Amazon CEO Jeff Bezos (l) and Doug McMillon, CEO of Walmart.

Getty Images | CNBC

Less shopping is happening on Amazon, and consumers are favoring Walmart, according to a new survey.

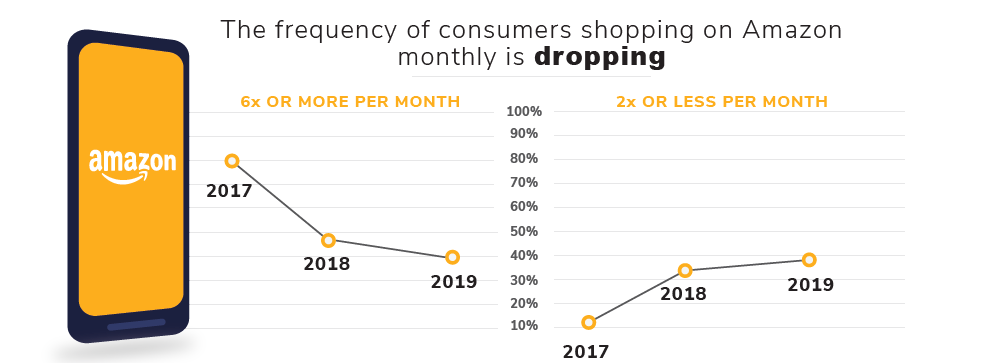

The frequency of people buying items on Amazon six times or more per month has dropped to 40% this year from 80% in 2017, according to surveys by First Insight, a retail analytics firm that collects data to help retailers such as Dick’s Sporting Goods, Crocs and Kohl’s make product decisions.

First Insight conducted three consumer surveys of about 1,000 people each in December 2017, September 2018 and last September to compile the results. They included shoppers with and without a Prime membership.

A majority this year, 55%, said they prefer to shop at Walmart versus Amazon, up from about 47% a year earlier. The percentage of people who favor Amazon has dropped to 45% from about 53% in 2018.

“The excitement of the Amazon box coming to your house is kind of dwindling off,” First Insight CEO Greg Petro said in an interview. “I think the novelty of Amazon is wearing off.”

Source: First Insight

Amazon has disclosed it has more than 100 million Prime members worldwide. But according to First Insight, signups are dropping. The firm said it found 52% of survey respondents were members in 2019, down from 59% a year earlier.

The survey’s findings could be a sign that Walmart’s e-commerce investments are paying off, and Amazon still has its work cut out for it. Both companies have been in a battle over delivery.

Amazon announced plans last month to start delivering grocery products for free within a two-hour window to all Prime members living in the 2,000 regions eligible for the service. Until then, Prime members had to pay an additional $14.99 per month to get access to Amazon Fresh, a separate program that offered two-hour grocery delivery.

With the company spending billions of dollars to expand its free one-day delivery program, Amazon’s third-quarter earnings report last month fell short of analysts’ expectations.

Walmart, meanwhile, has begun testing delivering groceries directly to customers’ refrigerators in three cities. Its InHome grocery delivery membership program costs $19.95 a month. And making the most of its bricks-and-mortar stores, it has more than 2,700 grocery pickup locations for online orders across the U.S.

Walmart’s profits in the latest quarter topped Wall Street estimates, and the company said e-commerce sales surged 37%.

“[Walmart’s] speed is allowing them to leapfrog and get hyper-competitive with Amazon in a short period of time,” First Insight’s Petro said.

The true test could come this holiday season, which has six fewer days than last year, putting more pressure on companies to pull shoppers into stores and to their websites sooner. Walmart and Amazon have already started offering deals.

Representatives from Amazon and Walmart didn’t immediately respond to CNBC requests for comment.

Amazon shares are up about 19% this year. Walmart shares have rallied more than 26%. Amazon has a market value of roughly $888 billion, compared with Walmart’s $334 billion valuation.