In the last year, Raeshanna Mcanuff, 27, a cosmetic chemist, asked for a raise at her job.

Adam Sherif, 24, who works at a music talent agency, paid off the first $30,000 of his $60,000 in student loan debt.

Jami Bish, 37, a social worker, saved $3,000 to open her first investment account with Vanguard and increased contributions to her retirement accounts.

Siobhan Barrington, 28, who runs a nonprofit, learned how to better budget her personal expenses, invest and overcome some of the shame she felt around money.

A major component to their success? A weekly book club where a group of people built a community around a better understanding of personal finances and have worked together to achieve their goals.

More from Invest in You:

Before you quit your job, here’s what you need to know

Knowing these 3 people will help you get promoted

House passes bill to protect older Americans in the workplace

How it started

One year ago, amid the coronavirus pandemic, Yamiesha Bell decided to start a book club that incorporated personal financial literacy and mindfulness.

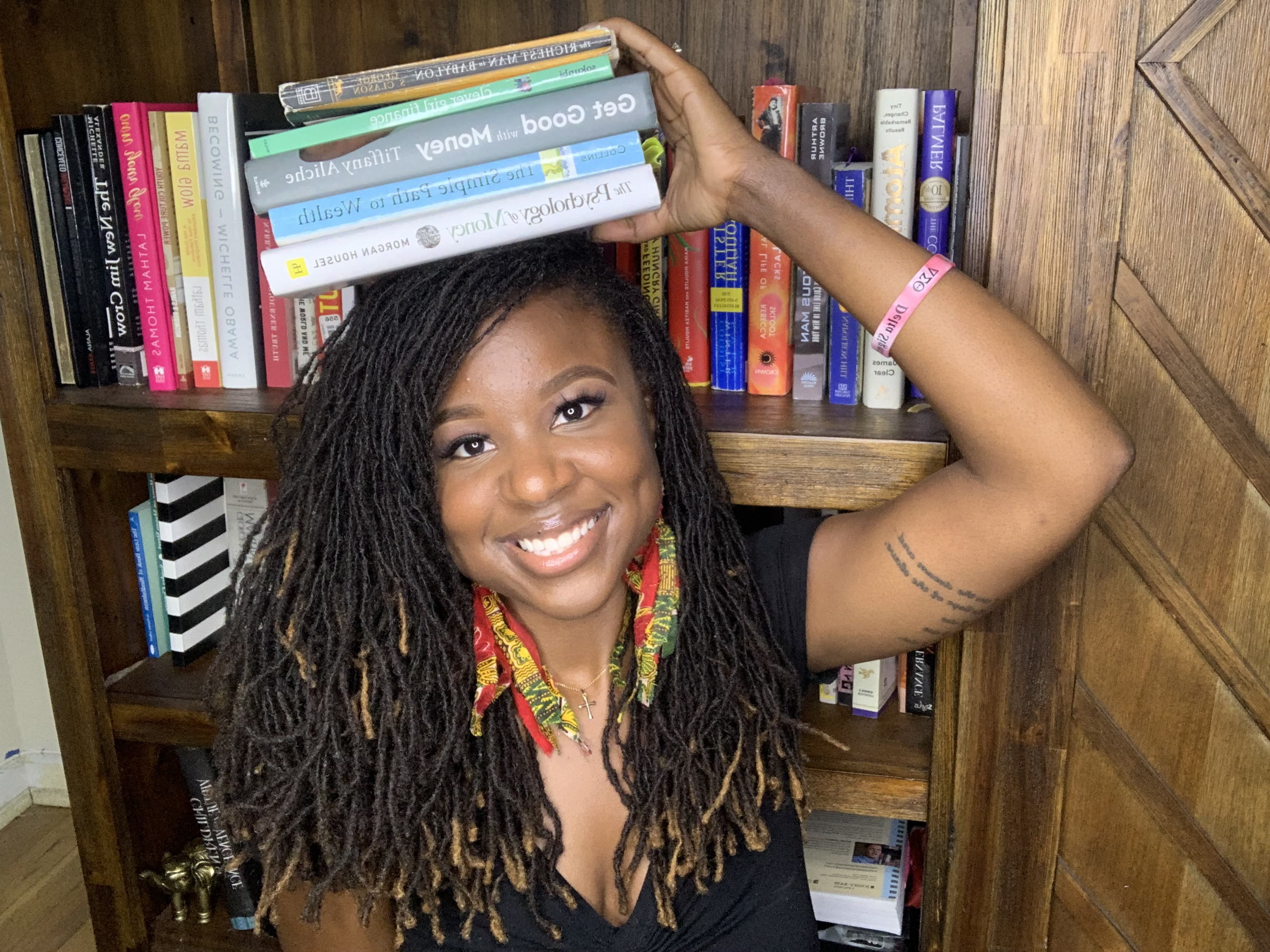

Bell, 27, is a 10th grade special education teacher at Gotham Collaborative High School in The Bronx in New York City. She also runs the Instagram account The Bold Budgeter, where she details her own experience of paying off $27,000 in credit card debt over seven months and building her own personal wealth — this year, she hit her goal of $100,000 in net worth.

Starting her process of paying off debt was a lonely one, she said, and she wanted to share her journey with a community. She also wanted to address and break down obstacles that have kept Black and Brown communities from building wealth in the U.S.

“I wanted our book club focused and grounded in financial wellness as a whole, and wellbeing, not just based off the numbers,” said Bell. “If it was just off the numbers, everyone would be doing great financially as long as they had a livable wage.”

Today, about 15 people regularly attend the book club’s weekly Zoom meetings, and more follow along with the reading assignments. The members of the group range in age from early 20s to late 60s and are diverse in gender, race, age, religion and experience.

Bell facilitates most of the meetings, and other members also take turns running the group. On occasion, guest speakers such as personal finance bloggers A Purple Life, The Fioneers and Tracy Watson attend to speak to the group.

The last book that the group read was Tiffany Aliche’s “Get Good with Money.” Next, they’ll be reading Morgan Housel’s “The Psychology of Money: Timeless Lessons on Wealth, Greed and Happiness.”

The power of community

In addition to discussing the books they’re reading, the group holds each other accountable with their progress on spending, saving and other financial goals.

The members are all encouraged to use a spending tracker — which Bell developed herself with Google sheets — and they discuss how they fared in following a budget each week. They also check in on larger personal financial goals once a quarter.

