Businessman looking tired while working at his office desk

Real estate investment trusts (REITs) are on fire—and we need to be very careful not to get burned.

Here’s the twist: there’s plenty more upside ahead—and you can thank the Fed for that. Its latest rate cuts will keep powering REITs higher, for two reasons:

- Lower rates cut REITs’ borrowing costs, and these trusts (owners of everything from senior-care centers to cell towers) need lots of borrowed cash to buy new buildings and upgrade current ones.

- Savers are getting clobbered: With 10-year Treasury rates at 1.8%, REIT dividends, which can run into the 7% range, look very appealing by comparison.

And what if we see negative interest rates in the US? It’s something everyone from former Fed chair Alan Greenspan to the head of fixed income at JPMorgan Chase (JPM) says could very well appear.

What would happen to REITs then?

Their 2019 spike would be a puff of smoke compared to the surge we’d see. Because almost any yield (let alone a growing 5%+ payout) would be irresistible compared to putting your cash in a Treasury note and getting less than your principal back!

But we can’t just grab the REITs with the biggest dividends and call it a day. Because this latest run has already pushed some REITs to valuations far out of whack with their fundamentals.

If we buy these “dividend land mines,” we could lose 10%, 20% or even 30% of our capital! It’s the same risk as buying a regular stock at a high price-to-earnings ratio.

So how do we tell when a REIT is overpriced? Its share-price movements are only half the story, because a big move up could be warranted if the REIT has the rising cash flow to back it up.

How We “Timed” This Cheap 7% Dividend for 24% Upside

Which brings me to hotel operator Chatham Lodging Trust (CLDT), which I recommended to my Contrarian Income Report readers in December 2016. It’s a great example of how you can use a critical REIT metric—funds from operations (FFO)—to separate bargains from overpriced REITs.

When I recommended Chatham a little less than three years ago, it traded at a bargain 8.4-times FFO.

Why so cheap? Investors fretted that Airbnb would swamp Chatham’s hotels. But that ignored the fact that most of its locations are near airports or in suburbs, far from Airbnb’s downtown turf. When you looked “under the hood,” things got better:

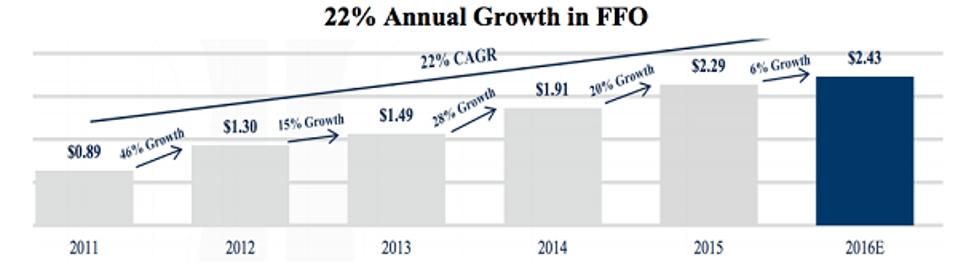

Chatham Lodging

That outsized 22% average yearly FFO growth was driving a surging dividend, up 57% in just three years! Best of all, this stock yielded 6.8%—its highest level ever.

What happened after our buy call? Chatham soared, handing us a market-crushing 24% total return in less than two years.

But by September 2018, Chatham’s price-to-FFO ratio got a little too plump, at 10.7-times. The cat was clearly out of the bag, so we checked out, avoiding the 16% drop in price.

Now let’s look at three REITs investors are blindly piling into, overinflating their valuations and setting them up for Chatham-like plunges of 16% or more.

Overpriced REIT No. 1: Kimco Realty (KIM)

Kimco Realty just might tempt you with its 5.2% dividend, but don’t take the bait. First-level investors have bid the mall landlord’s stock into the stratosphere, up a whopping 48% year to date, far ahead of VNQ!

A chart like this might be okay if Kimco’s FFO had kept pace with its rising share price. But FFO was up just 3.4% in the third quarter.

That, along with the soaring share price, means you’ll pay 15-times adjusted per-share FFO today, compared to 9.7-times a year ago. Worse, dividend growth has stalled.

A soaring valuation and a frozen dividend are a classic setup for a correction. And that’s before we even talk about the challenge mall operators like Kimco face from Amazon.com (AMZN). Stay away.

Overpriced REIT No. 2: Independence Realty Trust (IRT)

Apartment landlord Independence is another REIT that’s gotten ahead of itself, with a share price that’s spiked 67% from January 1, nearly tripling VNQ’s gain.

Sure, Independence is performing pretty well: core FFO rose 3% in the third quarter, and average rental rates gained 5.7% across its portfolio. The stock also yields a tidy 4.7%—though the payout does consume a tight 95% of per-share FFO, so there’s little potential for a raise.

The main problem is that shares now trade at 20.4-times core FFO, compared to 12.3-times a year ago. That’s far too high for an apartment landlord, and it sets the stock up for a hard fall on any bad news.

Overpriced REIT No. 3: Public Storage (PSA):

We need to talk about Public Storage, the biggest self-storage player, with 2,500 facilities. The company yields 3.6% now, and it’s been left behind in the REIT run, with just a 9% gain year to date.

So is PSA a bargain—or does it have further to fall?

The latter. Here’s why.

For one, even after the stock plunged on disappointing third-quarter results last week, PSA still trades at 20.5-times FFO. That’s out of whack with a company whose core FFO barely budged, up just 1.1% from a year ago.

Worse, the cost of running its business jumped 6.4%, including a whopping 69.5% increase in marketing costs, as Public Storage spent heavily to attract new clients in the highly competitive (and fragmented) self-storage market.

With costs rising, dividend growth has taken a back seat: the payout hasn’t budged since PSA rolled out its last hike nearly three years ago.

The bottom line? I don’t see any point messing around with a pricey REIT with a stalled dividend when there are plenty of trusts with higher yields and growing payouts to choose from.

Brett Owens is chief investment strategist for Contrarian Outlook. For more great income ideas, click here for his latest report How To Live Off $500,000 Forever: 9 Diversified Plays For 7%+ Income.

Disclosure: none