If you can see through these misperceptions about assets, you can be a better investor.

Fallacy #1: Price Equals Wealth

Say you bought a $500,000 suburban house a while back and now it’s worth $1 million. You have no plans to move. Has your wealth gone up by $500,000?

Not exactly. Wealth isn’t just a footing on a balance sheet. It’s a measure of how well you can live. If the house is the same as it was—same living room, same kitchen, same bathrooms—then you aren’t any better off. The price has changed, but your living standard hasn’t.

To be sure, price translates into wealth if you are about to sell. If you sell the million-dollar house and move in with your in-laws, high house prices made you richer and the new owner poorer. But inflation in asset prices does not make the whole country better off. It does not make living rooms bigger.

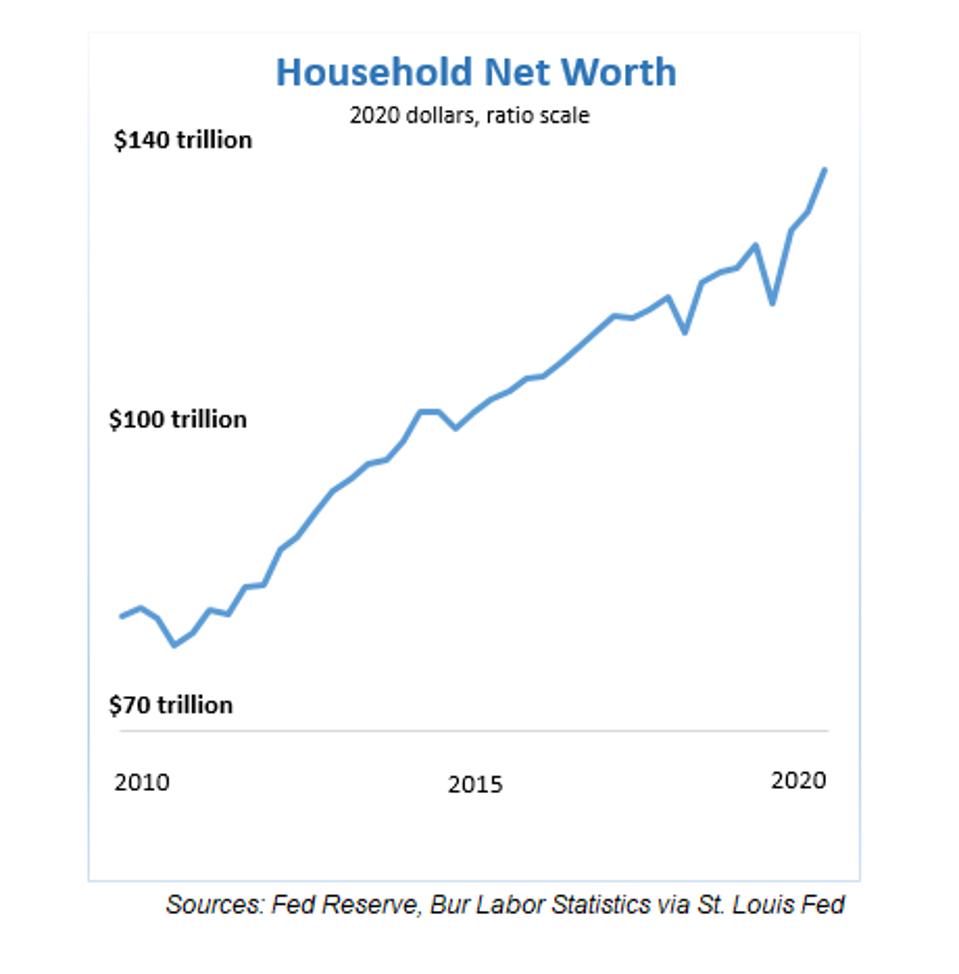

The country’s collective net worth, shown in the graph, has shot upward. What you’re looking at, for the most part, is a repricing of existing assets. Our stock of capital is delivering only a slightly fatter stream of comforts.

National wealth

Forbes

There are exceptions to the pattern. Amazon has twice as many warehouses, twice as many satisfied customers and twice as much revenue as it did a short while back. So its price gain reflects in some measure a wealth gain. But a large part of the change in the national net worth is only a price illusion.

Over the past decade corporate earnings, as measured by the S&P 500 index, are up 37%, while stock prices have tripled. The Amazons are outnumbered by the beneficiaries of bidding wars: the mediocre companies trading at double their historical multiples, the GameStops, the bitcoins and the special purpose acquisition companies.

