Democratic presidential candidate Joe Biden speaks during a campaign event in Fort Lauderdale, … [+]

AFP via Getty Images

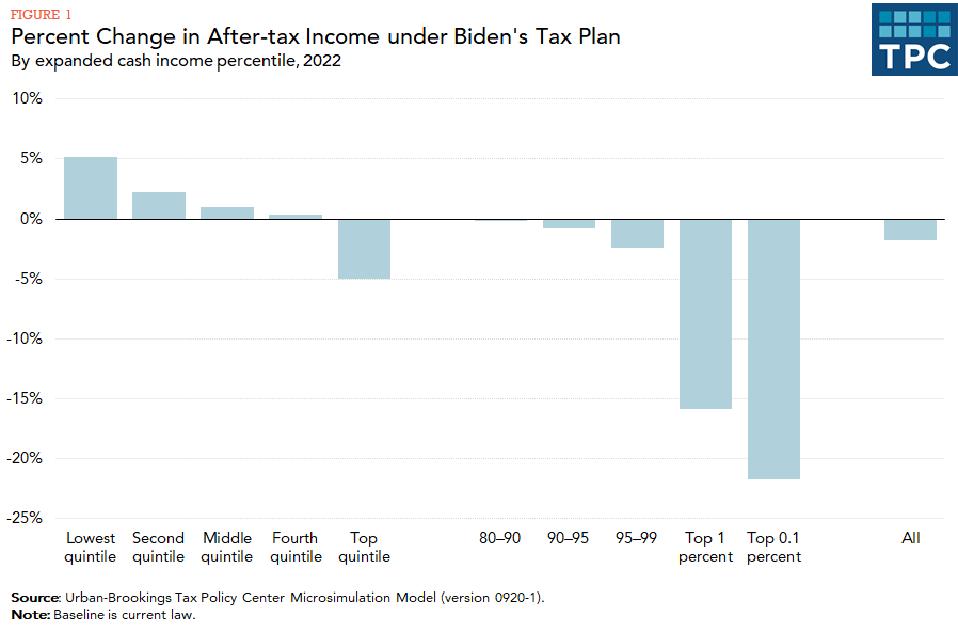

Democratic presidential candidate Joe Biden’s current campaign plan would raise taxes by $2.4 trillion over the next decade, about 0.9 percent of Gross Domestic Product (GDP), according to an updated analysis by the Tax Policy Center. The burden of nearly all those tax increases would fall on high income households. In 2022, on average, all but the highest-income 20 percent would get a tax cut under Biden’s plan, while the top 1 percent— those making about $790,000 or more— would see substantial reductions in their after-tax incomes.

Change in 2020 after-tax incomes under Joe Biden tax plan

Tax Policy Center

TPC’s updated revenue estimates differ substantially from its March 5 analysis that showed Biden’s tax proposals would raise about $4 trillion.

· About one-third of the difference is due to new initiatives Biden proposed since February.

· Another third is the result of the recent economic slowdown, Biden’s revisions to his earlier proposals, and changes in modeling assumptions.

· About 20 percent is due to TPC’s assumption that due to the pandemic, Biden would delay the implementation of most proposals until 2022.

· The rest reflects TPC’s decision to not model some of Biden’s ideas because they are incomplete or because Biden has changed some proposals in ways that make them difficult to model.

TPC plans to analyze President Trump’s tax platform as well.

An average tax hike of $1,500

TPC estimates that Biden would raise taxes by an average of about $1,500 in 2022. However, a middle-income household (making between about $50,000 and about $90,000) would receive an average tax cut of about $600, an increase in after-tax income of about 1 percent.

The story is very different for high income households. Those making between about $330,000 and $790,000 would pay about $9,000 more on average in 2022, or about 2.4 percent of their after-tax income. Those in the top 1 percent (who will make about $790,000 or more) would pay roughly $265,000 more in taxes on average, or 16 percent of after-tax income. Those in the top 0.1 percent (who will make $3.5 million or more) would pay $1.6 million more than under current law, a steep 22 percent reduction in their after-tax incomes.

Averages can be misleading

Keep in mind that the average tax change for a given income group—especially those low- and moderate-income households benefiting from his tax cuts—can be misleading. Because many of Biden’s proposed tax breaks are available only to those in specific circumstances—families with children, first-time homebuyers and the like—some households would benefit significantly more than others.

For example, the lowest income households would receive an average tax cut of $750 under Biden’s plan. But households in that income group with children would see their average 2022 after-tax incomes increase by substantially more thanks to increases in the Child Tax Credit (CTC) and Child and Dependent Care Tax Credit (CDCTC).

The story is essentially the same if you exclude Biden’s corporate tax changes and look only at his individual income tax, payroll tax, and estate tax proposals. However, specific effects would be somewhat different. For instance, the average tax increase would fall to about $600. Middle-income households would get an average tax cut of roughly $1,000 and the top one percent would see their average tax burden rise by about $220,000.

Many tax changes

Overall, Biden would make more than 50 tax changes for households and businesses.

He’d repeal tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA) for taxpayers with incomes above $400,000. He’d also limit the value of itemized deductions to 28 percent for those making more than $400,000 and impose Social Security payroll taxes on earnings over $400,000. He’d tax capital gains and dividends at the same rate as ordinary income for those with incomes above $1 million, tax unrealized capital gains at death, and raise estate taxes.

For low- and middle-income households, he’d increase and make fully refundable the CTC (for 2022 only) and the CDCTC (permanently). He’d create new tax credits for first-time home buyers, family caregivers, and low-income renters, and replace the deduction for retirement saving with a refundable tax credit.

He’d raise the top corporate income tax rate from 21 percent to 28 percent, and create a 21 percent country-by-country foreign minimum tax, a 15 percent minimum tax on companies’ global book income, and a risk fee for large financial institutions. Those tax hikes would be partially offset by several new tax credits, including a ten percent credit for new domestic investments.

New proposals

Biden has added several proposals in recent months that were not in TPC’s March analysis. They include:

- the temporary expansion and full refundability of the CTC

- the domestic manufacturing tax credit

- the first-time home buyer’s tax credit

- the expanded CDCTC

- the low-income renter’s tax credit

- the increased estate tax

- the risk fee on large financial institutions

TPC also assumed that Biden generally would limit his proposed tax increases to households making $400,000 or more, tracking a promise has made repeatedly during the campaign.

These changes would significantly reduce the size of Biden’s net tax increase and provide generous new benefits for low- and moderate-income households and domestic manufacturers.

But the basic story remains the same: A President Biden would substantially raise taxes on high income households and businesses to help fund an ambitious domestic spending agenda.