Despite the partisan noise swirling around the impeachment hearings in Washington, DC, supporters of at least one bill remain hopeful that the divide won’t derail its passage.

The Secure Act, as the measure is called, aims to increase the ranks of retirement savers and the amount they put away. While it cleared the House in May with broad backing from both sides of the aisle — the vote was 417 to 3 — the bill remains stalled in the Senate.

“Retirement has always been an issue with bipartisan support, and it still is,” said Paul Richman, chief government and political affairs officer at the Insured Retirement Institute, which is one of many groups — both industry and consumer — that support the legislation.

“It’s just getting caught up in the partisan politics in the House and Senate, and that has made it more complex to deal with than it would be in some other political environments,” Richman said.

Janhvi Bhojwani | CNBC

The Secure Act, if passed by both chambers of Congress and signed into law by President Trump, would bring the biggest changes to the U.S. retirement system since 2006.

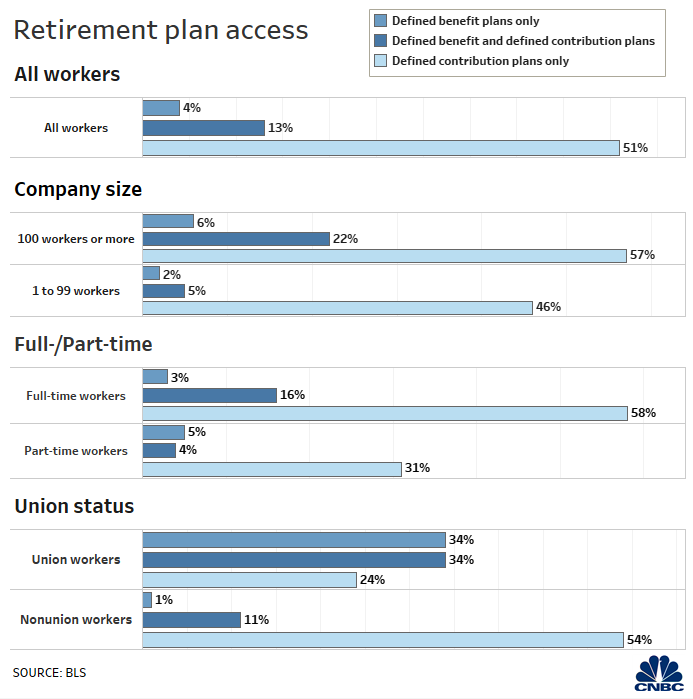

Among the provisions are: making it easier for small businesses to band together to offer 401(k) plans, requiring companies to let long-term, part-time workers become eligible for retirement benefits and repealing the maximum age (70½) for making contributions to traditional individual retirement accounts.

Additionally, the measure would raise the age to 72 from 70½, when the dreaded required minimum distributions, or RMDs, from certain retirement accounts must start. The bill would also allow more annuities in 401(k) plans.

It also would require most nonspouse beneficiaries to withdraw money from inherited retirement accounts within 10 years of the original owner’s death instead of spreading out withdrawals across their lifetime.

Bipartisan support hasn’t been enough to get the Secure Act across the finish line.

After the bill passed the House in late May, the Senate moved to pass it under a process called unanimous consent, which would have essentially have fast-tracked the bill to passage — with no changes to it — if all lawmakers agreed.

That didn’t happen: Three Republican senators put “holds” on the bill, which remain in place. And, an effort by Senate Majority Leader Mitch McConnell, R-Kentucky, two weeks ago to consider the bill with both limited debate and amendments also was unsuccessful, with Democrats’ opposing any changes to the bill.

With those routes to passage not working, the Secure Act either has to go through the typical legislative debate process — which would consume floor time that the Senate has little of — or get attached to another bill that lawmakers view as “must-pass” legislation, Richman said.

“There are still a lot of opportunities for it to be attached to something that the Senate wants to move before the end of the year,” he said.

One possibility would be a budget bill. While Congress is expected to approve a so-called continuing resolution this week to keep the government open until Dec. 20, it means lawmakers would need to take action again before then to avoid a partial government shutdown. That could come in the form of another agreement that again temporarily funds the government, or as one large funding bill or several smaller ones that fully fund the 2020 budget (the end of the 2019 federal fiscal year was Sept. 30).

In other words, anyone opposed to the Secure Act at that point would have to oppose the budget bill — or any other, for that matter — that it was attached to. There also could be other must-pass bills, Richman said, including one that makes technical fixes to the 2017 Tax Cuts and Jobs Act, or even a bill that establishes a new North American trade agreement.

Asked by CNBC if there are plans to get the Secure Act passed this year, a spokesman for Senate Majority Leader Mitch McConnell’s office said he has no updates or guidance to provide.

We continue to be optimistic that the merits of this bill will weigh in the favor of passage in the Senate and the president signing it.

Paul Richman

Chief government and political affairs officer at the Insured Retirement Institute

If supporters’ plan of attack doesn’t work, it would mean looking at next year when Congress returns from the winter break. And at that point, the challenges could be greater.

In addition to being an election year, impeachment proceedings could also be a factor. If the Senate receives articles of impeachment from the House at some point in December — which some pundits expect — a trial would consume the Senate’s time in the early part of next year.

Richman sees that as working in the bill’s favor for passage before the calendar flips to 2020.

“Even if the House does send over articles of impeachment in late December, the Senate is talking about a January or February trial,” he said. “So they have time to act on things like the Secure Act this year.”

And could the impeachment process muck up President Trump’s assumed support of the bill?

“We continue to be optimistic that the merits of this bill will weigh in the favor of passage in the Senate and the president signing it,” Richman said.

More from Personal Finance:

Hoping to save on your 2019 taxes? Time is running out

This ‘rule’ about credit card use could be costing you

How to make the most of your 401(k)