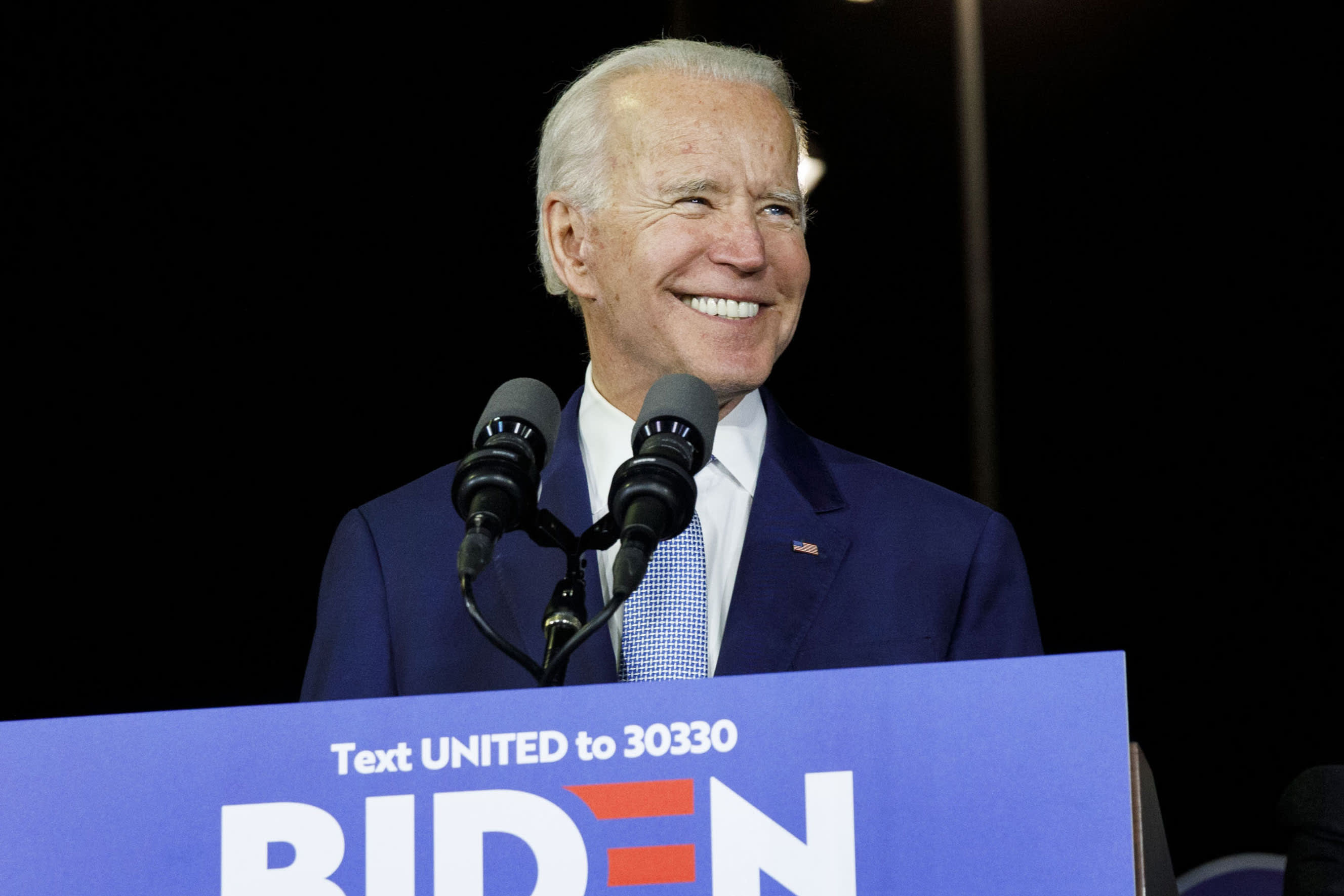

Former Vice President Joe Biden, 2020 Democratic presidential candidate, smiles during an primary night rally in the Baldwin Hills neighborhood of Los Angeles, California, U.S., on Tuesday, March 3, 2020.

Patrick T. Fallon | Bloomberg | Getty Images

Stocks came back in a big way Wednesday, with many Wall Street firms attributing the relief rally to the outcome from Super Tuesday.

Former Vice President Joe Biden secured a lead in the Democratic primary after racking up big wins in delegate-rich states like Texas and Virginia. Biden’s performance put him ahead of Bernie Sanders in delegates, soothing some of Wall Street’s fears about the Vermont senator’s anti-capitalist policy proposals.

“The race is not yet over, but immediate reaction is likely a relief rally as the tail risk of some of Sanders’ policies will be seen as less likely today than last week,” Raymond James policy analyst Ed Mills said in a note to clients.

After losing nearly 800 points on Tuesday despite an emergency interest rate cut from the Federal Reserve, the Dow Jones Industrial Average was up more than 750 points on Wednesday around 1 pm ET. The S&P 500 and Nasdaq were also up 1.8% and 1.7%, respectively. By far the biggest contributor to the Dow’s gain is UnitedHealth Group, solely adding about 160 points to the 30-stock benchmark as the managed care provider gained 9%.

Sanders, a self-proclaimed democratic socialist, has vowed to take on the pharmaceutical industry and his biggest proposal, “Medicare for All,” would end private health insurance like that provided by UnitedHealth.

‘Investors fear Bernie’

“These developments in the Democratic primary could set the [Medicaid] and Hospital stocks up for a relief rally as the market likely prices in reduced risk of Bernie winning the Democratic nomination,” Stephens analyst Scott Fidel told clients. Shares of UnitedHealth are down about 7% since the coronavirus-driven market sell-off that pushed stocks to their worst week since the financial crisis.

Sanders is also advocating for policies including higher taxes on the wealthy, breaking up big banks and a $15 per hour minimum wage.

“Investors fear Bernie because he wants to cut off the head of capitalism by raising taxes significantly on the rich and using the funds to provide free everything to everybody else. He also wants to regulate everyone,” Yardeni Research’s Edward Yardeni said in a note. “No wonder investors are reacting to him as though he is going to infect us all with the virus of socialism.”

While stocks reacted poorly to the Fed’s lowering of interest rates by 50 basis points in order to combat the economic damage from the coronavirus, MUFG chief financial economist Chris Rupkey said the easing measure could be at play in the markets on Wednesday.

“The one-two punch thrown on Tuesday by the big Fed rate cut and the Biden win last night has put a floor under the stock market for now so investors are giving a huge sigh of relief and short-sellers are exiting stage left,” Rupkey said in an email to clients.

To be sure, there is a narrative that Sanders as a front runner is bullish for equities, because President Donald Trump would have an easier time beating him. But Wall Street seems to see Biden and Trump as safer for equities.

“That makes a market-friendly matchup between President Donald Trump and Biden the most likely outcome,” Michael Pearce, senior U.S. economist at Capital Economics, said in a note.

— with reporting from CNBC’s Michael Bloom and Fred Imbert.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.