Even though stocks are trading around all-time highs, CFRA’s Sam Stovall thinks Wall Street isn’t bullish enough.

According to the firm’s chief investment strategist, an under-the-radar historical trend suggests the S&P 500 will continue to reach record levels through December. He credits a phenomenon that’s only happened 28 times since WWII.

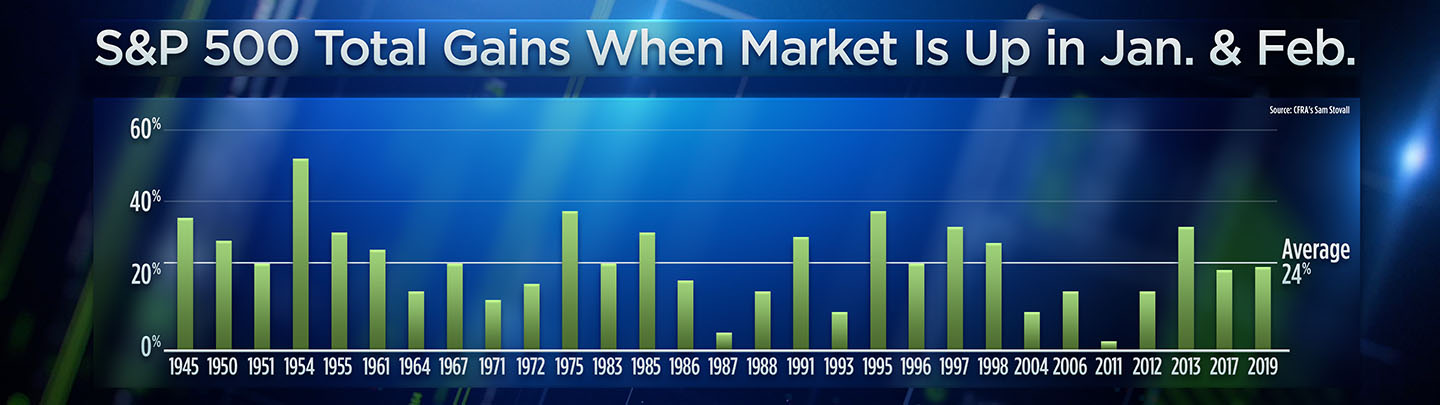

Stovall highlighted the pattern in a chart on CNBC’s “Trading Nation.”

“There’s something special about this year. We had a positive move in the market in both January and February,” Stovall said on Thursday. “February is the second worst month of the year — second only to September. It’s usually a digestive month.”

When the market is up the first two months of the year, Stovall notes the S&P has been up 100% of the time. He estimates the average total return is 24% for the full year. So far this year, the index is up 24.4%.

However, that doesn’t mean market gains are in for 2019.

Stovall points to another unusual characteristic of the year’s record run: Stocks hit highs this month, too.

“Throw in a new all-time high in early November and you’re essentially flat to higher 11 of 11 times,” he added.

Stovall came into 2019 with a 2,975 year-end S&P price target — about 5% below Friday’s close of 3,120, a record high. He’s now focused more on his 12 month rolling target of 3,200.

The Dow also hit a milestone on Friday. It closed above 28,000 for the first time ever.

Despite his upbeat forecast, he acknowledges some risks lie ahead.

“If you end up with a strong end of year run that could be borrowing a bit from what we would expect in 2020,” Stovall said. “So, as I frequently say, I call myself a bull with a lower case ‘b.'”

Note: The S&P 500 was created in 1957 from back-tested data.