Happy surprised old senior lady looking through her eyeglasses isolated on white background.

What if I told you there was a corner of the market where every single fund has turned a profit? And these amazing investments paid out a huge income stream that was entirely tax-free?

The kicker: many of these funds—including one throwing off a 4.6% dividend now (that could be worth 7% or more to you, depending on your tax bracket)—are trading at discounts to their “true” value now. I’ll name this low-risk income (and growth) play shortly.

146 Funds, 0 Losers

This story starts with municipal bonds, which are issued by cities, counties and states to fund buildings, roads and hospitals. My favorite way to buy “munis” is through closed-end funds (CEFs).

First, here’s what I mean when I say every one of these CEFs has turned a profit: of the 146 municipal-bond CEFs tracked by my CEF Insider service, not a single one is down over the last decade or since their IPO, whichever is most recent. More impressively, 19 of these low-volatility funds have yearly returns of 8%+, more than the average return of stocks.

That’s quite a feat, considering the very low volatility muni-bonds boast in relation to your typical S&P 500 name.

Boosting Your Dividends 66% …

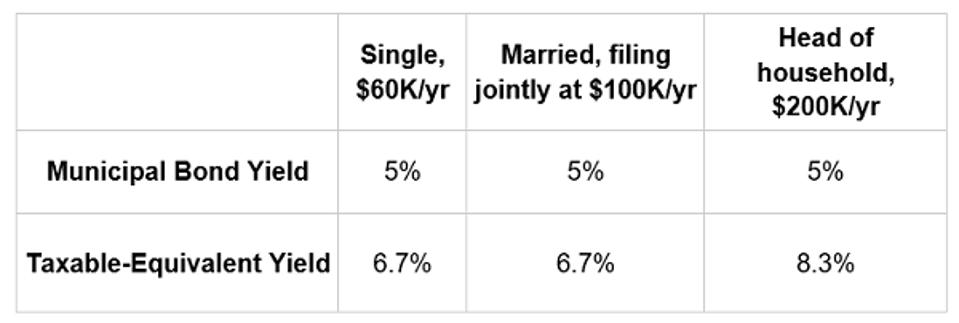

The increased income stream from a municipal bond’s tax break is impressive, and easy to overlook, so let me give you some examples.

Contrarian Outlook

As you can see above, a 5% dividend from a muni fund is the same as 6.7% for a single taxpayer earning $60,000 a year. A high-earning head of household? You’d need to get 8.3% from junk bonds, stocks or whatever else to meet the 5% income stream from municipal bonds—or 66% more income. And this doesn’t include any exemptions on state taxes!

… While Cutting Your Risk

Because they’re backed by state and local governments, municipal bonds are one of the lowest-risk asset classes in the world. But even so, scary headlines about cities going bankrupt have frightened many investors away (though the smart money has stayed in munis for decades).

The truth is, less than 0.01% of muni bonds default, and even when they do, investors tend to get most of their money back.

And you get even more safety when you invest in muni bonds through a CEF, because you’re buying into a fund that has bought hundreds of different municipal bonds. The fund then collects the income from those bonds and passes it on to investors. In this way, your exposure to a single default drops to almost zero.

This is the main reason why all muni-bond CEFs have made money, and 85% of them have annualized returns of 5% or more.

Beating the Benchmark … 98% of the Time!?

Consider this: over the last decade, the muni-bond index fund, the iShares National Municipal Bond ETF (MUB), is up just 3.9% annualized. A whopping 98% of all muni-bond CEFs have gained more than that over the same period, meaning it’s almost impossible to do worse than the benchmark with muni-bond CEFs.

The main reason for this is that municipal bonds aren’t like stocks, which are open to everyone. Muni bonds go through brokers who privilege their biggest clients first, meaning the bigger you are, the better issuances you tend to be able to buy right off the bat. That gives muni CEFs’ managers the pick of the litter: another reason why these funds are the way to go when adding municipal bonds to your portfolio.

NZF: Tax-Free Income at a Discount

This brings be back to that muni CEF I mentioned off the top, the Nuveen Municipal Credit Income Fund (NZF), which is currently trading at a 1.9% discount to its net asset value (NAV, or the value of its underlying portfolio), even though it pays a whopping 4.6% tax-free dividend.

If you think this deal exists because the fund underperforms, think again.

NZF has been destroying the muni-bond market for years, and it’s not the only one. In fact, there are dozens of muni-funds that have both beaten the market for a long time and trade at a large discount. NZF’s discount is tiny compared to some of these other funds, which are now trading for 7% (or more) below the market value of their assets, even while they give investors massive tax-free returns year in and year out.

Michael Foster is the Lead Research Analyst for Contrarian Outlook. For more great income ideas, click here for our latest report “Indestructible Income: 5 Bargain Funds with Safe 8.5% Dividends.”

Disclosure: none