The wealthy are preparing for tax increases, working with their accountants to give away money or shift their income to avoid some of the impact of higher rates.

With rising deficits at both the state and federal level, as government spending soars and revenue drops from the Covid-19 crisis, taxes are likely to go up in the coming years, especially for the highest earners. Presumptive Democratic nominee Joe Biden told wealthy donors at a fundraiser Monday that he planned to forge ahead with his campaign plan to hike taxes on the wealthy.

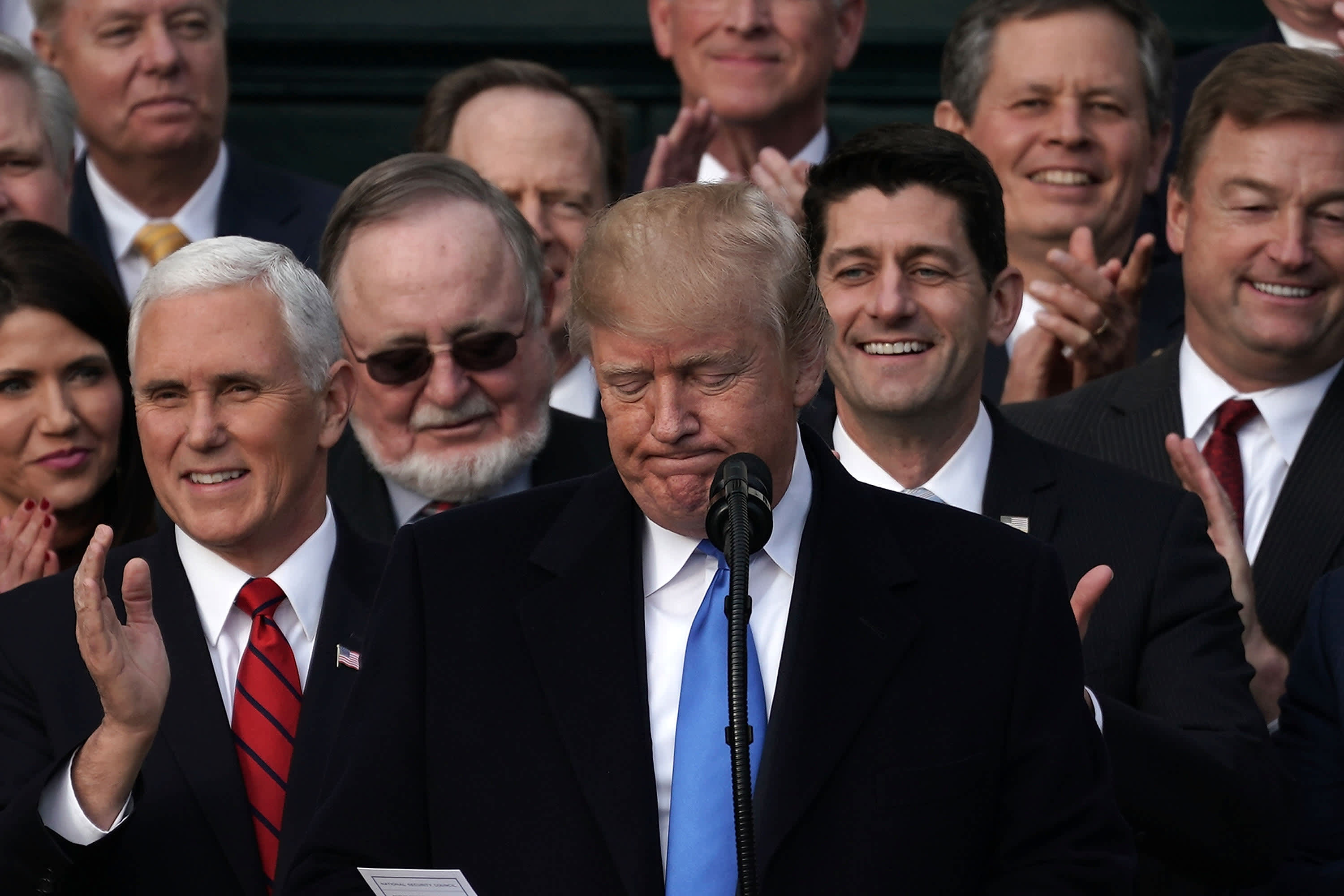

“I’m going to get rid of the bulk of Trump’s $2 trillion tax cut,” Biden said, “and a lot of you may not like that, but I’m going to close loopholes like capital gains and stepped up basis.”

Accountants and tax lawyers say they’re seeing surge in calls and emails from wealthy clients asking about actions they can take now to avoid tax hikes in 2021 and beyond.

“It’s coming up in almost every conversation,” said David Handler, partner in the trusts and estates practice at Kirkland & Ellis. “People are not just thinking about it, they’re acting on it. They know that one way or another, tax rates may be headed up.”

The main action the wealthy are taking now is giving money to family and friends. Under the current estate and gift tax, individuals can give away up to $11.58 million — and couples can give away up to $23.16 million — over their lifetimes without paying the gift tax of 40%. Democrats in Congress have been pushing for years to lower the exemption for both the gift and estate tax to raise more revenue.

So accountants are advising the wealthy to give up to the maximum $11.58 million this year in case the exemption falls or the tax rate increases.

“For many clients, this is a motivating factor for gifts they were planning to make all along,” Handler said.

Regardless of who wins the White House, accountants say the wealthy fear some form of tax increase at the state or federal level. At the center of Biden’s tax plan is an increase in the capital gains tax and the elimination of the step-up in basis, which allows any appreciation in the value of property that occurred during the owner’s life to go untaxed.

Accountants say they’re also advising the wealthy to sell assets now that have appreciated over a long period of time, and that they intended to sell soon anyway. That way they will pay a top tax rate of 20% rather than risk the 39.6% rate proposed under Biden’s plan. Of course, given the decline in some asset values and the stock market so far this year, many of the wealthy may not want to sell yet.

Still, accountants and lawyers are advising clients who have seen big gains in their stocks or properties over the years to sell now if it’s feasible.

“It has to make sense economically first,” said Joseph Perry, tax and business services leader at Marcum. “A lot of people will wait until the end of the year, especially with stocks given the volatility in the market. But if you wait to incur a gain until next year, you run the risk of rates going up.”

The wealthy are also making plans to shift income into 2020, to shield it from potentially higher tax rates in 2021 and beyond. Owners of private companies, for instance, are negotiating contracts with customers that front-load more of the earnings in 2020. Company owners are also shifting expenses into next year when possible.

Taxpayers who are members of partnerships or have pass-through income are also taking as much income as possible this year if they can shift it from 2021.

The coronavirus pandemic and looming tax increases have also caused high earners to think more seriously about moving out of high-tax states. Even if the limit on state and local tax deductions — which was part of the Trump tax cuts — is repealed, accountants say the wealthy who have been working from home in other states now realize how easy it would be to leave. While the process of changing a tax residency is lengthy — and could take more than a year — accountants say many of their clients are starting the formal process of changing their permanent residence.

“This was the tipping point for a lot of people, especially in finance,” Perry said. “That connectivity that kept them in New York may not be there anymore. So now they realize they don’t have to be there and pay those taxes.”