Are you better off than you were three years ago?

Tax cut calculator

Taxpayers will be pondering the tax cut in April, and again in November. I decided to do a little experimenting with the tax code, using a spreadsheet that I invite you to download.

The 2017 tax cut that its main promoter described as huge is a mixed blessing. It dished out some big benefits—via an increase in the standard deduction and a lowering of the top rate—but it punished high earners by limiting their itemized deduction for state and local taxes.

The perception among a lot of voters is that the law change made them worse off. Here’s something that just landed in my in-box from a group called Unidos U.S.: “43% of Latino adults said their taxes went UP after the law passed [and] just 10% think any of the savings from the law went into their households.”

Then there are the high-income residents of states like New Jersey and California who had been deducting, on their federal returns, state and local taxes—large amounts, like $25,000 or $50,000. Trump chopped that deduction to a maximum $10,000. Surely they are worse off with the tax changes?

The answer may surprise you. It surprised me.

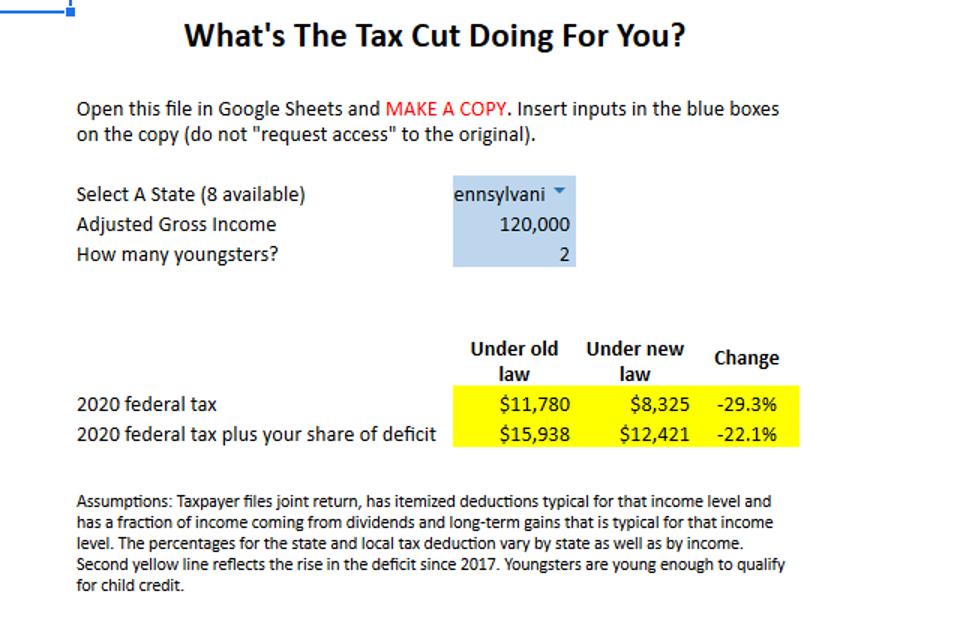

For the experiment, I looked at what would have happened to hypothetical couples filing jointly in nine different states, including several with stiff state income taxes and two with none. I compared what their federal taxes would have been for 2020 under the old tax law with what they’re going to pay next year under the new law.

My calculator takes into account itemized deductions that are average for taxpayers at a certain income level. It assumes that a percentage of income comes from favorably taxed dividends and capital gains—a percentage that rises as income rises. It uses hypothetical tax brackets for 2020 under the old law that reflect the inflation adjustments that would have occurred if the law had remained on the books.

Here’s what came out. For couples with an income of $60,000 and two young children, the Trump tax cut resulted in a complete elimination of federal income tax. It doesn’t matter what state they’re in.

At $120,000 of income (and the same two kids), Trump is cutting taxes by amounts ranging from 22% in New York to 30% in Texas.

At $600,000, you see reductions ranging from 7% to 9%, even in high-tax locales like California. How can this be, given the cutback on the deduction for state and local taxes? The answer relates to the alternative minimum tax that was a prominent feature of the old law. The AMT had the effect of making that deduction largely unusable.

There are some taxpayers who were made worse off by the 2017 law change. Kick up the income to $1 million and you see some increases in New York, New Jersey and California (small increases, a few percentage points). My calculator ignores “miscellaneous itemized deductions,” since so few people used those, but if you were one of the beneficiaries you would be unhappy that Trump eliminated them.

Trump was pretty generous with the child credit. Take out the dependents when you’re playing with my calculator and you’ll see the law change as a somewhat smaller gift to taxpayers.

Once you download the calculator, you can modify the income and kiddie count and you can see what is happening in different states. The file is here. Open it in Google Sheets and make a copy. Put your inputs on the copy; do not “request access” to the original.

The calculator uses published statistics on itemized deductions that were claimed under the old law for mortgage interest and charitable donations. It interpolates between data points to arrive at a percentage of income that would be claimed. It does something similar to figure a percentage of income that comes in the form of qualified dividends and long-term capital gains.

For the controversial state-and-local-tax deduction (which legislators from high-tax states are vainly trying to restore), I used IRS stats that vary both by income level and by state.

For those of you who are looking for a dark side to the 2017 tax act, I have one last straw to grasp at. In its usual fashion, Congress enacted the tax cut without an offsetting spending cut. The deficit went up, and we taxpayers will have to cover it someday.

If your federal tax payment for 2020 comes to $40,000, you might reasonably say that your true liability is $60,000, with the government collecting $40,000 immediately and running up a $20,000 tab on your credit card. This expansive view of the income tax burden is reflected in the second set of figures output by my calculator.

If you don’t like Trump, focus on the second line. It makes the new law into less of a bonanza. But even from that angle you see the law cutting tax burdens for a lot of people, including those in blue states.