Our healthcare landlord Omega Healthcare Investors (OHI) is officially back. This 6% dividend has upside once again. We are about to receive our first payout raise since early 2018, which ends our seven-quarter drought in which the big dividend was paid but not raised.

I say “drought” partially in jest because OHI yielded a fat 10% when it froze its payout. The stock slipped on the news, but we discussed that a freeze isn’t the same as a cut, and OHI’s payout was well covered by its funds from operations (FFO).

Congratulations to you calculated contrarians who stuck with the pick. We’ve rocketed from slightly negative returns early last year to gaudy 68% total gains today! Most of the returns have come from cash dividends, and most of our profits have dropped in after OHI’s bit of bad news!

Want a surefire formula for making 68% gains with OHI? Just buy it any time it pays 10% or more. This real estate investment trust (REIT) has been around for a while. And anytime that OHI has paid double-digits in the past, it marked a major bottom for the stock.

Here’s what I mean. The orange line represents OHI’s yield (on a trailing basis) over the past 12 years, while the blue line represents its price. A high yield has indicated a low price every single time!

Secure REIT yields are the truly the “rubber duckies” of the investing world. Mr. Market can push them underwater for a period of time, but eventually, they rocket up to the surface.

Let’s watch this in action at OHI over and over for fun and profit. We’ll rewind 12 years to the top of the last extended bull market. If you were savvy enough to time the top in 2007, you would still have been doing yourself a disservice by selling your OHI shares (not least, how would you have known when to have “gotten back in?”)!

Five years later, while the S&P 500 barely recovered its crash losses, OHI investors had enjoyed 133% returns (including steady, fat payouts throughout). And while the presence of a dividend does not guarantee protection from losses, examples like this one show that payout-focused investors have a serious edge in the markets because:

Buying REIT stocks for their dividends alone makes day-to-day price action irrelevant.

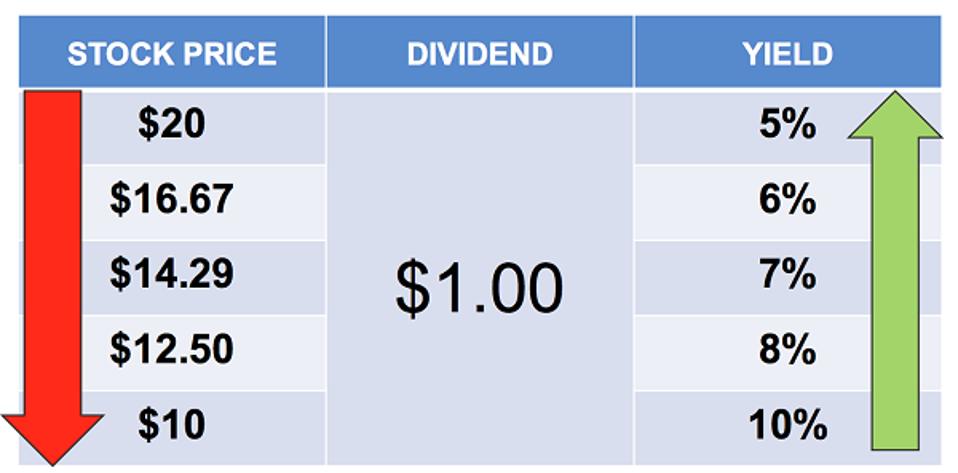

Here’s why. A falling price attracts more dividend buyers. Let’s take a $20 stock with a $1 dividend (a 5% yield) that begins falling in price. As it drops, income investors buy it because they are now able to secure more dividend for their initial dollar:

Contrarian Outlook

Which means REIT investors need not concern themselves with short-term price action. They only need to consider whether the underlying payout is safe.

Of course in this case it was profitable to concern ourselves with short-term yield action. We knew that a 10% yield was too good to last, and sure enough, it was. We’ve got the 68% gains to prove it!

Brett Owens is chief investment strategist for Contrarian Outlook. For more great income ideas, click here for his latest report How To Live Off $500,000 Forever: 9 Diversified Plays For 7%+ Income.

Disclosure: none