getty

Is there a budding bull market in “boring?”

Warren Buffett’s Berkshire Hathaway made news this week when they disclosed their latest investment. The giant conglomerate now owns about 5% of the outstanding shares of 5 Japanese trading companies. Or, as they call them in Japan, sogo shosha. Berkshire also owns nearly $6B worth of Japanese government bonds. So, Buffett is no stranger to the Land of the Rising Sun.

These businesses are behemoth importers, and they service manufacturers. They are the business pipelines that enable growth in the Japanese economy, and by association, throughout Southeast Asia.

Japan and growth? Like oil and water.

However, “growth” is a term to be used loosely when it comes to the Japanese market. For someone who started his career at a Japanese Bank in NYC way back in 1986, I must assume that most of today’s investors do not see Japan as an investment center the way we did back then.

The 1980s saw Japan’s economy rise to prominence. It took a few decades after their defeat in World War II. But by the 80s, everyone…I mean everyone…wanted to do business with the Japanese.

Japan rises, then stops

Then, around the time of the 1987 Crash, the music slowed for Japan. Then it stopped. And it has not restarted in over 3 decades.

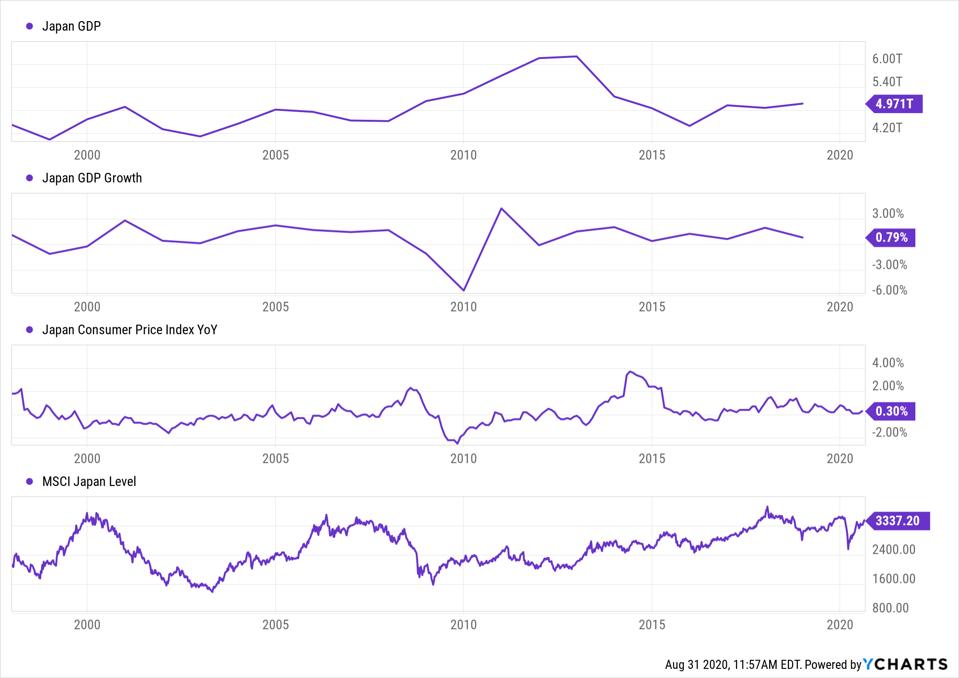

The 4-story chart below tells one consistent story. That Japan has been an unexciting economic story. For folks like Warren Buffett, that often creates value.

From top to bottom: Japan’s Gross Domestic Product (GDP), the total value of goods and services produced, was not much different a year ago than it was 20 years ago. That means no long-term growth.

Japan’s economic trek, in a single chart

And that’s what you see in the chart just below. At a time when much of the world was growing at 2-4% or more, Japan was typically near zero, but for the 2008-2009 plunge and subsequent recovery.

Ycharts.com

The 3rd section of the chart shows that in addition to zero growth, Japan’s consumer prices did not change much either. Put those together, and you have a rare case of a large economy essentially being like a car in “park” mode…for 20 years. No big changes either way.

The lower section of the chart shows that Japan’s stock market has generally moved up and down with global stock markets. However, it will come as no surprise that the moves have been more muted than, say, those in the S&P 500 and Nasdaq

NDAQ

Perhaps most intriguing to equity-focused investors like me is that the Japanese stock market’s price, like its GDP growth and inflation rate, also land at about the same spot versus 20 years ago. You read that correctly: a 20-year return of zero! Or, just slightly below what Japanese bonds have yielded over that time.

What this all means

This should be looked at 2 ways by every serious investor:

- Japan’s 20-year stagnation could happen in the U.S.

- Japan’s relative stability as that occurs could make it a relatively attractive investment area for the next decade or so. After all, they have gotten pretty good at this “zero interest rates, zero growth” game. We in the States are just starting to recognize it.

You might think it is preposterous to suggest that the U.S. stock market and economy could stagnate for 10-20 years like Japan’s did. How soon we forget!

I think we’re turning Japanese, I really think so

The Global Financial Crisis produced a zero return for the S&P 500 for 10 years, ending in 2009. Our debt is piled high, and Congress can’t get on the same page, ever. The Fed is keeping short-term interest rates near zero for as long as it takes, so they say. And, we in the U.S. have a massive “transfer payments” crisis brewing.

That is, Social Security, Medicare and Medicaid for a massive number of people, as Baby Boomers retire, folks live longer, and there are not enough skilled workers to replace them.

This is very similar to what befell Japan a few decades ago. Except back then it was just a threat. All these years later, it is a way of life.

Importantly, all of these economic growth-inhibitors were in place way before Covid-19 came along. Keep all of this in mind as we continue forward.

Under the educated guess that everything old becomes new again, I wonder if the Japanese economy will be rewarded for what it has NOT done over the past decade. Unlike the rest of the developed world, there has been no consumer debt bubble. Japan’s consumers are still among the better net-savers in the world.

Who’s sexy now?

This is not a sexy investment story. But I think there is growing evidence that when investors, amid the next panic, seek out relative economic stability, Japan may again be in the spotlight. If so, I hope to be, in a bizarro Justin Timberlake kind-of-way, credited with bringing boring back.