Jill Fromer | E+ | Getty Images

While you might feel numb to data breaches due to their increasing frequency, experts say you shouldn’t be indifferent to the possibility of one actually causing you harm.

Two years after the announcement of the massive Equifax breach — a cyberattack that compromised the personal information of about 148 million people and recently led to a $700 million court settlement — consumers are still falling short in their efforts to make sure they aren’t the victims of fraud, according to a new survey by CompareCards.com.

This comes despite thousands of other breaches since then, including more than 1,200 in 2018 alone, according to data from Statista.com.

“I think consumers are just desensitized to it because they live in a world where breaches are a reality,” said credit expert John Ulzheimer, president of The Ulzheimer Group in Atlanta.

More from Personal Finance:

More than half of parents blew their summer budgets

College graduates with this major could earn over $100,000

Retiring early? These 10 US cities could be your best bet

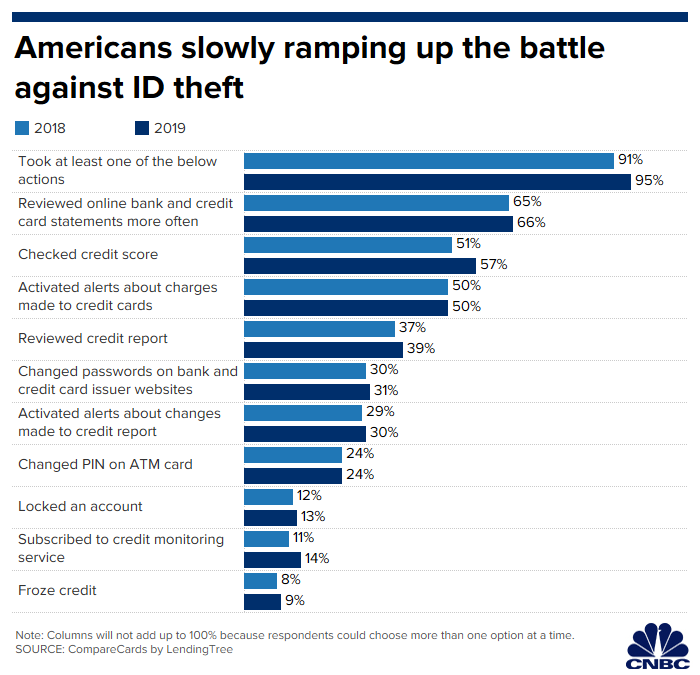

The CompareCards survey, conducted in mid-August among 750 consumers who have at least one credit or debit card, asked respondents what they had done in the past year to protect themselves from identity theft.

While 95% had taken at least 1 of 10 actions to help detect or protect against fraud — and most are being either somewhat or much more vigilant — the most effective methods to battle identity theft remained largely unused.

For example, just 9% froze their credit, which is the best way to hinder a fraudster’s effort to get a loan or credit card in your name.

A credit freeze generally blocks outside access to your file. This means a scammer would struggle to use your personal information to open a financial account, because the potential lender would be unable to check your report to approve the application.

While freezing your credit (or lifting a freeze) won’t cost you anything due to federal law prohibiting a fee, you must alert the credit-reporting firms — Equifax, Experian and TransUnion are the biggest — to freeze your report at each of them. You can do it by phone or online at each company’s website.

You also can initiate a short-term fraud alert, which lasts one year. They’re different from freezes: Under a fraud alert, a lender seeking to approve an application must first contact you to verify the request is not from an imposter.

To go this route, you only need to contact one credit-reporting firm which in turn is legally obligated to share your fraud alert notice with others. It also is free.

The CompareCards survey also showed that just 39% reviewed their credit report and just 30% have activated alerts to let them know when there is a change to their credit reports.

“There’s still a disconnect between consumers and the importance of their credit reports,” Ulzheimer said. “They just aren’t as commonly reviewed as, say, your bank or credit card statement.”

The survey also asked whether consumers were going to take part in the $700 million Equifax settlement, which had been announced about a month before the survey.

More than a third (37%) said they were unaffected by the breach that led to multiple lawsuits against the company, while another 42% said they plan to either collect monetary damages or the free credit-monitoring service as part of the settlement. The remainder (21%) said they wouldn’t claim damages.

— CNBC’s Nate Rattner contributed to this report.