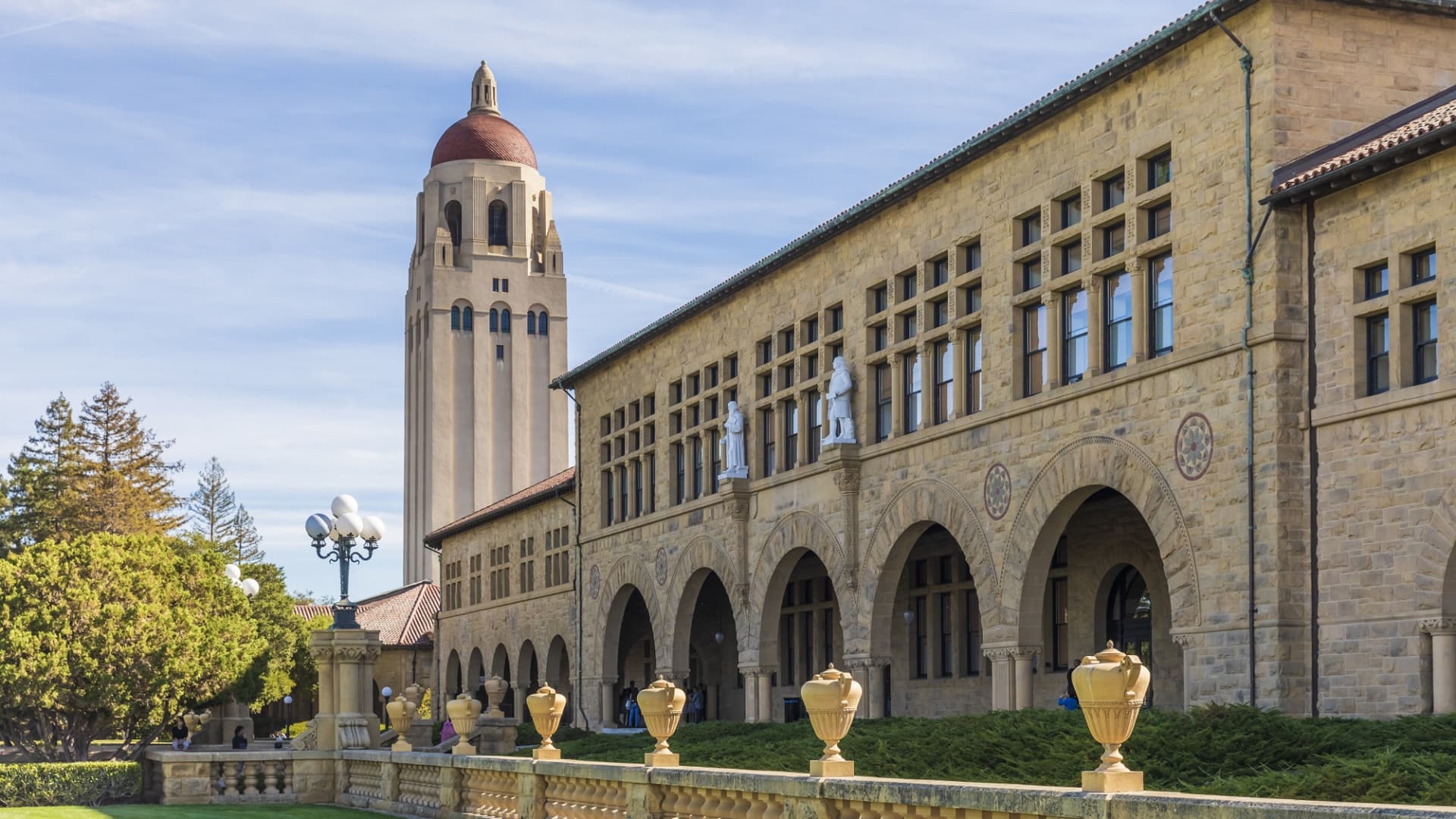

Stanford University is considered the ultimate dream school, according to a survey of students and their families.

It’s also one of the hardest to get into and among the nation’s most expensive institutions — tuition and fees, room and board and other student expenses came to more than $73,000 last year.

And therein lies the problem with college.

“This year has been the most competitive year ever,” said Alix Coupet, a former admissions officer at Stanford University and a current lead counselor at college counseling firm Empowerly.

The colleges at the very top of most students’ wish lists are not only highly selective (Stanford’s acceptance rate hit an all-time low just below 4% last year; at Harvard and MIT, the rate was also about 4%) and the sky-high price tags deter some from even applying.

As the pandemic’s economic impact continues to weigh unevenly on the economy, college is becoming a path only for those who can afford it, reports show.

Overall, tuition and fees plus room and board for a four-year private college averaged $55,800 in the 2021-22 school year; at four-year, in-state public colleges, it was $27,330, according to the College Board.

Nationwide, fewer students went back to school again this year, dragging undergraduate enrollment down another 3.1% from last year, according to a report by the National Student Clearinghouse Research Center based on data from colleges.

The number of undergraduates in college is now down 5.1% compared to two years ago — a loss of nearly 1 million students, the report found — with the schools serving low- and middle-income students seeing the largest declines.

At the same time, the students who are applying are casting a wider net, resulting in a record number of applications at many top colleges and historically low acceptance rates as a result.

So far application volume for undergraduate admission has jumped 21% from pre-pandemic levels, according to data from the Common App as of March 15.

More from Personal Finance:

Is college really worth it?

College enrollment continues to slide

Choosing a college based on tuition can be a mistake

As acceptance letters roll in, students have just a few weeks to figure out their next move ahead of National College Decision Day on May 1, the deadline for high school seniors to choose which college they will attend.

At that point, they must pay a non-refundable deposit to secure their seat at the school of their choice.

But the biggest problem remains how they will pay for their degree.

A majority of college-bound students and their parents now say affordability and dealing with the debt burden that often goes hand-in-hand with a college diploma is their top concern, according to The Princeton Review’s 2022 College Hopes & Worries survey.

A whopping 98% of families said financial aid would be necessary to pay for college and 80% said it was “extremely” or “very” necessary, The Princeton Review found.

Stanford was among several institutions that froze tuition during the height of Covid, marking the first year without a tuition increase in more than three decades amid concerns about the pandemic’s impact on students and their families.

However, total undergraduate charges will jump 4% next year to just over $77,000, including $57,692 for tuition, $18,619 for room and board and another $723 as a mandatory health fee.

“Money is an issue,” said Robert Franek, The Princeton Review’s editor-in-chief. “It is intimidating, but you needn’t be bested by it.”

Money is an issue … but you needn’t be bested by it.Robert Franekeditor-in-chief of The Princeton Review

“Never cross an expensive school off of your list of consideration based on sticker price alone,” Franek added. Consider the amount of aid available, since private schools typically have more money to spend.

“Many of those schools are giving out substantial scholarships — this is free money.”

In fact, Stanford offers generous financial aid for those that qualify. Tuition is covered for undergrads with family incomes under $150,000.

As a result, just 13% of undergraduates leave Stanford with student debt, owing an average of $13,700, according to the school.