Fertnig | E+ | Getty Images

When Aaron Shapiro dug through the workplace benefits his mother was entitled to as a 30-year employee at United Healthcare, he noticed a big missed opportunity.

The health insurer’s employee stock purchase plan gave her the ability to buy shares at a 15% discount with a feature called a lookback. That means a participant in the plan gets the lowest price from either the beginning or the end of the stock purchase period.

“It’s an opportunity that anyone in the institutional investing world would kill to have access to,” Shapiro said. “It just so happens to be sitting in the hands of an employee of a publicly traded company.”

By Shapiro’s calculations, not participating in the plan cost his mother more than $1 million.

That revelation led Shapiro to found his own company, Carver Edison, to help employees come up with the money to participate.

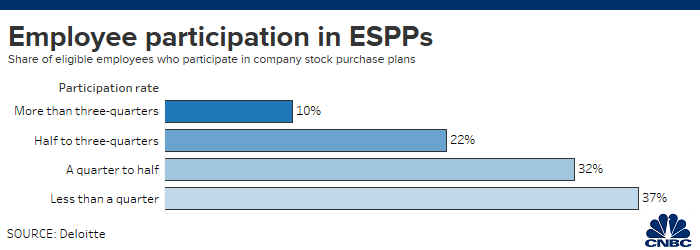

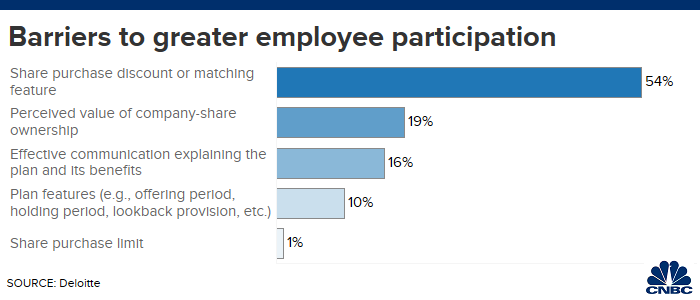

Nearly three-quarters of publicly traded companies offer employee stock purchase plans, or ESPPs, to at least some of their employees, according to a 2018 Deloitte survey. Yet employee participation in the plans is generally low, the study found.

How these plans work

Stock plans are generally available to all employees and allow them to purchase shares at a reduced price.

The purchase of company stock is made via payroll deductions. That means the money comes out of your pay after taxes, noted Emily Cervino, head of thought leadership at Fidelity.

Company shares generally are offered at a discount, which is typically around 15%, she said. Many plans also include a lookback.

So, if you enroll when the stock is at $10 per share, and the transaction occurs when the stock is $15, you get the discount on the lower of the two prices. That means you pay $8.50 per share if the stock is trading at $15.

Participating employees can choose their salary contributions, which usually range between 1% to 10%, Cervino said. The IRS limits your investment to $25,000 total per year.

Employee contributions typically accumulate over three to six months, at which point they are aggregated together to purchase shares.

In most cases, employees can sell the shares immediately after they’ve purchased them. Or, they can choose to sell them at a later date.

One big factor to consider when choosing between now or later: taxes. An immediate sale will be taxed as ordinary income. A future sale will be taxed at a lower rate as long-term capital gains.

To qualify as long-term capital gains, you generally need to sell at least two years from the first day of the offering period or at least one year from the purchase date.

Improving employee participation

Shapiro’s company, Carver Edison, is working to provide short-term interest-free rate loans on behalf of employees so they can increase their contributions to stock purchase plans.

For example, if a plan’s maximum is 10% of an employee’s income, and a worker can only afford to contribute 1%, Carver Edison will front the 9% difference.

Following the transaction, Carver Edison receives some shares to reimburse them for the loan. The employee’s net shares are then deposited into their brokerage account.

More from Personal Finance:

Knowing the ‘right’ people is key to getting the right salary

Your benefits at work can help your family save in 2020

Tips for maxing out your retirement contributions this year

“If things go well at the company, [the employee] stands to build more wealth over time,” Shapiro said. “If things don’t go well, the employee now owns more shares, [and] they have more dry powder to diversify their investments.”

Carver Edison works directly with companies. So an individual’s employer would need to be working with them in order for an employee to take a loan. The company recently completed a deal to provide their program to the publicly traded companies on E-Trade’s Equity Edge platform.

What to consider before you invest

Just because you can borrow to participate in an ESPP doesn’t mean you should.

And, as with all investments, financial advisors say you should proceed with caution if you want to participate in your employer’s plan.

“A good question to ask is, ‘Would I buy this stock if it wasn’t in my company plan?'” said Cathy Curtis, founder and CEO of Curtis Financial Planning in Oakland, California. “If the answer is probably not, then maybe it’s a better idea not to get involved.”

In addition, it’s also important to evaluate whether the strategy fits into your overall financial plan.

“The first thing to figure out is do you even have cash available to contribute,” said Roger Ma, founder of Lifelaidout in New York.

If you haven’t fully funded an emergency fund with at least six months’ living expenses, paid off all high interest credit card or other debts, or contributed enough to your 401(k) to get your employer’s match, you should think twice before investing in a stock plan, Ma said.

If you do decide to participate, be aware of how much overall exposure you have, Ma said. Keep in mind that you could be invested in the company in your 401(k). Plus, your 401(k) match or bonus could be in company stock. And, your employment is with the company.

Further, the share price may not necessarily go up. And be sure to avoid letting your concentration in the stock grow too large.

“Have a plan in advance to divest the shares periodically,” Curtis said. “Take advantage of the discount and the long-term capital gains treatment, and then diversify the proceeds.”