getty

Last year, the Internal Revenue Service introduced a draft version of a form that we haven’t seen since 1982: Form 1099-NEC, Nonemployee Compensation. Form 1099-NEC is intended to replace the nonemployee compensation part of a form many of us have come to know and love: Form 1099-MISC, Miscellaneous Income.

Form 1099-MISC is sticking around for other things, like reporting gross proceeds to an attorney, Section 409A deferrals, and nonqualified deferred compensation income. But nonemployee compensation – money paid to freelancers, independent contractors, gig workers and others that aren’t employees – will now be reported on Form 1099-NEC.

The Not Completely New Form 1099-NEC

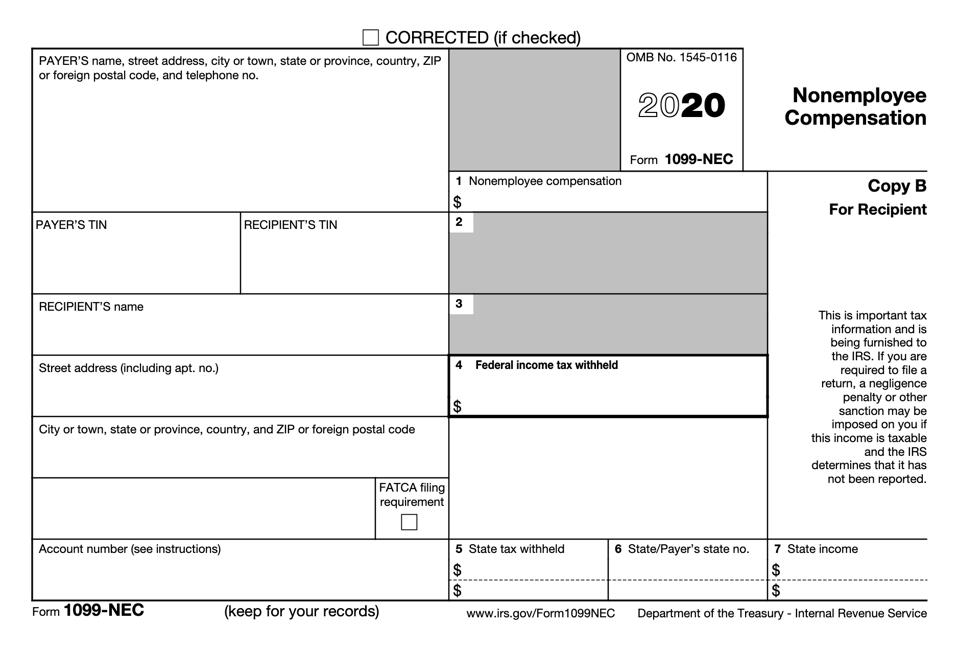

The form, which will make its comeback in 2021 for the 2020 tax year, looks like this:

2020 Form 1099-NEC

IRS

Who Gets A Form 1099-NEC?

The IRS says that trades or businesses need to issue Form 1099-NEC if the following four conditions are met:

- You made the payment to someone who is not your employee.

- You made the payment for services in the course of your trade or business (including government agencies and nonprofit organizations).

- You made the payment to an individual, partnership, estate, or, in some cases, a corporation.

- You made payments to the payee of at least $600 during the year.

Making The Change

Why is the form 1099-NEC being (re)introduced? The Protecting Americans from Tax Hikes Act of 2015 (PATH Act) enacted on December 18, 2015, made several changes to the way we file taxes. Notably, section 201 of the PATH Act of required taxpayers who claimed the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC) to wait until mid-February before they could receive their tax refunds.

Of course, taxpayers who claim the EITC and/or the ACTC must have earned wages, typically reported on Form W-2 or – until now – a Form 1099-MISC. Employers were required to furnish those forms to taxpayers by January 31. However, employers could wait until the end of February, if filing on paper, or the end of March, if filing electronically, to submit these forms to the government. That means that taxpayers who filed early could get tax refunds even before the IRS received the related forms from the employers. The result? Room for fraud. Scammers and thieves could file bogus tax returns weeks before the IRS had any chance to confirm wage information. That’s why the agency started holding onto the checks a little longer.

The PATH Act also required employers to submit forms W-2 and forms 1099-MISC to the Social Security Administration (SSA) on January 31, the same date that taxpayers receive their documents. By pushing out the tax refund issue date to February 15, the IRS has time to match up the employer forms with the taxpayer forms. Problem solved, right? Not exactly. The PATH Act didn’t change the due dates for all forms 1099-MISC. Remember – it’s a catch-all form. The due date for certain Forms 1099-MISC was January 31, while the due date for other forms 1099-MISC was February 15.

That was confusing for employers and taxpayers, and it was no less confusing for IRS systems and employees. The proposed solution was to bring back form 1099-NEC to report nonemployee compensation.

The Slight Hitch

It’s not all smooth sailing. This year, the IRS released its updated Publication 1220, Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G. Publication 1220 helps employers and tax professionals understand the specifications for filing certain information forms electronically with the IRS, including the requirements under the Combined Federal/State Filing Program (CF/SF).

(Stay with me, this will all make sense in a moment…)

The CF/SF Program was created to simplify the filing of information returns. As part of the program, the IRS forwards original and corrected information returns filed electronically to participating states free of charge for approved filers. That means that separate reporting to those states is not required.

Information returns that may be filed with the CF/SF Program are:

- Form 1099-B, Proceeds from Broker and Barter Exchange Transactions

- Form 1099-DIV, Dividends and Distributions

- Form 1099-G, Certain Government Payments

- Form 1099-INT, Interest Income

- Form 1099-K, Payment Card and Third Party Network Transactions

- Form 1099-MISC, Miscellaneous Income

- Form 1099-OID, Original Issue Discount

- Form 1099-PATR, Taxable Distributions Received From Cooperatives

- Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

- Form 5498, IRA Contribution Information

Um. It includes Form 1099-MISC, but where is Form 1099-NEC? That’s right. For now, Form 1099-NEC is not included in the CF/SF Program for 2020. That means that Forms 1099-NEC will have to be filed separately for state purposes.

This is important information for some taxpayers who might have relied on the CF/SF Program in the past to forward Form 1099-MISC for nonemployees. For 2021, you’ll have to make other arrangements for the new forms.

You May Still Need To File Form 1099-MISC

Also important to know? Even though beginning with tax year 2020, you’ll use new Form 1099-NEC to report nonemployee compensation, you should not report prior-year nonemployee compensation on Form 1099-NEC. If you need to issue a form to report prior-year nonemployee compensation – for example, you realize that you forgot to report a 2019 payment – you’ll need to use a prior-year Form 1099-MISC. Got it?

The Round-Up

Usually, these kinds of technical changes are reserved for the tax professionals and tax geeks among us. But these changes will also impact businesses who work with independent contractors and freelancers.

And independent contractors and freelancers? You need to know this information, too, so you’ll know which form to look out for (Form 1099-NEC) and when (by January 31 in most years, but in 2021, it will be February 1).

The IRS will provide more information about filing requirements for next year (2021) as 2020 draws to a close. Stay tuned!