact that this funding was stripped is just mind-boggling.”