Getty Images

Health savings accounts offer a triad of tax benefits, and the savviest investors can stretch their dollars even further if they’re willing to do a little legwork.

This fall, you just might encounter a health savings account, or HSA, as you select your 2020 medical benefits at work.

These tax-favored accounts, which you can also open on your own outside the workplace, are often paired with high-deductible insurance plans.

HSAs offer three key benefits: You can contribute to them on a pretax or a tax-deductible basis, have your savings grow free of taxes and then make tax-free withdrawals for qualified medical expenses.

A less-known sweetener is that while 401(k) contributions are subject to Social Security and Medicare taxes, pretax HSA contributions are not.

In 2020, you can contribute up to $3,550 to an HSA if you’re in a qualifying health-care plan with self-only coverage. That number goes up to $7,100 for family plans.

Realizing those tax benefits is often just the beginning. Users who’ve had their HSAs for a while can graduate to using other techniques.

“After you’ve had the HSA for a while and you understand what is and what you can do with it, sometimes investors realize they are looking for something different,” said Roy Ramthun, founder of Ask Mr. HSA.

Shopping around

EmirMemedovski | E+ | Getty Images

Generally, it pays to shop around for an HSA. These accounts can charge different fees based on how you use the money.

Those that act like a checking account — where the customer keeps a low level of cash and uses the money for current expenses — often credit interest and charge account maintenance fees.

To that end, the average account balance of $2,000 has an average of $25 in annual maintenance fees and earns $5 in interest, according to Morningstar.

.1570548951932.1573664861396.png)

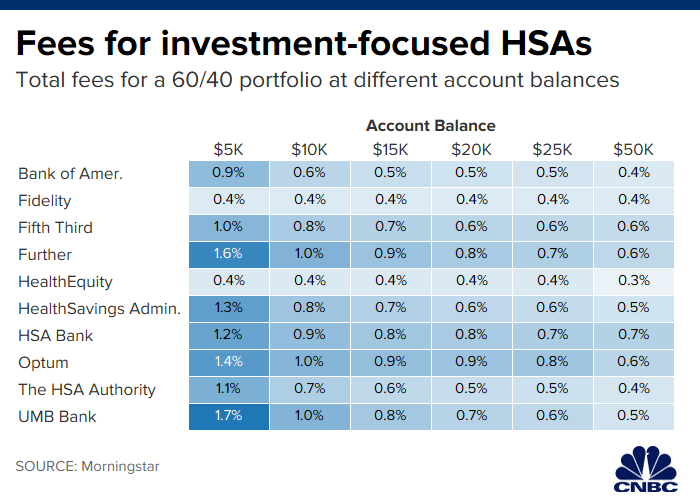

Meanwhile, those that are investment-focused — meaning clients grow their money over years — add on annual maintenance fees, plus investment fees and fund charges.

These investment-focused HSAs have an average of $13,000 in them and assess annual maintenance and investment fees averaging $54, or 0.42% of the balance, Morningstar found.

If your employer makes an HSA available to you, but you’d rather keep the account you’ve already been funding outside of your workplace plan, there may be a strategy worth considering.

In this case, you maintain the HSA you get through your workplace plan, fund it and then transfer the money at the end of the year to a different account, said Kelley C. Long, CPA and member of the American Institute of CPAs’ National CPA Financial Literacy Commission.

“You don’t have to leave your job or leave your plan to change your HSA,” she said.

Do some serious thinking before you shift the money from your company’s HSA provider to your own.

More from Personal Finance:

The biggest mistakes people make with their 401(k)

5 last-minute tips before open enrollment ends

How much more you’ll pay for Medicare Part B in 2020

That’s because the custodian of your account may charge a distribution fee for moving the funds.

Further, employers often cover a range of HSA costs, so you’d have to figure out whether moving the money is worth the added expense and administrative burden.

Be aware that even if you’re maintaining two accounts, you’re still restricted to the same annual contribution limit — and you must have high-deductible health-care coverage to fund it.

“It would be nice to max out contributions to each HSA we own, but we can’t,” said Ramthun.

One-time rollover

Panuwat Dangsungnoen / EyeEm | EyeEm | Getty Images

Here’s a once-in-a-lifetime deal: funding your HSA with money you have in your traditional or Roth individual retirement account.

This might be an attractive move for a saver who’s currently in a high-deductible plan, is age 55 or over – and thus eligible for a $1,000 catch-up HSA contribution — and would like to set aside money for medical costs in retirement.

You can rollover up to the annual HSA contribution limit for that year.

You have only one shot to make this rollover, so talk to your financial advisor first.

“Going from a traditional IRA to an HSA is advantageous because you have tax-free money coming out for qualified medical expenses,” said Nate Black, associate vice president of health savings and spending accounts at Voya.

Normally, money coming out of a traditional IRA is subject to income taxes, plus a 10% withdrawal penalty if you take a distribution before you turn 59½.

The IRA-to-HSA rollover is less of a good deal if you’re moving dollars from a Roth account.

Remember, you’ve paid income tax on your Roth contribution, and it will accumulate earnings free of tax. Distributions once you’ve retired are also tax-free, regardless of how you use the money.

“With the Roth IRA, you’ve already paid taxes on the contribution, so there aren’t a lot of advantages for putting money into the HSA,” Black said.

That’s because while HSA dollars come out tax-free for medical expenses, you’ll pay income taxes if you use the money for any other purpose. If you’re under 65, you’ll face an additional 20% penalty tax.