Bond prices, too, are much higher than they used to be in relation to interest payments. Your brokerage statement says that your bonds are worth a lot more than they were a few years ago—but you’re getting the same old coupons.

For most people, the price-equals-wealth fallacy is only an economic abstraction. For one group of people, though, it matters a lot. That group is people about to retire. They are trying to live off a stock of capital without depleting it. They need an antidote to the fallacy.

If in 2011 your stock and bond portfolio was worth $1 million, now it’s probably worth $2 million. But its earning power, generated by warehouses and factories and patents, is only a little higher. The price has doubled. But your wealth, measured by how well you can live, has not doubled.

Calculating the fraction of your assets you can safely spend each year is a complicated affair, because a retiree’s portfolio does not have to emulate an endowment and last forever. If you’re 67 now, you only need for your savings to last 30 years. You can nibble capital as you go along. To continue the analogy with houses: It’s as if you were downsizing a little every year. So you can turn a portion of asset price inflation—a small portion—into pocket money.

The old rule of thumb for a withdrawal rate was 4%. If you had $1 million, you could safely take out $40,000 the first year, keep that draw up with the cost of living and have a pretty good chance of not outliving your assets. The formula reflected not just the earning power of stocks and bonds but also the market’s uncertainties and the differing abilities of stocks and bonds to keep pace with inflation.

In today’s bull market for stocks and bonds, when earnings and interest payments are tiny in comparison to securities prices, the 4% rule doesn’t work. It would be foolhardy to look at the doubling of your portfolio over the past decade and conclude that it doubles your living standard.

The antidote to the price-equals-wealth fallacy is to scale down your expectations. Just what the new safe withdrawal rate should be is a matter of debate, but it’s surely a lot lower than 4%. I think a 2.5% draw is fairly safe, at which rate you could spend $50,000 a year out of a $2 million portfolio. That’s better than the old rate on the old $1 million price of the portfolio, but it’s not hugely better.

If you are prepared to reduce payouts if and when security prices crash, a higher starting withdrawal rate is okay. But not many retirees are so flexible.

Fallacy #2: Trading Increases Wealth

This grand illusion goes back at least a century, to when shoeshine boys traded tips on Radio Corp. of America. It reached a high point in 1999, when television ads featured day traders retiring young. It keeps New York City’s economy humming.

Last year the San Francisco cryptocurrency exchange Coinbase handled $193 billion of trading volume. Now, if you had the luck or wisdom to hold either bitcoin or ethereum for the 12 months, you made a pile. But how would your pile have been made any bigger by going back and forth among different cryptocurrencies, or between crypto and dollars? Did it not occur to any of these traders that trading is a zero-sum game?

Some trading is necessary to make the capital markets work. Without bids and offers, there wouldn’t be a way to know that a share of Seaboard Corp. is worth more than a share of Amazon, and there wouldn’t be a way to direct capital to the best users of it. But really. CBOE statistics say that last year, in a $21 trillion economy, we had $121 trillion of trading in U.S. shares.

Publicly traded companies will earn perhaps $1.5 trillion in 2021. Owners will surrender roughly a fifth of this bounty to middlemen—money managers, stockbrokers, market makers—in their striving to increase their shares of the pot.

The two greatest financiers of the past half century, Warren Buffett and John Bogle, both commented on this perplexing behavior. And they offered the same antidote. Buy index funds.

Fallacy #3: Money Is Wealth

Money makes wealth possible. Without a medium of exchange, we wouldn’t have those factories and warehouses. But money is not wealth. If it were, Zimbabwe and Venezuela would be wealthy.

Over here, we are engaged in an experiment. The government is metaphorically printing $100 bills, 60 of them for each citizen, and depositing the paper on doorsteps. To be more precise: It is creating a $1.9 trillion stimulus, financing that by having the Treasury issue bonds and then having another arm of the government buy the bonds with newly created money.

What is the resulting increase in wealth? My estimate: $0.

As for the antidote to any resulting boost in the CPI, there are only distasteful choices. You could invest a chunk of savings in 20-year Treasury Inflation Protected Securities, which protect you from inflation but, alas, offer a real return of -0.1%. You could buy shares of producers of commodities, but a lot of those commodities, like copper and oil, seem destined to become less sought after in years to come. Or you could own some alternative kinds of money. Gold bars and bitcoin are intrinsically just about as worthless as those benjamins, but they have the advantage that the government cannot easily create more of them.