There are other homework assignments, as well, geared towards building and protecting wealth. After reading Aliche’s book, for example, each member has been tasked with discussing estate planning and emergency documents with their family members.

Having a group of people with similar goals can be a huge help for anyone’s personal finance journey. Being accountable to a group has helped many of the members stick to their financial goals.

“Even though we’re all trying to excel to a different level in our lives, everyone has been able to provide me with some level of expertise and knowledge based on where they are, and I’m so grateful for that, ” said Shanequa Evans, a program coordinator at a university and a member of the book club.

She also opened her first investment account this year with support of the club. “I’m just on this journey of building that generational wealth and building a better financial platform for myself,” she added.

It’s also easier to have accountability with people who you know care about you, said Lauryn Williams, a certified financial planner and founder of Worth Winning.

“Support goes a long way,” she said. “When you feel like you’re doing it on your own, it gets pretty overwhelming, and that’s when people get that analysis paralysis where they stop in their tracks because they’re not sure how to move forward.”

Advice for starting a personal finance book club

The club recently celebrated its one-year anniversary, and members are looking forward to starting their next book and welcoming new participants.

Bell has some advice for anyone who may be interested in starting their own personal finance-focused group.

1. Determine the focus of your club

“Really figure out the non-negotiables you want from your group,” said Bell. For her, that meant prioritizing diversity — most of the books the group read in the first year were by women, and all the guest speakers have been women.

“It was important for me to diversify the image of what someone who is good with money looks like,” said Bell.

2. Send out invitations

Bell personally reached out to people she knew might be interested in joining her club, and put the information on her Instagram account, as well. In addition to the 15 members who attend book club each week, more than 90 people get Bell’s weekly emails.

It’s important to have invitations, especially around what can be a sensitive topic for many.

“People may be looking for this community but don’t feel comfortable asking,” said Bell.

3. Be consistent with meetings

Bell never cancels a book club meeting unless it’s discussed beforehand and is on a major holiday, she said.

“Just like personal finance, it’s about the consistency,” she said.

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: How to make money with creative side hustles, from people who earn thousands on sites like Etsy and Twitch via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.