Mike Molitoris received the second stimulus check via direct deposit on Wednesday. The pending funds will be available to use Jan. 4.

Mike Molitoris

Mike Molitoris, a wealth manager in Cary, North Carolina, heard that checks were being issued via direct deposit on the radio while he and his family were out seeing Christmas lights on Tuesday evening. He checked his bank account when he got home and saw no payment.

On Wednesday morning, he checked again and found the money pending in his account. The funds will likely be available to use on Jan. 4, when the deposit is dated.

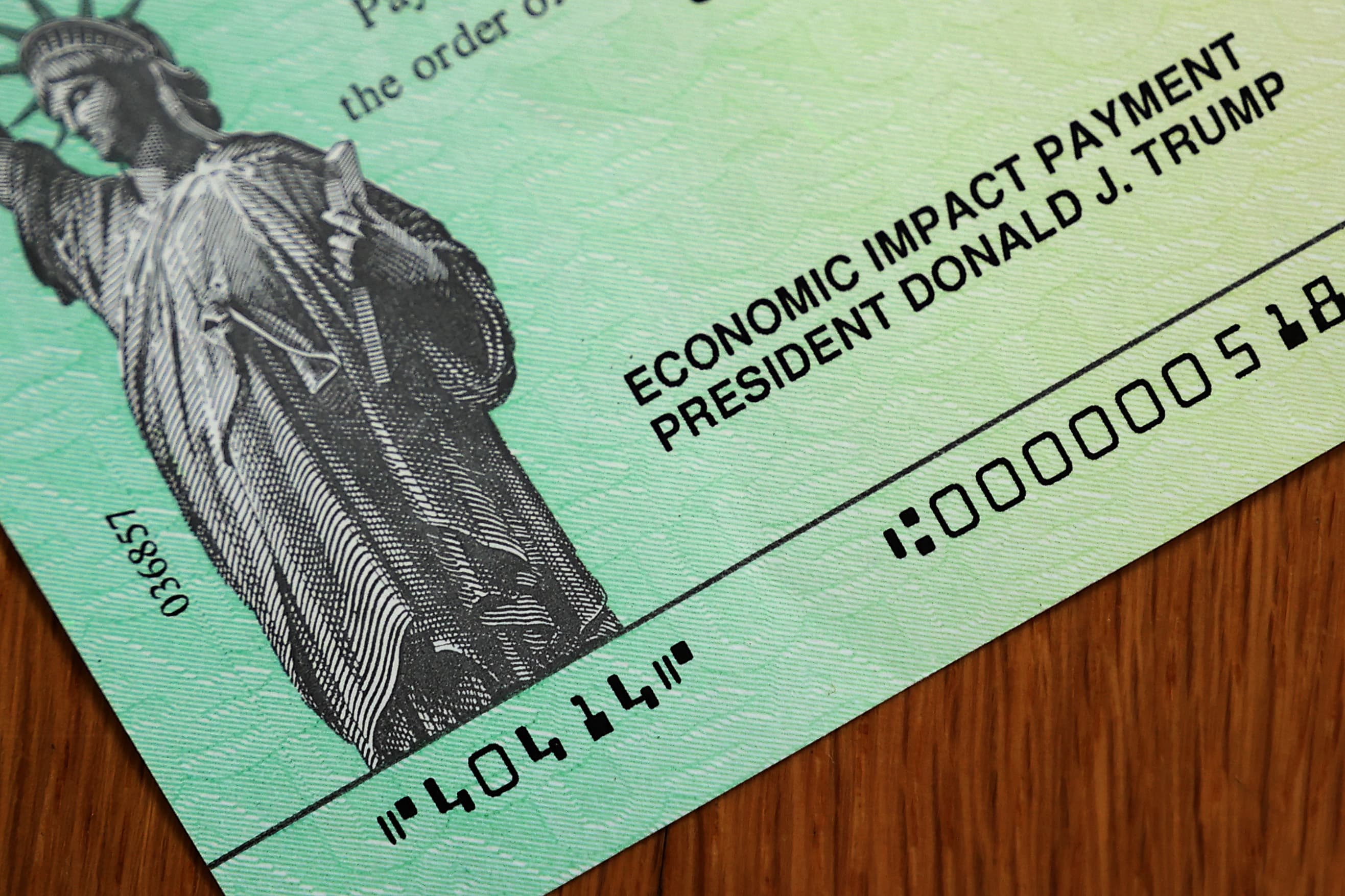

President Donald Trump’s name appeared on coronavirus economic assistance checks that sent to citizens across the country April 29, 2020.

Chip Somodevilla | Getty Images

“I was shocked, to be honest,” said Molitoris, adding that the deposit includes the full amount for him, his wife, and their three young children. The first time around, it took about six weeks for his family to receive the money, he said.

Molitoris may be one of the first to receive the second round of stimulus checks. On Tuesday, Mnuchin said that the checks, which are up to $600 for most individuals and $600 per child, would begin to be delivered by direct deposit and could land in accounts right away. Paper checks and debit cards will begin to be mailed to those who don’t have direct deposit set up with the IRS on Wednesday, according to the agency.

The second round of checks comes roughly 10 months into the coronavirus pandemic and ensuing economic recession. It’s half the amount of the first $1,200 check and begins to phase out for individuals making more than $75,000 per year and married couples filing jointly making $150,000. The payment is intended to help struggling families and individuals pay the essentials such as rent, utilities and food.

What the family plans to do with the cash

The Molitoris family has plans to give a chunk of the money away, as the year has fortunately been relatively stable for them.

“Obviously there’s a lot of people hurting, so we try to help out some charities because they need it,” said Molitoris.

They’ll also likely spend some of the money to boost the local economy. The family has been patronizing a friend’s restaurant and has also used other small businesses run by friends, such as a local garage.

Anything left over will be saved for potential healthcare expenses, Molitoris said. One of his children was exposed to Covid-19 earlier in the year, and the family is still in the process of working with insurance to have visits to the pediatrician covered in full.