As we end the Q3 2020, let’s look at what happened in the past quarter in the crypto tax compliance world (What Happened In the Cryptocurrency Tax Space In Q2 2020).

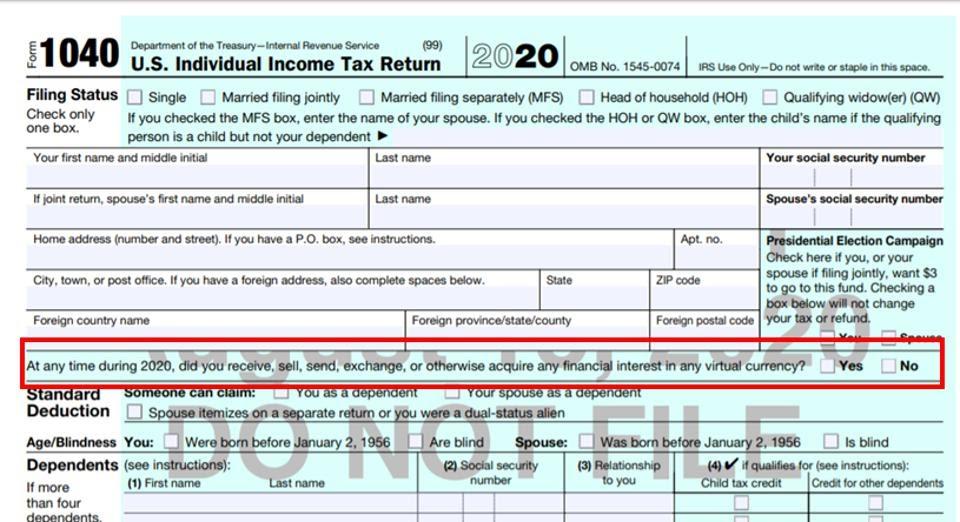

Infamous Crypto Question Was Moved To The Front & Center Of Form 1040

The 2020 draft Form 1040 released by the IRS on August, 18, 2020 showed that the infamous virtual currency question which was first introduced on Schedule 1 for the 2019 tax year has been moved to the front and center of the Form 1040. With this placement, every US taxpayer filing a tax return in 2020 will have to answer this question and file applicable forms if they have cryptocurrency transactions. This showed how seriously the IRS is looking into the crypto space.

IRS Draft Form 1040

IRS Draft Form 1040

Financial Rewards To Catch Crypto Tax Evaders

In this quarter, the IRS awarded a $250,000 contract to a crypto tracing software company to help with ongoing crypto tax audits. The criminal investigation division of the IRS also published a $625,00 bounty to anyone who can break into Monero and Lightning networks.

Crypto Users Received Tax Warning Letters, Again

We saw crypto users receiving another round of crypto tax warning letters printed on August, 14, 2020. The IRS first sent these out to 10,000 taxpayers in 2019. The warning letters came in three variations: Letter 6173, Letter6174 & Letter 6174-A.

In August 2020, we noticed both small and large crypto users getting letter 6174-As. These letters alerted recipients about their crypto tax reporting obligations and recommended amending the tax returns to fix errors and omissions.

Crypto Micropayments Are Taxable

In a memorandum released by the IRS on August, 28, 2020, the service concluded that cryptocurrency received for performing microtasks, for example, completing an online survey or reviewing images, is taxed as ordinary income and may even be subject to self-employment taxes. Even before this memorandum, cryptocurrency received for performing services was taxable as ordinary income. This memorandum reinforced this position and stressed that the payments were taxable “regardless of the value and the manner in which it is received”.

Former Coinbase User Sued The IRS

Jim Harper, a former Coinbase user and a Bitcoin researcher, sued the IRS, its commissioner and up to 10 unnamed agents of violating his privacy and due process rights under the Fourth and Fifth Amendments of the U.S. Harper was one of the recipients of the 10,000 tax warning letters sent out by the IRS in 2019. Harper claimed that he had paid taxes since 2013 and accused the IRS for violating his privacy.

Four Congressmen Requests Clarity On Staking Income Reporting

A letter addressed to the IRS signed by four congressmen asked for more clarity on staking related income reporting. The letter pointed out that staking rewards should not be taxed at the time of the receipt or discovery similar to other taxpayer-created property such as crops, minerals, livestocks and artwork. The rewards should be taxed only when they are sold.

Disclaimer: this post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.