Juanmonino | E+ | Getty Images

Congress wants business owners to head out to restaurants and claim a full tax deduction for doing so.

Whether it will be enough to save embattled dining establishments is another story, financial advisors and tax professionals said.

The $900 billion proposal, which was released on Monday and weighs in at 5,593 pages, includes a range of relief measures intended to get Americans through the pandemic.

The measure includes $600 stimulus checks for adults and children, as well as a $300 weekly unemployment boost.

The legislation also encourages business owners to help support restaurants by visiting often.

More from Advisor Insight:

How financial advisors say to use your $600 stimulus check

Here’s who’s likely eligible for a second stimulus check

Covid relief bill adds PPP tax breaks the Treasury opposed

Indeed, the bill calls for a “temporary allowance of full deduction for business meals,” and it applies to the cost of food or beverages provided by a restaurant and paid or incurred in 2021 and 2022.

“As you know, the president is concerned about restaurants, so we restored the deductibility of meal expenses for businesspeople,” said Treasury Secretary Steven Mnuchin, speaking on CNBC’s “Squawk on the Street” Monday morning.

Currently, there’s a 50% deduction that’s allowed for meals and snacks at work, as well as client meals if business is conducted.

If the measure seems familiar, it’s probably because you’ve seen it before. The HEALS Act, an earlier relief proposal from the Senate, called for a temporary 100% deduction on business meals.

That measure was championed by Sen. Tim Scott, R-S.C., and it was known as the Supporting America’s Restaurant Workers Act.

“It’s great for small businesses and restaurants; they really need that shot in the arm,” said Michael Goodman, a certified financial planner and CPA at Wealthstream Advisors in New York.

“Unfortunately, it’s not going to help right now, since it’s for 2021 and 2022,” he said. “It will do nothing for those restaurants that will have to go out of business.”

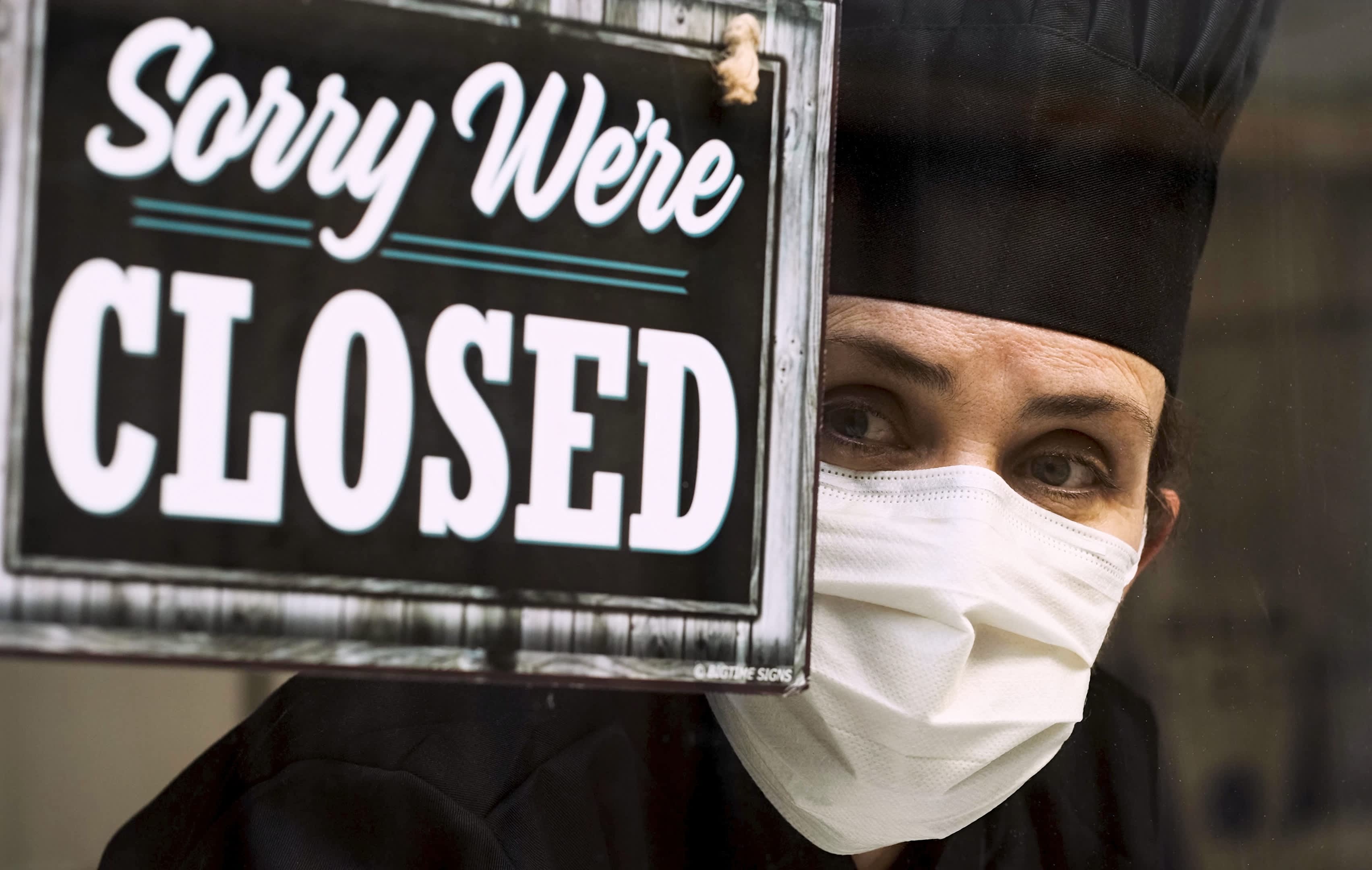

Restaurants taking hits

The proposal comes about at a difficult time for the hospitality industry. Restaurants lost 17,400 jobs in November.

Meanwhile, municipalities are locking down amid a resurgence in Covid cases.

That means indoor dining is prohibited in New York City, while outdoor seating at restaurants and breweries are closed to the public in Los Angeles County.

Tax professionals are also skeptical of whether business owners want to take the risk of dining out — particularly at a time when their own finances are already suffering.

“The three-martini lunch is a great idea in theory, but you’re assuming people have money to spend,” said CFP Dan Herron, CPA and principal of Elemental Wealth Advisors in San Luis Obispo, California.

“It’s great for wealthy folks who can blow money through a corporation, but I know people who are struggling to make ends meet,” he said. “Their priority isn’t a three-martini lunch.”